Ethereum’s price isn’t just up-it’s sprinting like it’s late for a meeting with Elon. In seven days, it’s surged nearly 20%, shattering the $4,000 barrier like it’s made of tissue paper. At $4,310, it’s now just 11.7% shy of its all-time high of $4,878. If you blinked, you missed it. Literally.

But here’s the kicker: the all-time high might be closer than your neighbor’s Wi-Fi password. Two factions-spot buyers and derivatives traders-are teaming up like Batman and Superman to push ETH into the stratosphere. Or maybe that’s just Ethereum’s way of saying, “I’ve got 99 problems, and gravity is one.”

Spot Buyers Keep Ethereum Supply Tight

If you’ve ever wondered how to turn a coin into a scarce collectible, Ethereum’s exchange reserves are your answer. These are the ETH stashed on centralized exchanges, like a squirrel hoarding acorns but with more drama. High reserves? More selling pressure. Low reserves? Buyers get a front-row seat to a price party.

On July 31, reserves hit a record low of 18.72 million ETH. By August 12, they’re still hanging out at 18.85 million ETH, even as the price climbed. Translation: Buyers are outpacing sellers so hard, it’s like watching Usain Bolt race a sloth. 🐢🏃

Sure, there’s some aggressive selling happening, but low reserves mean buyers are the real MVPs. Or, as Ethereum would say, “We’re all out of acorns. Time to hit the market.”

An #Ethereum ICO participant (who bought 20,000 ETH for $6,200 and now has $86.6M) just cashed in 2,300 ETH ($9.91M). His wallet’s probably laughing at the rest of us. 😂

– Lookonchain (@lookonchain) August 11, 2025

History shows that when reserves spike, ETH’s rally gets the side-eye. But right now, reserves are tighter than a toothbrush in a TSA bag. And the price? It’s dancing on the edge of a resistance line like it’s auditioning for a circus. 🎪

For token TA and market updates: Want more crypto insights? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. (Spoiler: It’s free. Probably.)

Derivative Traders Stack Positions

If spot buyers are the spark, derivatives traders are the gasoline. Open interest-the total value of futures and perpetual contracts-hit a jaw-dropping $29.17 billion on August 9. That’s enough to make a derivatives trader cry happy tears (or panic, depending on the leverage). 🤯

Why does this matter? High open interest is like a loaded cannon. If ETH breaks through a key resistance, short sellers might get squeezed like a lemon in a juicer. That’s not just a rally-it’s a rocket ride. 🚀🔥

But if bulls falter? Well, leverage is a two-edged sword. One misstep and it’s a free fall to Wall Street’s dance floor. But right now, with spot buyers hoarding ETH, the odds are in the bulls’ favor. It’s like a heist movie where the thieves are also the heroes. 🎬

Record-low reserves + record-high open interest = a bull-squeeze combo that could make Elon proud. Or at least give him a migraine. 🤯

