So, apparently, some of the universe’s largest institutional investors have decided that Ethereum is less like a cryptic alien language and more like the universal translator of finance. They’ve been buying up ETH like it’s intergalactic collector’s edition trading cards-nearly $900 million worth in recent days!

But don’t worry, they’re not flipping these digital assets for quick cash; no, they’re playing the long game. These financial titans are treating Ethereum like a bottle of fine wine (or maybe a barrel of fermented space grapes) meant to be savored over decades rather than guzzled at the next moon party.

Ethereum Takes the Galactic Throne While Bitcoin Gets Lost in Space 🪐✨

According to blockchain sleuths at Lookonchain (who we assume wear capes while decoding transactions), one shadowy institution recently created three new wallets faster than you can say “quantum entanglement.” Oh, and they also yanked 92,899 ETH-worth about $412 million-from Kraken. That’s right, folks, they pulled it out so fast even the exchange probably said, “Wait… what just happened?”

This kind of move usually screams bullishness louder than a Vogon reading poetry. It means someone’s hoarding ETH like squirrels stockpile nuts before winter-or in this case, before the next bull run.

Meanwhile, Donald Trump’s DeFi brainchild, World Liberty, decided to crash the shopping spree too. On-chain data reveals they spent $8.6 million USDC to grab 1,911 ETH at roughly $4,500 apiece. And because why stop there, they threw another $10 million into acquiring 84.5 Wrapped Bitcoin (WBTC). Clearly, their motto is something along the lines of “Go big or go back to reality TV.” 📺🤑

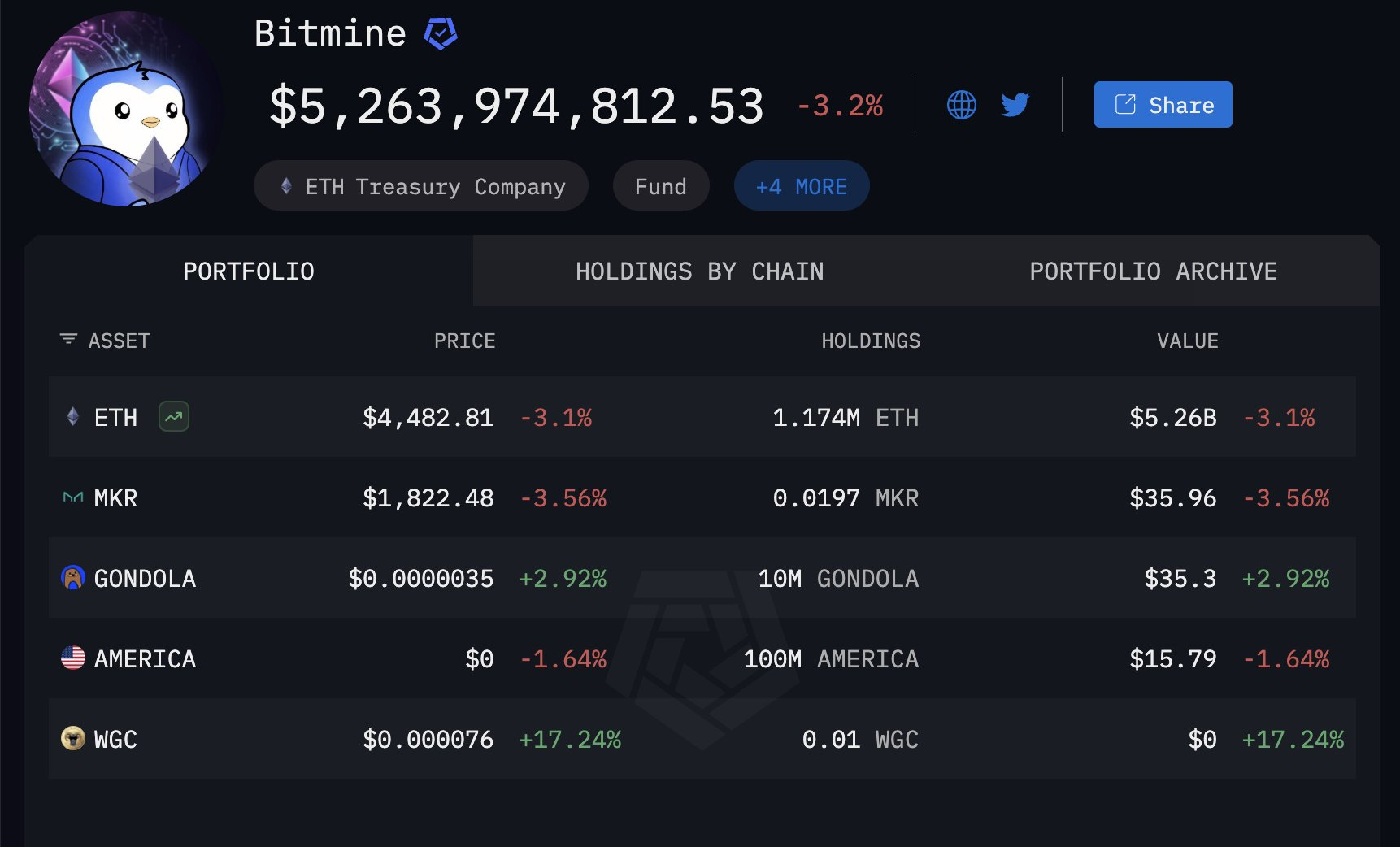

But wait, there’s more! BitMine-the Ethereum-loving behemoth led by Tom Lee-made the grandest gesture of all. In what can only be described as an act of cosmic confidence, they added 106,485 ETH to their treasury at a cost of $470 million. Their total stash now sits at 1.17 million ETH, valued at around $5.3 billion. Let’s take a moment to appreciate how absurdly large that number is. Imagine carrying that much change in your pocket-it’d weigh down even a spaceship!

