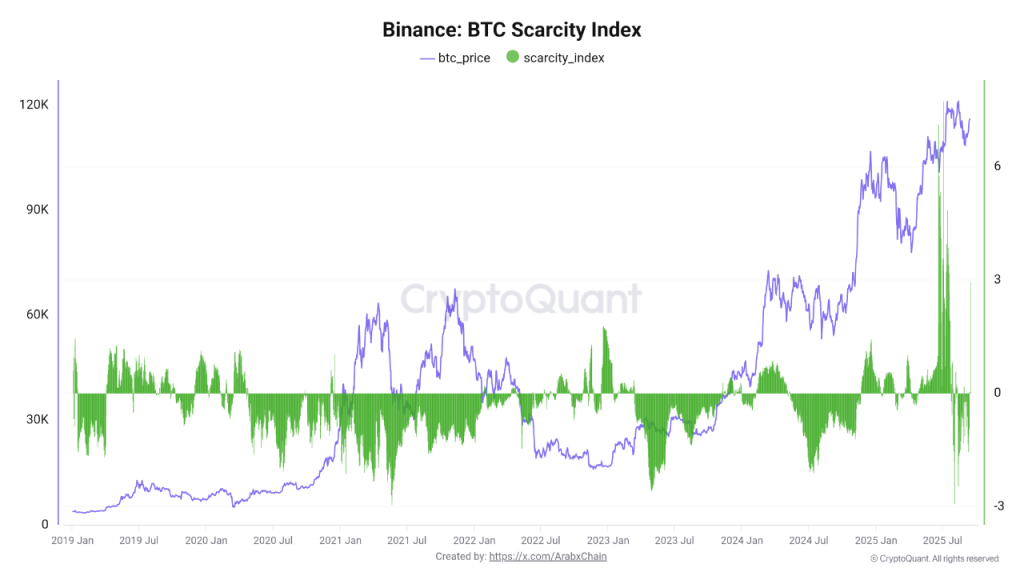

My dear, the BTC price is simply *the* topic du jour, as the Bitcoin Scarcity Index on Binance has, at long last, experienced its first spike since June. How utterly thrilling! This, my darlings, strongly suggests that the masses are once again flocking to the crypto altar with their wallets wide open. 🛍️💸

With BTC currently lounging at a rather fetching $114,855, this sudden shift in scarcity has the masses whispering: “Could this be the dawn of a fresh accumulation phase?” Oh, the drama! The intrigue! One can hardly keep up. 🕵️♂️✨

Scarcity Spike: The Whales Are Circling, Darling!

The latest tittle-tattle comes from that ever-so-reliable onchain metric, the “Bitcoin Scarcity Index“. It tracks the delicate balance between immediate buying power and the available supply on exchanges. How utterly civilized! 🧐📊

When this index rises sharply, it typically indicates that either the sell orders have taken a holiday or that the whales-those grande dames of the crypto world-are withdrawing their Bitcoin from the platform. How discreet! 🦈💼

This week’s jump, my dears, suggests that demand has suddenly outpaced supply, hinting at the return of those ever-elusive whales and institutions. Oh, the audacity! 🐳🏦

Notably, a similar spike last June preceded a rather splendid rally that propelled the Bitcoin price chart toward the $124,000 region. One can only hope history repeats itself, darling! 📈🌟

That said, if this current move sustains over several days, it could very well signal the start of another accumulation phase. How utterly delightful! 🛒💎

Institutional Accumulation: The Bullish Ballet Continues

Adding a touch of gravitas to this bullish narrative, Michael Saylor’s latest disclosure reveals that 525 BTC were recently acquired by “Strategy” for a cool $60.2 million at an average price of $114,562 per Bitcoin. How positively extravagant! 💼💰

This purchase brings their total holdings to a staggering 638,985 BTC, acquired for approximately $47.23 billion at an average price of $73,913 per coin. One can only imagine the champagne corks popping! 🍾🥂

Such large-scale accumulation, my darlings, underscores the growing institutional confidence, aligning perfectly with CryptoQuant’s analysis. It seems the big players still view Bitcoin as a long-term store of value. How très chic! 🏰💎

Divergence Pattern: The Macro Waltz Continues

Amid this scarcity shift, the Bitcoin price in USD has triggered a hidden weekly bullish divergence on its technical chart. How utterly sophisticated! 📉📈

This, my dears, signals underlying strength in the broader trend. It suggests that while short-term sentiment may be as fickle as a summer breeze, the macro cycle still leans toward a continuation of the bullish trend. How reassuring! 🌬️💪

Historically, Bitcoin has shown similar setups before significant rallies. If this divergence plays out, the BTC price forecast suggests it could lean bullish as we sashay into the final quarter of the year. How utterly fabulous! 🎩✨

Cyclical Patterns: A Fourth Quarter to Remember?

Meanwhile, a separate analysis comparing historical market cycles noted that Bitcoin rallied a staggering 72% from October to December last year. How positively dazzling! 🎢🎉

Applying that same pattern to 2025’s price action implies the possibility of BTC reaching nearly $200,000 before year-end if the rally repeats. One can hardly contain one’s excitement! 🎄💸

$BTC chart honestly looks bad if you ignore the macro cycle.

Last year Oct-Dec = +72%.

Run that back in 2025 → ~$200K BTC before Christmas.

Disclosure: I don’t make the rules. 😏

– Arca (@arcamids) September 15, 2025

While not guaranteed, this perspective adds a dash of optimism to the growing market enthusiasm surrounding the BTC price prediction for the coming months. One can only hope for a merry crypto Christmas! 🎁🚀

Read More

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- ETH PREDICTION. ETH cryptocurrency

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

2025-09-15 17:23