Oh, the drama! On-chain data reveals that Bitcoin’s Exchange Reserve has taken a rather dramatic turn, akin to a particularly flustered gentleman at a garden party. One might say it’s a sign that the asset’s price is as stable as a teetering tower of teacups.

Bitcoin Exchange Reserve Has Hit A Multi-Month High

In a recent missive on X, the esteemed CryptoQuant analyst Maartunn has noted a peculiar trend in the Exchange Reserve of Bitcoin. This enigmatic indicator, which tracks the total amount of cryptocurrency languishing in the wallets of centralized exchanges, has seen a most alarming spike. One might imagine it as a horde of investors, all clamoring to deposit their coins, much like a group of overly eager guests at a dinner party.

When this metric ascends, it suggests that investors are depositing their coins in droves, a move that could spell trouble for BTC’s price. One might liken it to a crowd rushing to the exit of a theater, only to find the door locked. A rather unappealing scenario, if you ask me.

Conversely, a decline in this indicator signifies that investors are withdrawing their coins, a gesture that could be interpreted as a desire to hold onto BTC for the long haul. A bullish sign, if one can call it that, akin to a gentleman choosing to keep his umbrella rather than part with it in a downpour.

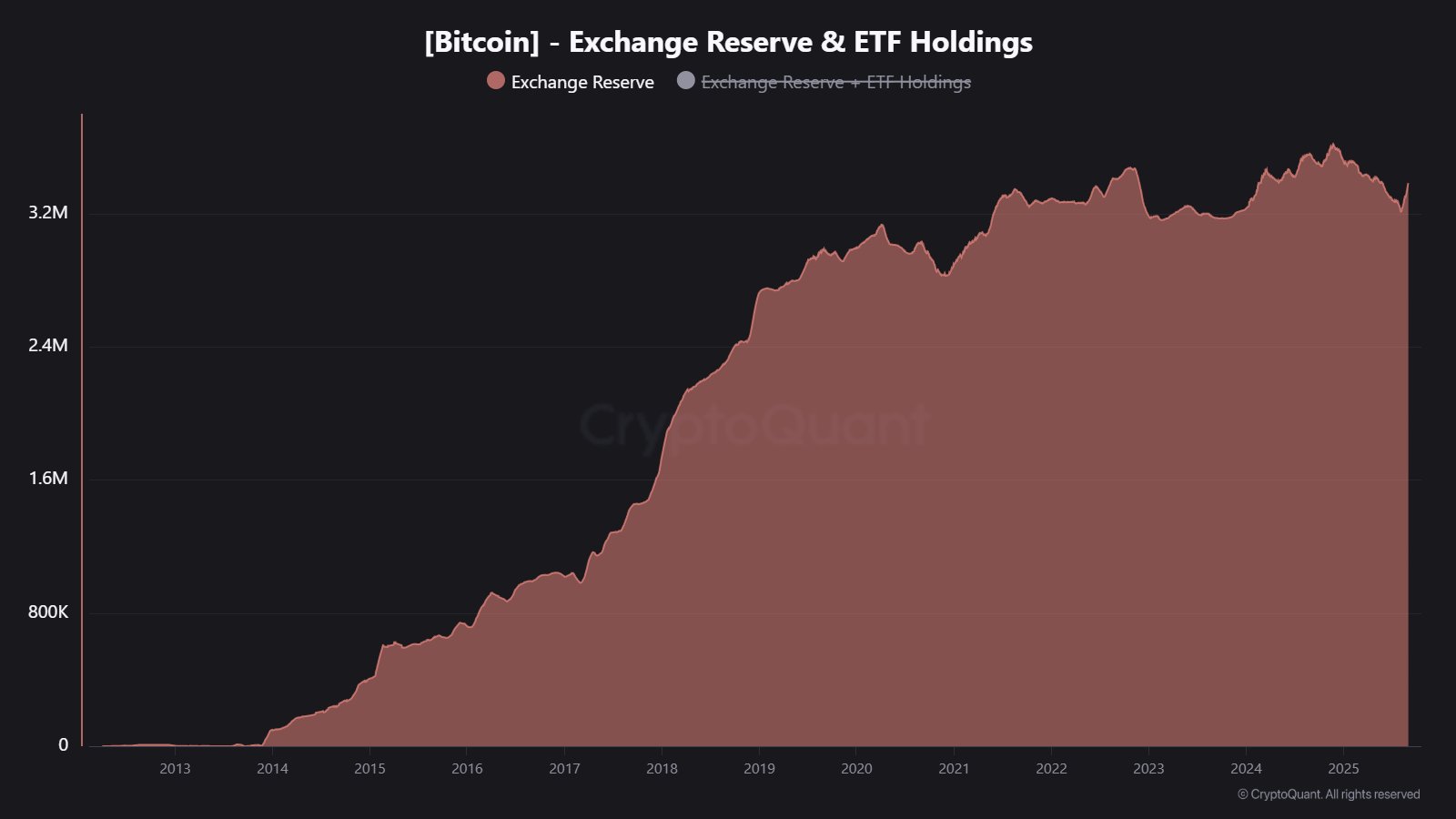

Behold, a chart illustrating the tumultuous journey of the Bitcoin Exchange Reserve:

As visible in the above graph, the Bitcoin Exchange Reserve reached its zenith in late 2024, only to plunge into a downtrend, suggesting a shift in investor behavior. A most curious development, to say the least.

The decline was persistent, but recently, a most unexpected reversal has occurred, with the indicator soaring once more. Its value now stands at 3.383 million BTC, a figure that would make even the most stoic of investors raise an eyebrow.

“This signals a shift in trader behavior,” remarks Maartunn, with the gravitas of a man who has just discovered the last of the crumpets. “More coins moving to exchanges often precedes increased selling pressure.” The deposit spree from investors has coincided with a period of bearish action in the Bitcoin price. One can only wonder if these exchange inflows will prolong the drawdown.

Speaking of the price decline, on-chain analytics firm Glassnode has offered insights into how this plunge compares to past ones in terms of BTC supply in loss.

As displayed in the chart, a mere 9% of the Bitcoin supply is currently in loss, with the maximum loss among these underwater coins standing at a modest 10%. As Glassnode explains, this dip remains relatively shallow, much like a puddle in a well-trodden path.

In contrast, the local bottom of this cycle saw >25% of supply at up to 23% losses, and global bear markets have reached >50% supply with up to 78% losses. This dip remains relatively shallow.

BTC Price

At the time of writing, Bitcoin is trading around $111,200, up 2% over the last 24 hours. A modest rise, but one that would likely be celebrated with a glass of champagne by the more exuberant of investors.

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

2025-09-03 10:01