Oh, the drama! The Bitcoin bull market is allegedly kaput, says some clever clogs with a ruler and a 200-day chart. The crypto crowd? Split like a banana at a monkey convention. Bearish for 2026? 🌧️🐻 Or just a spot of bother? 🤔

Apparently, Bitcoin’s under more pressure than a dwarf in a bounce house. One self-proclaimed oracle claims the bull’s had its last moo. 🥩

Enter Crypto Birb, the feathered fortune-teller of X, squawking about bearish omens. “The trend’s gone south!” they caw. Metrics? Check. Followers? Panicking. 📉🐦

Source – Crypto Birb X. (Views: 43,200+ and counting. Drama: off the charts.)

Cue the crypto circus! 🎪 Price movements? Spookier than a ghost in a spreadsheet. Volume spikes? Selling like hotcakes at a fire sale. Volatility? More unstable than a wizard’s potion shelf. 🧙♂️💥

Bulls Roar Back: “Not So Fast, Fuzzy!”

But wait! The bulls aren’t having it. Timbo78625468 (yes, that’s a name) on X says, “Higher highs and lows, baby!” 🦬💪 Charts? Still bullish. Bear bottom? Just a bad hair day.

Source – X, Timbo78625468. (Technical resilience? Or wishful thinking? You decide.)

Bitcoin could trip and still be in the race, they argue. Support lines? More arbitrary than a wizard’s hat size. 🎩

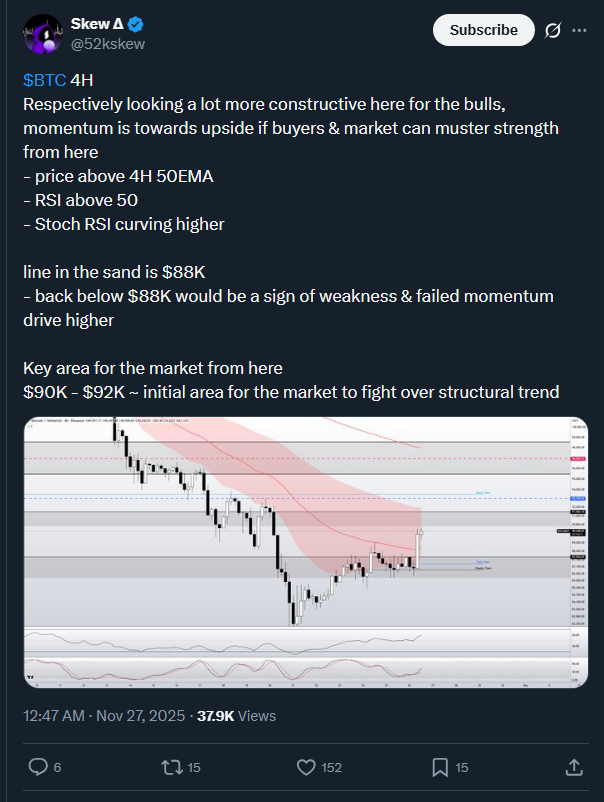

52kskew chimes in with a 4-hour chart that’s sunnier than a Discworld summer. 🌞 Price above the 50 EMA? Bullish! (Unless it’s not. 🤷♂️)

You might also like: Bitcoin News: Bitcoin ETF Exodus – $3.5B Flee Faster Than a Troll at a Tax Audit!

The $88,000 Question: To Hold or Not to Hold?

RSI above 50? Bullish! Stochastic RSI? Waving a tiny flag in the bullish direction. 52kskew says $88,000 is the line in the sand. 🏖️ Cross it, and it’s bear country. 🐻

Source – 52kskew on X. (Sand? More like quicksand if you’re wrong.)

Fail to break $88,000? Weakness confirmed. Momentum drives fizzle? Bears high-five. 🦬🆚🐻 The $90,000-$92,000 range? Where bulls and bears have a disco dance-off. 🕺💃

Distribution patterns? Sellers are queuing like it’s a sale at the Ankh-Morpork Market. Breadth indicators? Deteriorating faster than a wet scroll. 📜💧

Bitcoin’s been retesting support like a student re-reading a spellbook. Each attempt weaker than the last. Volume profiles? Accumulation’s heading south. 🧭⬇️

The 200-day moving average? A psychological wall thicker than the Library at Unseen University. Price can’t climb it. 📈🚫 History says corrections lurk nearby.

Momentum indicators? Flashing warnings like a wizard’s staff on low battery. MACD divergences? Daily charts look like a goblin’s tax return. 📉📊 Relative strength? Falling faster than a dropped spellbook.

Market structure? Wobblier than a troll on a tightrope. Lower highs, weaker support. Buyers? Scarcer than a honest politician. 🏛️🤥

Crypto Birb’s crystal ball? Foggy for 2026. Downward pressure? Check. Signs? As clear as a dwarf’s beer. 🍺

Technical breakdowns? Rarely fixed with a quick “Abracadabra.” Trends take time, like brewing a decent cup of tea. ☕ Patient traders? Waiting with more patience than a librarian in a silent archive.

The crypto crowd? Still arguing like wizards over a spell. Bulls cite fundamentals. Bears point to charts. 🦬🆚🐻 Who’s right? Only the Great A’Tuin knows. 🐢

You might also like: Bitcoin News: Legendary Trader Sounds Alarm – Or Is It Just a Snore?

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- POL PREDICTION. POL cryptocurrency

- GBP CNY PREDICTION

- USD VND PREDICTION

- Brent Oil Forecast

- EUR KRW PREDICTION

- EUR RUB PREDICTION

2025-11-27 18:00