All this institutional frenzy comes hot on the heels of Ethereum’s price taking a little tumble after weeks of climbing higher than Elon Musk’s ego. But instead of panicking, these money wizards saw opportunity. Their timing and scale suggest they weren’t speculating-they were strategizing. Like chess players planning five moves ahead, except their board is made of blockchain and their pieces are worth billions.

And let’s not forget the rise of ETF exposure and treasury companies gobbling up ETH like Pac-Man chasing pellets. Together, they’ve amassed over 10 million ETH-that’s $40 billion worth of digital gold, if you’re keeping score. 🏦💎

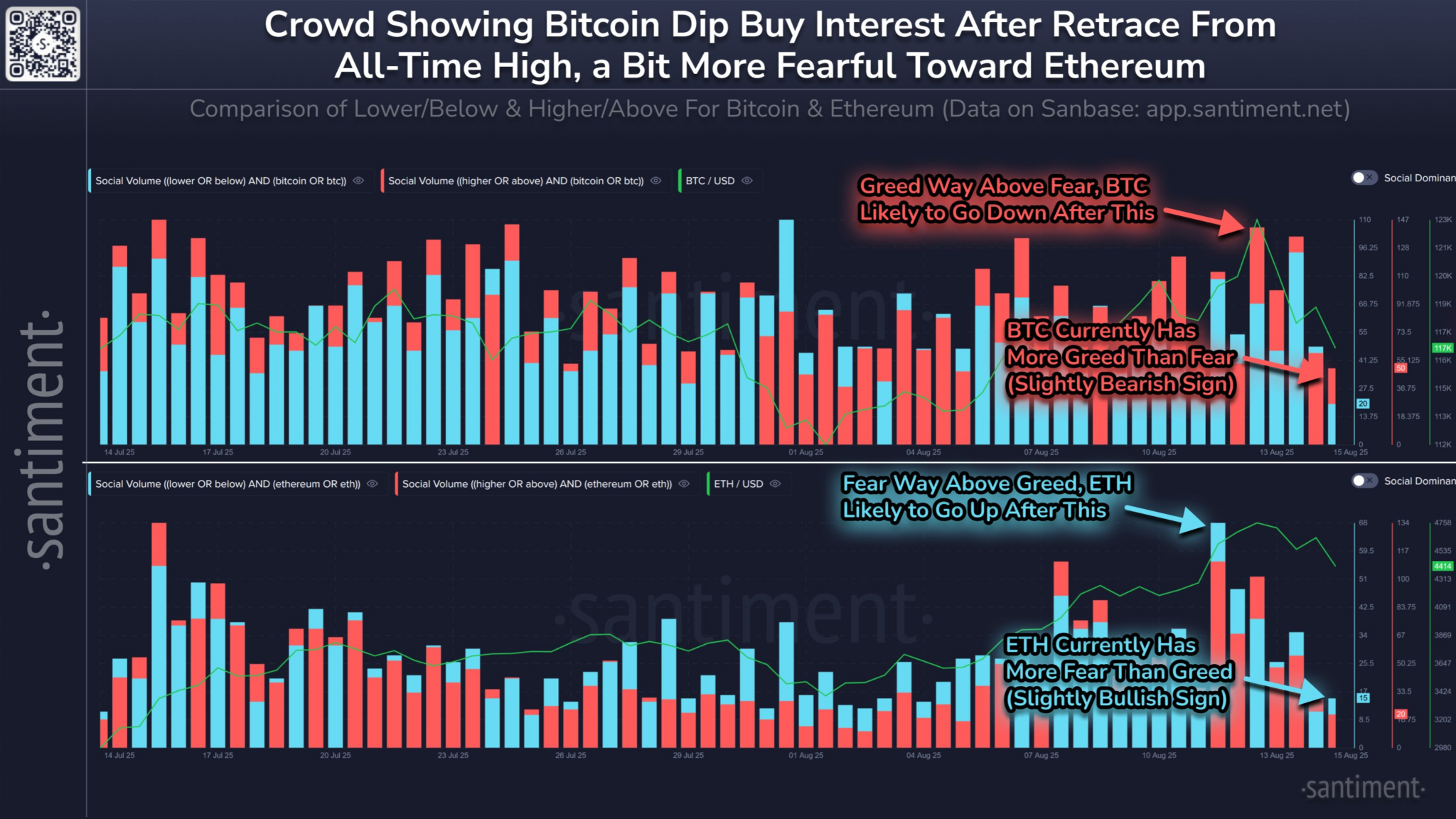

Blockchain analytics platform Santiment has weighed in, suggesting Ethereum currently holds a slight edge over Bitcoin when it comes to market sentiment. Apparently, Bitcoin’s rallies tend to spark social media frenzies akin to teenage fan wars over pop stars. Meanwhile, Ethereum’s steady performance attracts calm, calculated whales who prefer sipping coffee while watching the charts rather than screaming into the void of X (formerly Twitter).

According to Santiment, this disciplined approach hints that institutions see Ethereum as the cornerstone of the digital asset galaxy for years to come. Think of it as the Death Star of decentralized finance-but hopefully with fewer fatal design flaws. ☠️🌌

In conclusion, Ethereum isn’t just surviving; it’s thriving, thanks to big-money believers betting on its future. Whether they’re right remains to be seen, but one thing’s certain: the universe of crypto is never boring. So buckle up, dear reader, because the ride is far from over. 🎢🚀

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- ETH PREDICTION. ETH cryptocurrency

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

2025-08-16 19:03