Let me tell you, ever notice how life has this uncanny knack for ignoring your well-laid plans? In the world of cryptocurrency, where fortunes rise and fall faster than the average teenager’s hair, one might expect the news of ETF approval to send XRP prices sky-high, like a well-oiled kite caught in a tailwind. But no, dear friends, the XRP whales are more used to this choreography of disappointment.

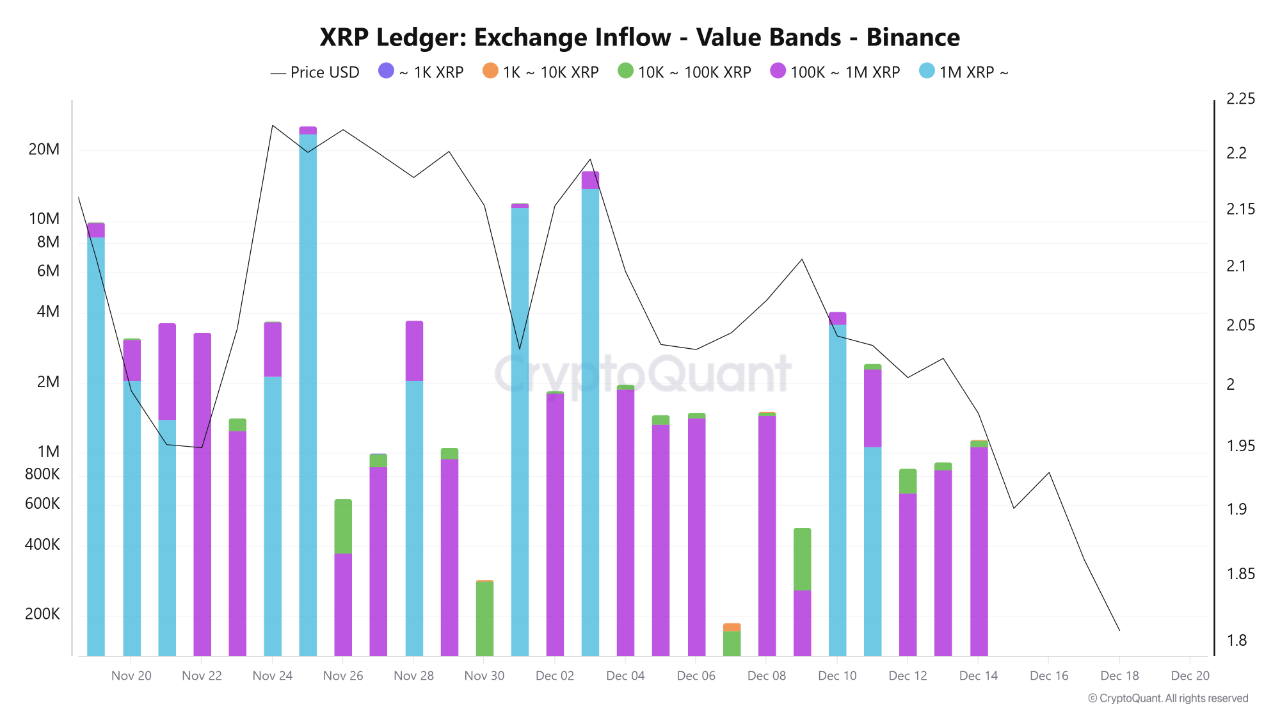

Enter our intrepid CryptoQuant analyst, PelinayPA. In their latest adventure, they’ve scoured the Binance Inflow-Value Band chart, looking for clues. It turns out the big cats are favoring exchanges with XRP stash ranging from 100,000 to over a million. No, they aren’t here to play, but rather to put the pedal to the metal on token transfers. You know, typical whale behavior. Now, these large inflows sound sophisticated, but let’s be honest, they’ve been precursors to selling, not buying. Like, “Oops, didn’t see that coming!”

While these digital giants aren’t dumping their XRP in one fell swoop-what a surprise!-their passive-aggressive supply increase has kept XRP in the red (and not the cool kind you get at fashion shows). Our dear PelinayPA notes that when these inflow spikes happen, the price does a graceful downward dance, forming what some might call chic “lower highs and lower lows.” Truly the stuff of financial avant-garde.

XRP Price: More Drama than Reality TV

And now, for the finance aficionados, our analyst has spotted an alluring support zone lurking somewhere between $1.82 and $1.87. It’s like trying not to imagine what tragic tales might ensue from any further price dips below $1.50-pathetic, really. With sharks circling, XRP struggles to stay afloat around $1.95. And the current chart, my friends, does not read “preparing for a joyous rally.” That’s enough to make even the most optimistic XRP supporters sob into their crypto-themed handkerchiefs.

PelinayPA posits that theory and reality have never been further apart. Despite the hullabaloo about ETF progress supposedly helping institutional buyers pounce on XRP, what we have on our hands is instead an orchestrated sell-off. These whales, they’ve got sophistication, they wait for retail demand driven by ETF hype and then-kaboom-they unload. It’s almost majestic, if not terribly depressing for the hopeful XRP investor.

XRP ETFs and Their Astonishing Stay of Inflow

Meanwhile, somewhere over at XRP-land, there’s a different kind of intrigue brewing. The XRP ETFs have kept up a stellar streak of inflows for 30 straight trading days. And Brad Garlinghouse, our XRP crusader, is head over heels about it. At least someone’s enjoying some good economic weather-I’m sure those ETFs are doing much better at being upbeat than I am at trying to convince myself that my dog is not secretly plotting to take over my small apartment.

Leading this ETF parade was Canary Capital, making quite the splash as the first U.S. spot XRP ETF. Almost like a cartoon character racing away with a winning lottery ticket, but instead, they left investors gushing with nearly $250 million. This boom sparked a frenzy, and in pretty quick succession, Franklin Templeton, Bitwise XRP ETF, and Grayscale XRP ETF have followed suit, all jostling for the top of the pile like kids in a school cafeteria line. And the queue only gets longer as more launches loom.

Read More

- GBP CHF PREDICTION

- USD VND PREDICTION

- EUR USD PREDICTION

- USD MYR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- EUR RUB PREDICTION

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- USD JPY PREDICTION

- USD TRY PREDICTION

- CNY JPY PREDICTION

2025-12-21 04:58