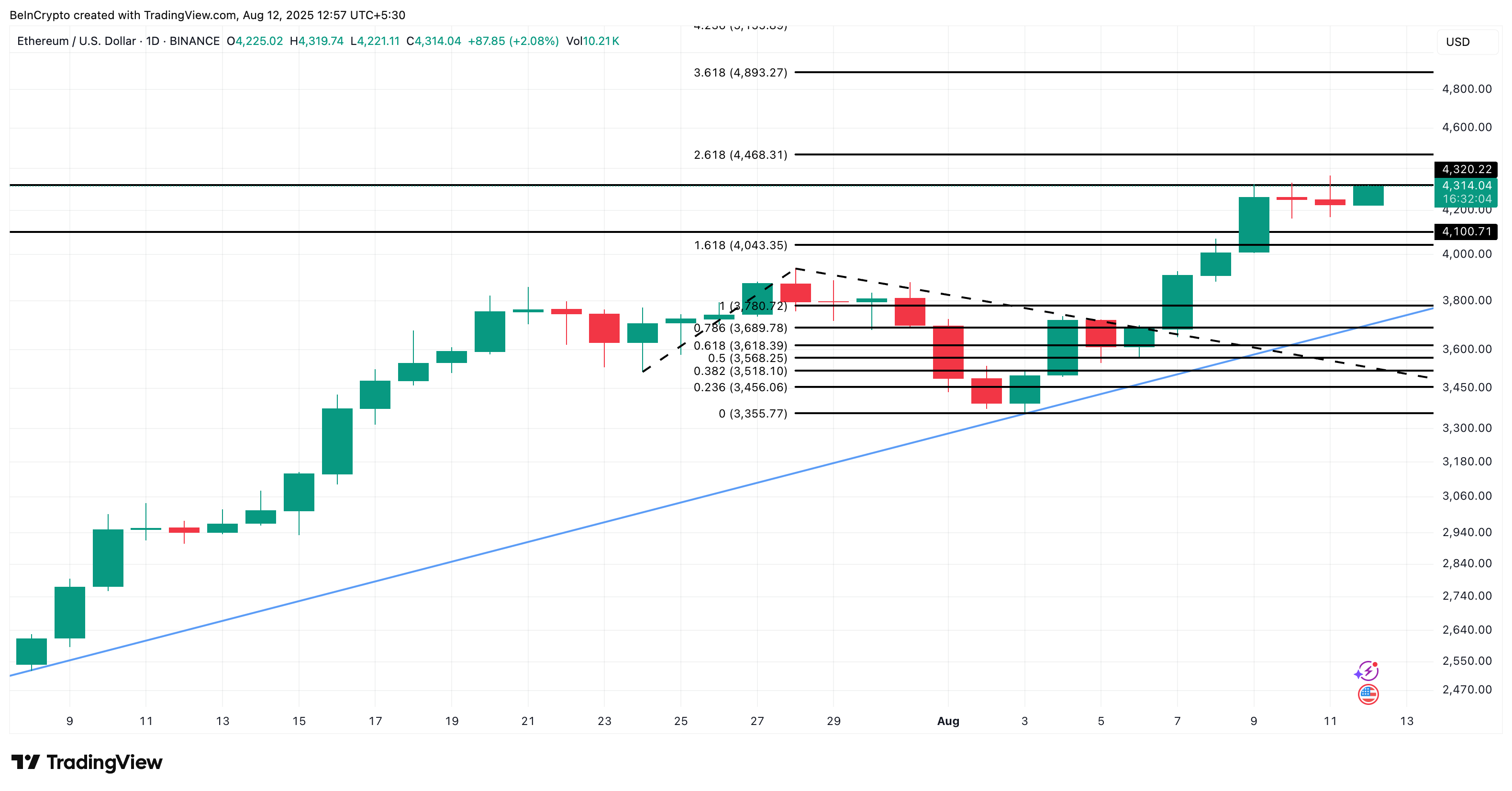

Key Ethereum Price Levels to Watch: One Stop Could Trigger A New Peak

Technically speaking, ETH is in an ascending triangle pattern, with a resistance level at $4,468. Think of it as the final boss in a video game. Beat it, and the all-time high of $4,878 is just a few more levels away. 💾

A clean break above $4,468? That’s not just a win-it’s a “I-told-you-so” moment for every analyst who ever said ETH would moon. And the next Fibonacci target? A fresh all-time high at $4,893. It’s like Ethereum’s saying, “I’m not done yet. Let’s go higher.” 🚀

But if ETH slips below $4,043? Buckle up for a rollercoaster. The downside support is like a safety net-if you fall, you’ll at least land in a pile of regrets. 🙃

Read More

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Gold Rate Forecast

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- Crypto Carnage: Fed’s “Hawkish Cut” Leaves Bitcoin in Tatters 🎢💸

2025-08-12 12:23