EUR USD PREDICTION

Today the price for 1 EUR is 1.20 USD. Yesterday the rate was 1.19 USD for 1 EUR. EUR/USD traded in the range of 1.19 – 1.20. The difference compared to the previous day was 0.84%.

Today the price for 1 EUR is 1.20 USD. Yesterday the rate was 1.19 USD for 1 EUR. EUR/USD traded in the range of 1.19 – 1.20. The difference compared to the previous day was 0.84%.

The price of silver tomorrow will be 117.5 US dollars. Today the price for 1 oz was 117.8 USD. Yesterday the rate was 105.5 USD for 1 oz of silver. Trading of silver took place in the range 103.1 – 110.5 USD. The difference compared to the previous day was -8.30%.

The price of gold tomorrow will be 5 837 US dollars. Today the price for 1 oz was 5 522 USD. Yesterday the rate was 5 080 USD for 1 oz of gold. Trading of gold took place in the range 5 080 – 5 080 USD. The difference compared to the previous day was 0.00%.

The price of Brent crude tomorrow will be 69.9 US dollars. Today the price for 1 bbls was 67.7 USD. Yesterday the rate was 67.6 USD for 1 bbls of Brent crude. Trading of Brent crude took place in the range 65.0 – 67.8 USD. The difference compared to the previous day was 3.02%.

The price teeters just below this psychological threshold, a faint echo of its former glory after many dark days. Is it possible for XRP to reclaim $2, hold its head high, and gather strength like a phoenix about to rise?

And so, the bitcoin miners, once shackled by the halving of their rewards and the crushing weight of competition, have found salvation in the AI boom. Like cunning survivors in a dystopian novel, they pivot, repurposing their data centers to host the very machines that threaten to eclipse their former glory.

Dogecoin, that darling of the digital masses, has captured the imagination anew, as technical indicators whisper of a potential volte-face after months of downtrodden despair. The enigmatic ‘World of Charts,’ a pseudonym as mysterious as a Dorian Gray portrait, has unveiled a breakout structure that could herald a bullish renaissance. Trading near a key price area, the meme coin finds itself at a crossroads, its upward trajectory thwarted by a resistance as stubborn as Lady Bracknell’s disapproval.

Наш аналитик Cryptosahintas, как уставший ветеран на пенсии, объяснил: путь у AVAX примерно один – или он взлетит к 22.5 доллару, или суданская жара начнётся раньше – упадет до 8.5. Как говорится, «жить – значит ловить моменты», а тут уж кто кого: поднимется на высоты или упадет, как метеор, – остаётся только гадать и ждать.

On this fine day, January 28, which just so happens to be the five-year anniversary of what we’ll affectionately refer to as the Great GameStop Fiasco, Tenev took to Twitter (the modern-day town crier) to regale us with tales of yore. “Five years ago today,” he tweeted, “Robinhood and other brokers were forced to halt buying of several meme stocks, most memorably GameStop, in one of the strangest and most visible equity market failures in recent history.” In other words, it was like watching a circus elephant try to tap dance on a tightrope – thrilling, but ultimately a recipe for disaster.

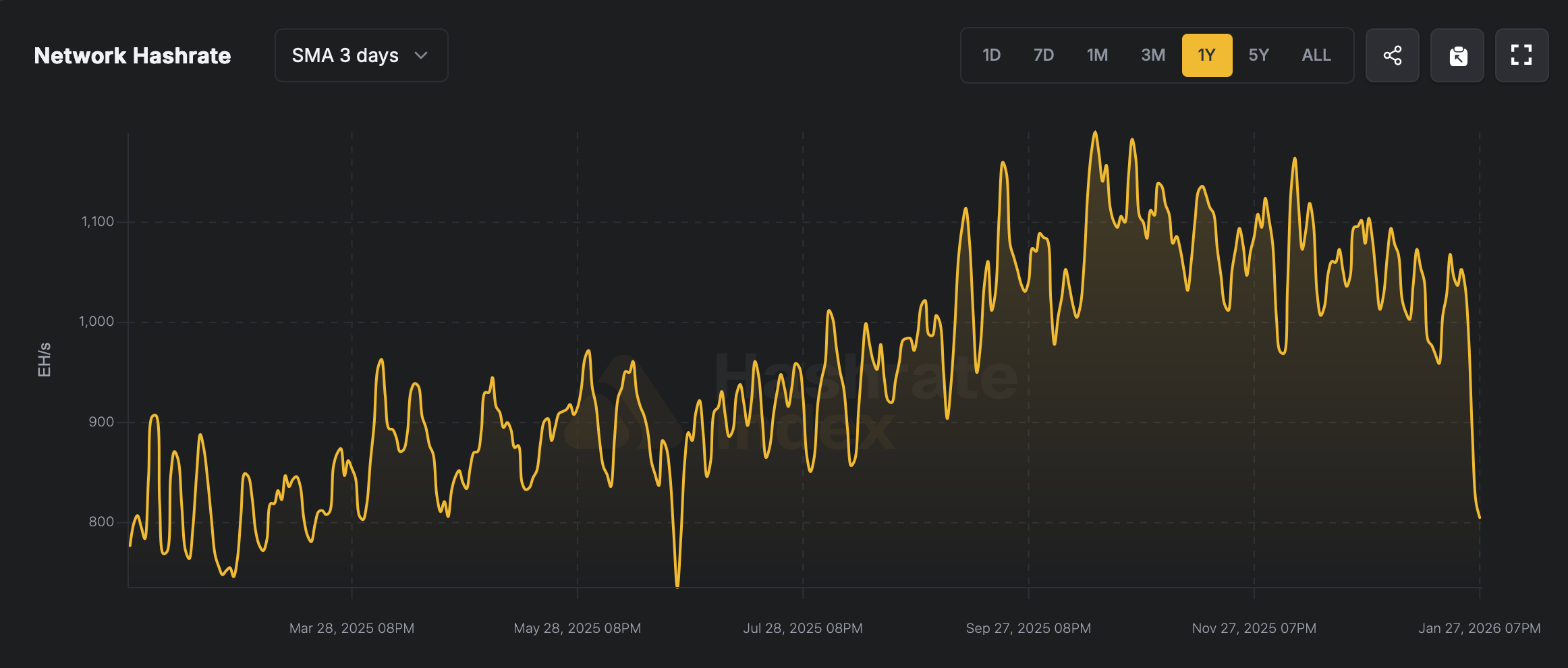

This blustery Arctic storm has officially made the South and the lower Ohio Valley its chilly playground, with Tennessee, Texas, Louisiana, Mississippi, Kentucky, Georgia, Alabama, and West Virginia feeling the brunt of it. These states aren’t just cozying up with hot chocolate; they also host sizable clusters of bitcoin mining facilities, with Texas strutting around like a peacock in a mining competition.