Ah, the fickle embrace of capital! 🤑 Ethereum, that darling of the digital realm, finds itself bathed in the golden glow of $3 billion in ETF inflows, a sum so prodigious it would make even the most stoic of institutions blush. 🌟 The question, my dear reader, is whether this influx shall propel ETH to the dizzying heights of $4,800, or if it shall merely serve as a prelude to a dramatic denouement of selling pressure. 🎭

ETH’s Price: A Tale of Bullish Bravado

In the sultry days of mid-August, Ethereum flexes its muscles with a bullish sentiment so robust, it could rival the bravado of a peacock in full display. 🦚 Spot Ether ETFs have seen demand so extraordinary, one might suspect they’ve discovered the Fountain of Youth. 💰 Inflows exceeding $3 billion in a fortnight? My word, the coffers are overflowing! 🏦

Daily inflows, you say? A mere $700 million, with peaks surpassing a billion! 🤑 Such extravagance has pushed ETH’s net assets to record highs, a clear sign that investors are no longer content with the mundane and have instead embraced the regulated allure of Ethereum. 🌟

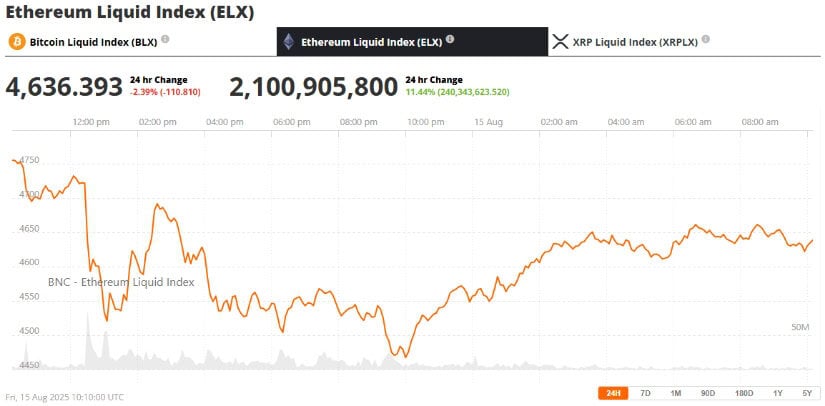

The price, oh the price! ETH has ascended nearly 20% in a week, grazing the celestial heights of $4,765, a figure not seen since the halcyon days of yore (2021, to be precise). 📈 Now, it teases us with the prospect of breaching $4,800, a resistance point as tantalizing as a forbidden fruit. 🍎 Will it succumb to profit-taking, or shall it soar to its all-time high of $4,891? Only the market, that fickle mistress, knows. 🧙♀️

Technical Insight: A Bull in a China Shop

Technically speaking, ETH trades in a bull channel so well-established, it could be mistaken for a gentleman’s club. 🦬 Key support levels? Check. Short-term moving averages? Check. A break above $4,870 would be as dramatic as a grand entrance at the opera, propelling ETH toward $4,950-$5,000. 🎭 Failure, however, would see it retreat to $4,720 or, heaven forbid, $4,504. 😱

Momentum gauges? Bullish, my dear, without a hint of overbought excess. The MACD, that trusty barometer, signals sustained buying pressure, while Bollinger Bands expand like a socialite’s wardrobe. 👗 Expansion phase, indeed-a buyer’s paradise! 🛍️

Institutional Catalysts: The Big Fish Swim In

Ah, the institutions! Those titans of finance have finally deigned to grace ETH with their presence, adding it to their portfolios with the enthusiasm of a collector acquiring a rare artifact. 🏛️ Steady accumulation, combined with historic ETF inflows, keeps sell-side pressure at bay, like a bouncer at an exclusive club. 💼

Total Ethereum Spot ETF Net Inflow chart: SoSoValue

Optimists, those eternal romantics, envision ETH leaping to $7,500 by year-end, provided ETF demand, staking growth, and regulatory clarity remain on course. 🌈 But let us not forget, my dear, that the market is a stage, and tragedy is always a possibility. 🎭

ETFs: The Fuel in ETH’s Engine

Spot Ether ETFs, those darlings of the investment world, have seen interest so sustained, August may well be their crowning month. 👑 Inflows averaging hundreds of millions daily, with peak days surpassing a billion? My word, it’s a veritable feast! 🍾

Total net assets? Climbing to records, like a mountaineer scaling Everest. 🏔️ Regulated investment channels are all the rage, and flagship products from leading asset managers dominate inflows, a testament to Ethereum’s institutional allure. 🏆

Ecosystem Tailwinds: Upgrades & Altseason

Ethereum’s recent network upgrade has improved scalability and reduced Layer 2 gas fees, making it as appealing as a summer breeze. 🍃 Layer 2 protocols like Arbitrum, Optimism, and zkSync are flourishing, with TVL growing like a well-tended garden. 🌱

And let us not forget the altcoin market, gaining traction like a runaway train. 🚂 Decentralized applications, tokenized assets, and staking rewards add to the bullish sentiment, a symphony of optimism. 🎶

Short-Term Outlook: To $5,000 and Beyond?

In the short term, ETH’s fate hinges on its ability to conquer $4,800-$4,870. 🗡️ Should momentum hold and ETF inflows remain robust, a move into the $5,000 zone is as likely as a sunset in the evening. 🌅

Medium-term forecasts? $6,000-$7,500, provided the stars align. 🌠 But beware, macroeconomic shocks or regulatory reversals could send ETH tumbling back to $4,500, a reminder that even the mightiest can falter. ⚡

Final Thoughts: A Breakout or a Breakup?

Ethereum stands on the precipice of glory, driven by record ETF inflows and a technical setup as bullish as a charging bull. 🐂 With institutional demand, ecosystem upgrades, and sentiment all in harmony, a breakout above $4,800 seems inevitable. 🌟

Yet, my dear investor, beware the whims of the market. Short-term volatility lurks like a shadow, ready to test this critical level. 🕶️ Will ETH soar to new highs, or shall it break hearts instead? Only time, that great revealer of truths, will tell. ⌛

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

2025-08-15 21:22