So, the FTX Recovery Trust has decided to throw another party, and this time they’re handing out $1.6 billion in September. 🎉 Yes, you heard that right-another slice of the pie is being served, and creditors are lining up like it’s the last buffet on Earth. This marks the third round of repayments since the trust started cutting checks earlier this year, bringing a sliver of relief to those who lost their life savings in what can only be described as the crypto equivalent of a clown car crash. 🚗💥

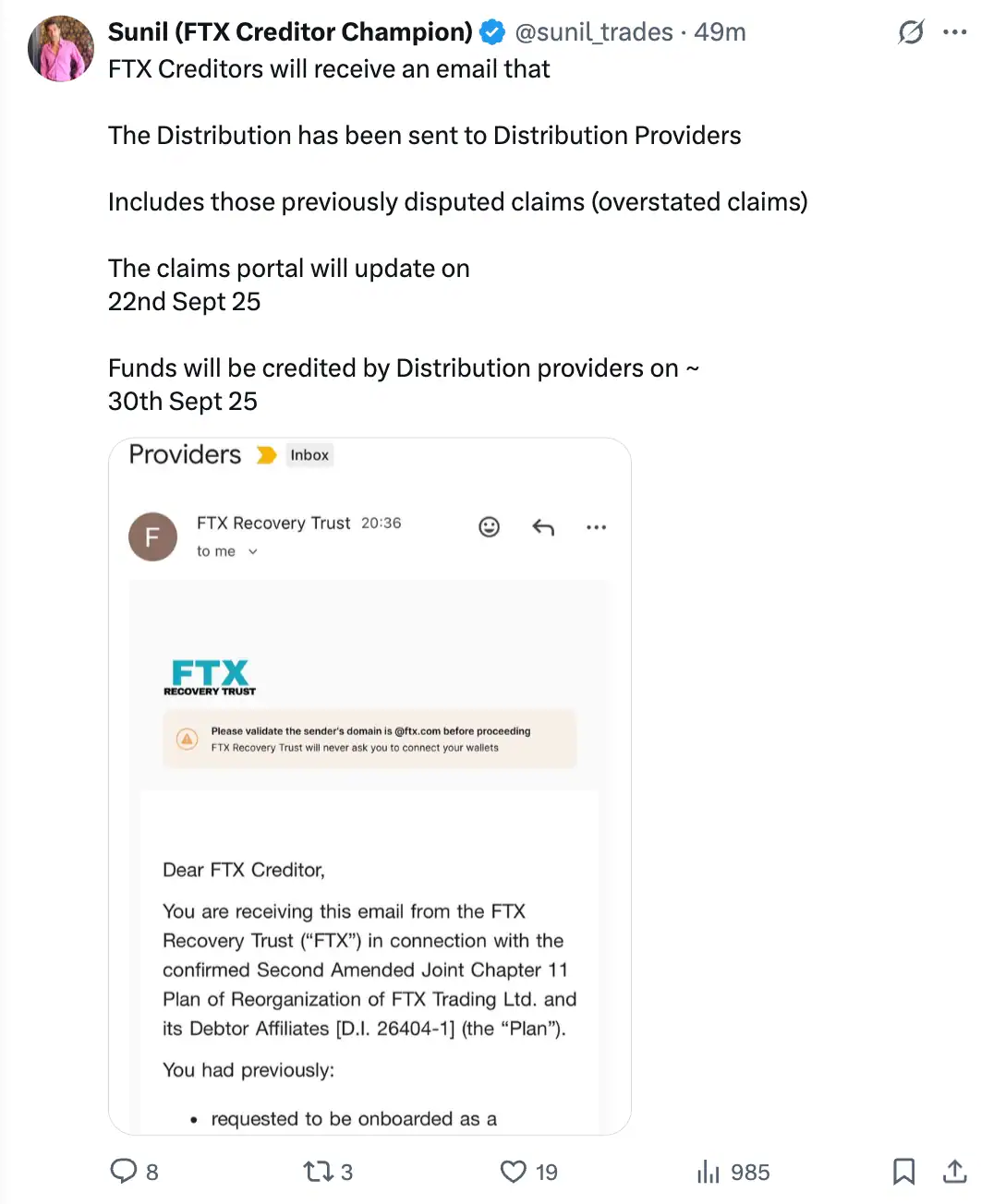

The claims portal will open tomorrow, source: X

Who Gets the Golden Ticket? 🎟️

September’s payout is about as uniform as a bowl of alphabet soup. Here’s how the pie is being sliced, and yes, it’s as arbitrary as a game of pin the tail on the donkey:

- Dotcom Customer Claims: 6% distribution 🥧

- US Customer Entitlement Claims: 40% distribution 🇺🇸

- General Unsecured Claims & Digital Asset Loan Claims: 24% distribution 🤷♂️

- Convenience Claims: a whopping 120% reimbursement 💰💥

That last one-“convenience claims”-is the bankruptcy court’s way of saying, “Let’s just get this over with.” Creditors in this category are walking away with more than they lost, which is about as common as a unicorn in a business suit. 🦄

The Bigger Picture 🌍

This latest tranche follows a $1.2 billion disbursement in February and a $5 billion payout in May, with up to $16.5 billion ultimately earmarked for creditors. Given how chaotic the collapse was in 2022-when FTX’s implosion dragged the entire crypto market into a winter colder than a British summer-the fact that anyone is seeing money back at all is nothing short of miraculous. 🌨️❄️

But let’s not break out the champagne just yet. 🍾 These repayments are less of a victory lap and more of a slow, painful march through the wreckage of one of the most spectacular failures in financial history. Traders are still watching each distribution like hawks, wondering if the sudden influx of cash will send the crypto markets into another tailspin. 🌀

The Shadow of SBF 🦹♂️

All of this is happening under the looming shadow of Sam Bankman-Fried, the man who once promised to save the world with altruism and ended up being the poster child for financial fraud. Convicted in late 2023 on seven counts ranging from wire fraud to money laundering conspiracy, SBF was sentenced in March 2024 to 25 years in prison. The judge called his crimes “serious,” which is a bit like calling the Titanic’s sinking a “minor inconvenience.” 🚢💨

Naturally, SBF isn’t going down without a fight. His lawyers are appealing the conviction this November, arguing that the trial was unfair and-get this-that FTX was never actually insolvent. Right, because all those creditors just lost their money on a wild goose chase. 🦢

Why It Matters 🤔

For many, these repayments are less about the money and more about closure. The FTX collapse wasn’t just another exchange failure; it was a confidence nuke that reshaped how regulators, investors, and even normies view crypto. 💣

Now, as the Recovery Trust continues to pick up the pieces of SBF’s shattered empire, the real question isn’t just how much creditors will get back-but whether the industry can ever rebuild the trust that Sam Bankman-Fried so thoroughly torched. 🔥

So, grab your slice of the pie, but don’t forget: in the world of crypto, the circus never really ends. 🎪

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

2025-09-21 22:35