Ah, the fickle fortunes of the digital realm! On the eve of September 27th, Hyperdrive, that vaunted Hyperliquid protocol, found itself bereft of 782,000 tokens, thanks to a cunning exploit in its smart contract. A thief, no doubt with a smirk and a flair for the dramatic, emptied its coffers with the finesse of a seasoned pickpocket. 😏

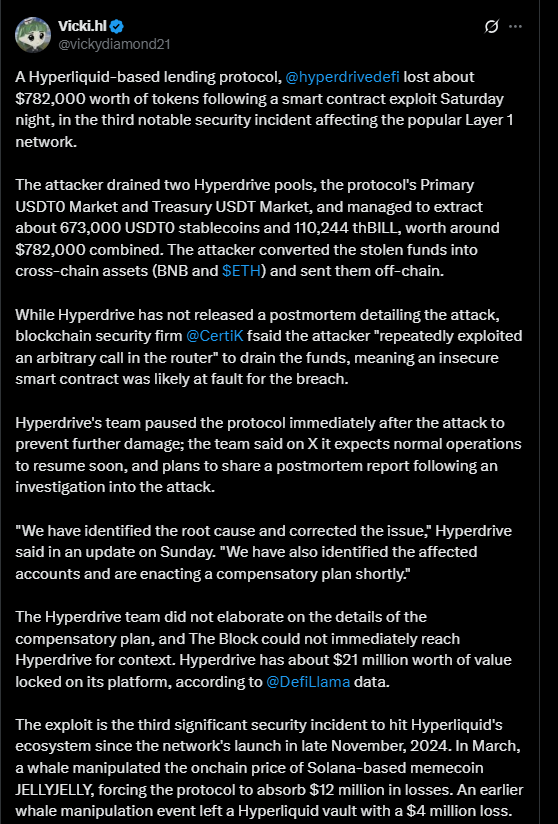

Hyperdrive, a lending protocol perched atop the Hyperliquid network, suffered this indignity on a Saturday night-a time when one might expect the world to be sipping tea or perhaps indulging in a novel. Alas, the digital realm knows no rest. Two of its most prized liquidity pools, the Primary USDT0 Market and the Treasury USDT Market, were left as barren as a Russian steppe in winter. 🥶

The spoils? A modest 673,000 USDT0 stablecoins and 110,244 thBILL tokens, swiftly laundered into cross-chain assets like BNB and ETH, and spirited away into the ether. CertiK, those vigilant sentinels of blockchain security, noted that the attacker employed an arbitrary call in the router of Hyperdrive’s smart contract-a flaw as subtle as it was devastating. 🕵️♂️

Source – X

This vulnerability, a chink in the armor of Hyperdrive’s code, allowed for unauthorized withdrawals-a reminder that even the most sophisticated systems are but castles of sand before the relentless tide of human ingenuity. 🏰

Hyperdrive, to its credit, halted operations posthaste, lest further damage be wrought, and launched an investigation with all the fervor of a spurned lover. 💔

The Root of the Malady, and a Promise of Reparation

The culprit, it seems, was a defect in the router contract-a flaw as inevitable as a Russian winter. The protocol’s team, with a mix of contrition and resolve, declared the vulnerability mended and pledged a compensation scheme for the aggrieved users. The details, alas, remain shrouded in mystery, though a postmortem report is promised in due course. 🧩

Despite this debacle, Hyperdrive’s total value locked (TVL) stands at a respectable 21 million. Yet, this is but the latest in a series of misfortunes for the Hyperliquid ecosystem, which has endured no fewer than three major breaches since its launch in November 2024. A veritable gauntlet of trials, one might say. ⚔️

Whale manipulations, those leviathans of the crypto seas, have proven particularly vexing, inflicting losses in the millions. One cannot help but wonder if the ecosystem is but a ship adrift in a storm, its hull breached by unseen forces. 🌊

Hyperliquid’s Security Woes: A Saga of Woe and Woe Again

This latest exploit has cast the Hyperliquid ecosystem into the harsh glare of scrutiny. In early 2022, a whale manipulated the price of the Solana memecoin JELLYJELLY, forcing the protocol to cover a staggering 12 million in losses. Another whale attack saw a Hyperliquid vault relieved of 4 million. One begins to suspect a pattern, does one not? 🐳

Hyperdrive’s swift response and promised compensations are a testament to its desire to restore trust. Yet, one cannot help but question the robustness of Layer 1 chain-based decentralized finance protocols built upon Hyperliquid. Are they but houses of cards, waiting for the next gust of wind? 🃏

In the end, the tale of Hyperdrive is but another chapter in the grand, often absurd, saga of human ambition and its inevitable foibles. Will they learn from this? Only time-and perhaps a few more exploits-will tell. 🕰️

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

2025-09-29 18:19