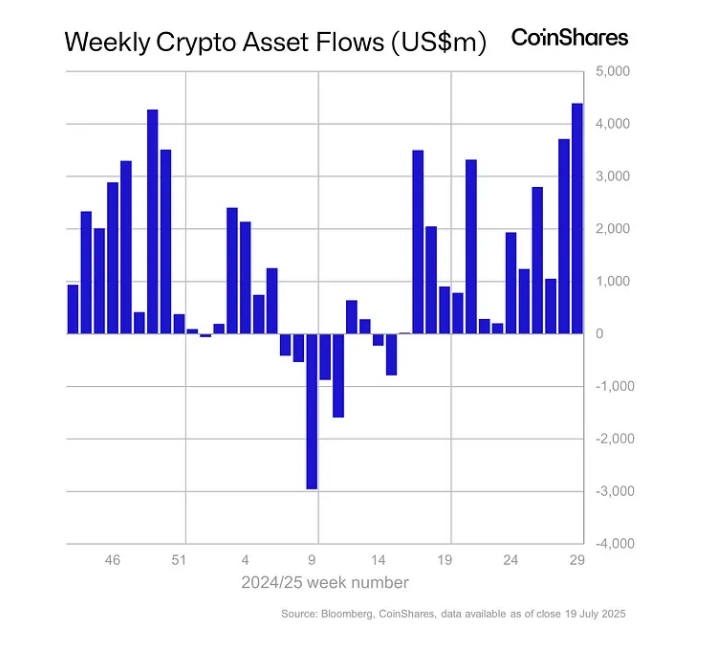

Oh my, oh my, what a week it’s been in the wacky world of crypto! 🤑Investors have been throwing money around like confetti at a wedding, and guess what? They’ve broken yet another record! According to CoinShares, the net inflows into digital-asset products have skyrocketed to a whopping $4.40 billion. That’s right, folks, they’ve beaten the previous record set after the 2024 US elections by a cool $120 million! 🎉

And it doesn’t stop there! This marks the 14th consecutive week of positive flows, pushing the year-to-date inflows to an impressive $27 billion. Total assets under management have soared to a new high of $220 billion. Can you believe it?!

Last week’s haul wasn’t just a small bump; it was a giant leap for crypto-kind! Investors have been pouring capital into these funds non-stop since early April, showing a significant shift towards digital assets in their portfolios. It’s like a stampede of bulls charging through Wall Street! 🐃

Last week digital asset products saw all-time high weekly inflows of US$4.39bn, bringing YTD inflows to US$27bn, pushing AuM to a record US$220bn. Ethereum attracted a record US$2.12bn in inflows, while Bitcoin saw inflows of US$2.2bn.

— Wu Blockchain (@WuBlockchain) July 21, 2025

Total assets under management have reached an astronomical $220 billion, putting these products on par with many traditional asset classes in terms of sheer size. With $39 billion in weekly turnover, trading spreads have tightened, making it easier for the big boys to jump in and out without causing a tsunami. 🌊

