What to know (Or: How to Pretend You Understand Cryptocurrency at Parties):

In the office of The Hitchhiker’s Guide to Cryptocurrencies, researchers have compiled the following utterly baffling observations:

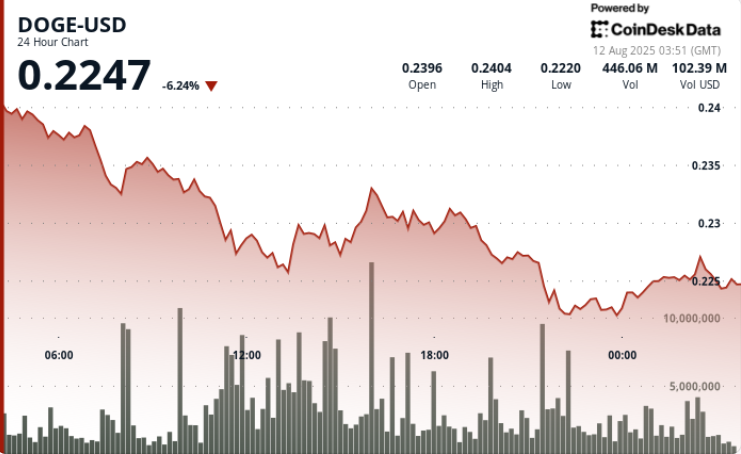

- DOGE fell over like a narcoleptic giraffe at a bowling convention, tumbling 6.88% in what experts call “not ideal” 📉

- $0.238 wasn’t just resistance – it became the financial equivalent of that one friend who always says “we should totally hang out” and never does

- Meanwhile, mysterious forces called “the broader market” and “regulatory uncertainty” conspired against DOGE holders who just wanted to afford that third avocado toast

The Saga of DOGE: A Technical Tragedy in Three Acts

Our plucky cryptocurrency protagonist found itself in quite the predicament when, against all wisdom and several laws of physics, it decided to plunge 6.88% during a 24-hour period that many would describe as “weekdays.” Like a teenager attempting to parallel park for the first time, DOGE reeled from $0.24 to $0.22 while bid-side liquidity folded faster than a deck chair in a hurricane.

The crisis moment arrived at precisely 07:00 (give or take) when prices slid from $0.238 to $0.233 on volume so high it could be heard in neighboring galaxies. This established $0.238 as resistance – which in cryptocurrency terms means “the price at which everyone suddenly remembers they should probably sell.”

Newsflash from the Galaxy Next Door

Meanwhile, in the broader universe where normal people try to understand cryptocurrency, there was what economists call “a whole situation.” Regulatory uncertainty loomed large, much like that questionable leftover takeout in your fridge. Global trade tensions escalated with all the grace of a hippopotamus attempting ballet, causing institutional investors to shed crypto holdings faster than a golden retriever sheds fur in summer.

The Price Action Soap Opera

• DOGE performed an elegant 6.88% swan dive (score: 8.5 from the Russian judge) 🤸

• $0.238 became the new “DOGE at this price? No thanks!” benchmark

• $0.226 saw some brave buyers, though whether they were heroes or just very bad at math remains unclear

• The final hour saw DOGE trading in the tightest range since your last Zoom meeting that could have been an email

Professional Opinions (Available for Rent)

Somewhere in a glass tower, actual experts determined that whales were taking profits at $0.238 resistance, which caused the entire ecosystem to spiral into mild-to-medium chaos. Support buying appeared in textbook fashion, repeatedly getting rejected near $0.231 like your Tinder match who ghosted after three messages.

The structure now hints at potential base-building – though macro headwinds could blow hard enough to test $0.22 again, much like how your ex “tests” your patience by liking old Instagram posts at 2 AM.

Things That Look Fancy But Might Not Mean Anything

• Resistance: $0.238 (“nope”), $0.231 (“maybe later”)

• Support: $0.226 (“for now”), $0.2247-$0.2249 (“please?”)

• 24-hour range: Wide enough to make rollercoasters jealous

• Volume patterns suggesting sellers might be getting bored, which happens to the best of us

What Traders Pretend to Care About

• Will $0.22 hold? Current Vegas odds: 🤷♂️

• Breakouts above $0.231 – the crypto equivalent of your New Year’s resolutions

• Macro headlines because nothing says stability like “tariff disputes” and “central bank policy shifts”

• Signs of whales appearing again, possibly with tiny cryptocurrency harpoons

Read More

- EUR USD PREDICTION

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

2025-08-12 08:20