Well, butter my biscuit and call me astonished! Chainlink’s price has gone hog-wild, rallyin’ over 50% in the past week. Seems like the whales are swimmin’ upstream with their wallets wide open, and the bigwig institutions are jumpin’ on the bandwagon like it’s the last train to El Dorado. 🤑

- LINK’s up 50% this week, hit a 7-month high of $24.28 – that’s what I call a barn-burner! 🔥

- Chainlink’s buddying up with Intercontinental Exchange, bringin’ onchain pricing data for FX and precious metals. Fancy, ain’t it? 🏦

According to them smarty-pants at crypto.news, Chainlink (LINK) shot up to $24.28 on Wednesday, Aug. 13, Asian time. That’s a 50% weekly gain and a whopping 123% from its low point this year. Market cap’s sittin’ pretty at $16.4 billion – that’s more than a hill of beans! 🌟

Whales Are Gobblin’ Up LINK Like It’s Candy 🍬

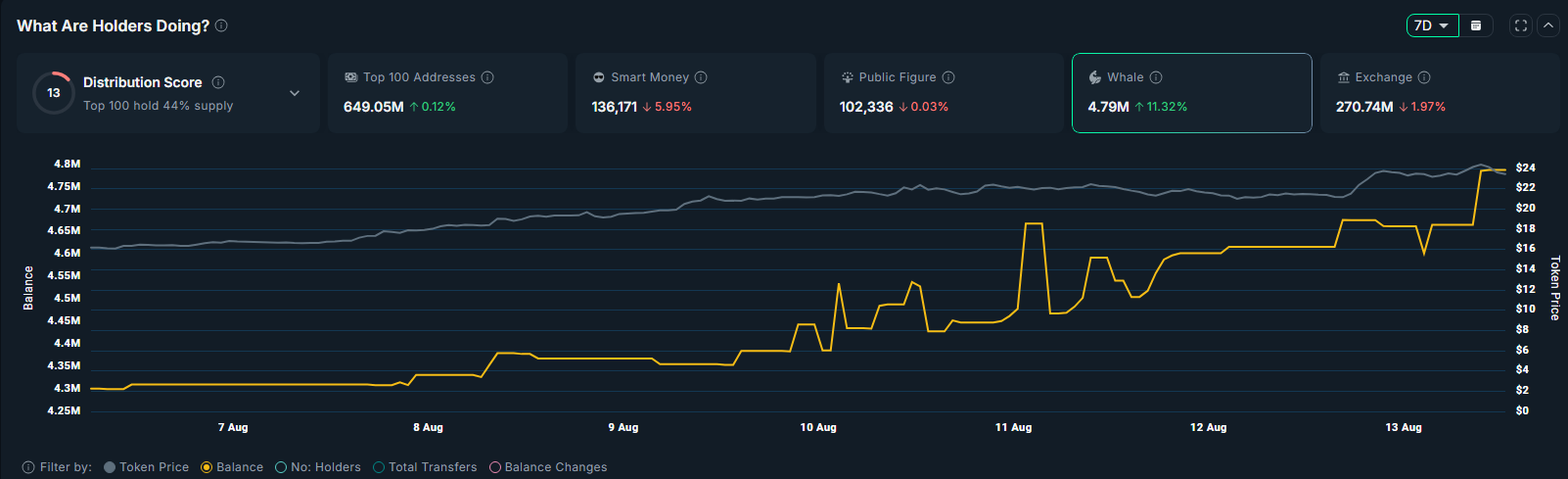

Now, what’s fuelin’ this rocket? Why, it’s them whales, of course! Nansen’s data shows these big fish have been hoardin’ LINK like it’s the end of days. Their wallets are up 8.5% in the last 7 days, holdin’ 4.65 million tokens – that’s a far cry from the 3.42 million they had in May. Them retail investors are followin’ suit, thinkin’ it’s a surefire bet. 🐳

Whale accumulation? That’s like seein’ a rainbow and bettin’ on a pot of gold. Retail folks are chasin’ these deep pockets, hopin’ to strike it rich. If the sentiment stays sunny and the fundamentals keep smilin’, this train ain’t stoppin’ anytime soon. ☀️

And let’s not forget Chainlink’s CCIP, which is cozyin’ up to Swift – yep, that Swift, the one used by 11,500 institutions. Now banks can chat with blockchains like old friends, makin’ interoperability smoother than a baby’s bottom. 🤝

The trial had big names like Euroclear, Citi, and BNP Paribas – that’s like the Who’s Who of finance. And now Chainlink’s teamin’ up with Intercontinental Exchange, bringin’ real-time pricing feeds for FX and precious metals. Talk about movin’ on up! 🚀

LINK Price: A Wild Ride or a Steady Climb? 🎢

On the charts, LINK’s dancin’ in an ascending broadening wedge – sounds fancy, but it’s just a bunch of lines meanin’ volatility’s on the rise. Then there’s the double-bottom formation at $10.9, with the neckline at $18. Breakin’ above that? That’s a bullish signal, my friend. 🌋

The 50-day movin’ average’s above the 200-day – that’s a bullish trend, no two ways about it. But here’s the kicker: an ascending wedge is usually bearish, yet LINK’s eyein’ $40, a cool 65% above where it’s sittin’ now. Some folks say $46’s in the cards if the rally keeps its pep. 🧙♂️

$29 and $46 are the next stops for Chainlink $LINK.

– Ali (@ali_charts) August 12, 2025

So, will LINK hit $40? Only time will tell, but one thing’s certain – this ain’t your grandma’s investment. Strap in, folks, it’s gonna be a wild ride! 🤠🚀

Read More

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- NEXO PREDICTION. NEXO cryptocurrency

- CNY JPY PREDICTION

- USD MYR PREDICTION

- USD COP PREDICTION

- OP PREDICTION. OP cryptocurrency

- HBAR’s Price Tango: A Bumpy Ride with a Bearish Twist!

2025-08-13 10:36