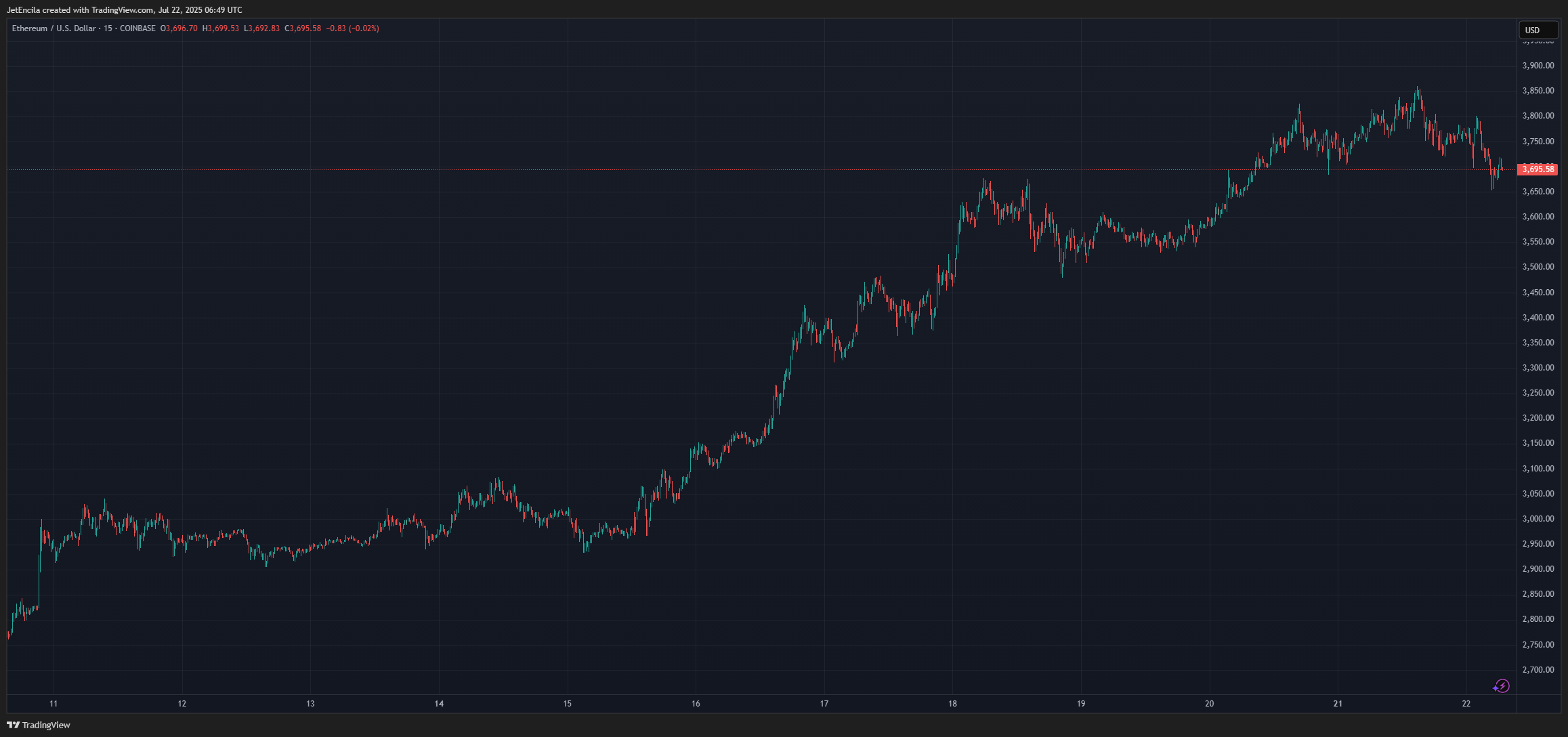

Ethereum Takes Center Stage

But wait, there’s more! Ethereum has stolen the show this week, attracting a staggering $2 billion in inflows. That’s almost twice its previous weekly high of $1.2 billion! Ether prices have surged 24.5%, reaching heights not seen in over seven months. 🚀

This price rally has certainly caught the attention of buyers. Bitcoin hasn’t been left behind either, with $2 billion in inflows, although that’s slightly down from the previous week’s $2.7 billion. ETPs accounted for 55% of Bitcoin’s total exchange volume, indicating that institutions are eager to get a piece of the action through these regulated vehicles. 🏷️

US Market Surges Ahead

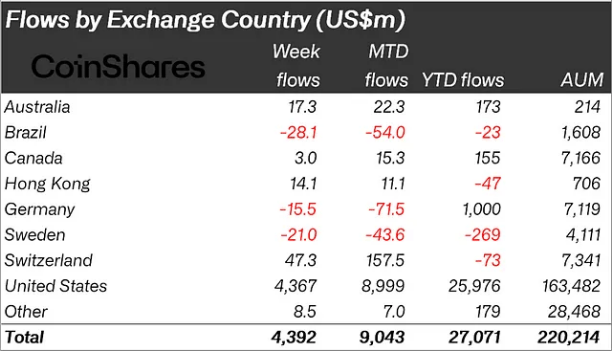

When it comes to regional flows, the United States leads the pack with $4.30 billion of last week’s inflows. Switzerland, Australia, and Hong Kong have also contributed their fair share, but Brazil and Germany experienced minor outflows as domestic investors took profits or changed their strategies. 📉

The massive demand in the US is a testament to the regulatory clarity surrounding spot crypto ETFs and the growing confidence of asset managers in utilizing these products. It seems like the crypto fire is only getting hotter! 🔥

Read More

- BTC PREDICTION. BTC cryptocurrency

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- EUR USD PREDICTION

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

2025-07-22 16:18