Bitcoin took a nosedive to $113K, sending retail traders into a tailspin of “ultra bearish” despair. But hey, maybe it’s just Bitcoin’s way of saying, “Hold my crypto.” 🍿

Bitcoin is back in the hot seat, folks! After dropping to $113K, the internet is ablaze with debates hotter than a Liz Lemon one-liner. 🔥 And yes, retail traders are freaking out like they just found out their boss is a werewolf. 🐺

This dip marked a 17-day low, causing panic among traders who went from “to the moon!” 🚀 to “oh no, the abyss!” 🕳️ faster than you can say “mean girls.” Analysts, however, are sipping their coffee ☕ and reminding us that this kind of doom and gloom is usually a golden opportunity for long-term investors. So, maybe don’t sell your kidney just yet.

Retail Traders Lose Their Chill as Bitcoin Dips Below $113K

According to Santiment’s recent X update, social media sentiment around Bitcoin is more negative than a bad Yelp review for a vegan cheese shop. 🧀 And guess what? This level of negativity hasn’t been seen since late June, when everyone was freaking out about geopolitical stuff. You know, the usual.

Santiment reminds us that extreme negativity often precedes a price rebound. So, maybe this is Bitcoin’s version of a dramatic pause before the big comeback. 🎭

Retail traders did a full 180 after Bitcoin failed to rally and dipped below $113K. The past 24 hours have been more bearish than a Monday morning without coffee. ☠️ The last time we saw this much panic was on June 22nd, when everyone thought the world was ending. Spoiler: it didn’t.

Historically, this negative… 🎢

– Santiment (@santimentfeed)

Bitcoin hit $112,656 on Coinbase during late trading on Tuesday, according to TradingView. That’s its lowest point since August 3, folks. The decline brought it near a major support level of $112,000, which is basically Bitcoin’s safety net. 🪂

This retreat is an 8.5% slide from last week’s all-time high of just over $124,000. Meanwhile, the total crypto market cap slipped below $4 trillion, marking a two-week low. So, yeah, it’s been a wild ride. 🎢

Santiment also pointed out that markets love to do the opposite of what everyone expects. When fear is high and retail investors start selling, it’s often the perfect setup for a recovery. So, maybe this is just Bitcoin’s way of saying, “Buy the dip, people!” 🛒

Will Bitcoin Pull a 2017/2021 Repeat? 🎉

Corrections are as common in bull markets as awkward silences in a Tina Fey movie. Analysts believe Bitcoin loves to pull back before setting new highs. These phases are called “bear traps,” where small crashes shake out the weak hands before the big rally. So, if you’re feeling shaky, just remember: this too shall pass. 🌪️

One of the most positive things about this pullback is that this same type of retrace happened at this exact moment in the cycle in both 2017 and 2021. And guess what? Both times, it preceded new all-time highs. 🎉

– Rekt Capital (@rektcapital)

Historical data backs this up. In September 2017, Bitcoin corrected by 36% before hitting new highs three months later. The same thing happened in September 2021, when Bitcoin lost 23% before rebounding. So, if history repeats itself, Bitcoin could dip as low as $90,000 before soaring again. Strap in, folks! 🚀

Analysts warn that while these dips are stressful, they’re also prime buying opportunities for long-term investors. So, maybe don’t panic-sell your crypto just yet. 🛑

ETF Outflows Add to the Drama 🎭

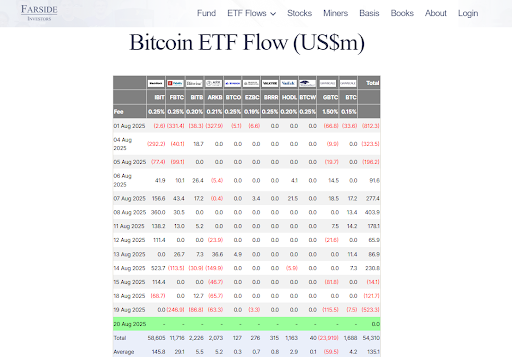

It’s not just retail traders selling; institutional investors are also hitting the brakes. Spot Bitcoin ETFs saw outflows of $523 million on Tuesday, which is more than four times Monday’s withdrawals. Yikes! 😬

Ether ETFs also took a hit, with $422 million in outflows, doubling from the previous day. In total, Bitcoin and Ether funds have lost $1.3 billion over three days, alongside recent price declines of 8.3% and 10.8%, respectively. So, yeah, it’s been a rough week. 😢

But hey, as they say in the biz, “This too shall pass.” Or, as Tina Fey would put it, “If you’re not failing every now and again, it’s a sign you’re not doing anything very innovative.” So, maybe this is just Bitcoin’s way of keeping things interesting. 🌟

Read More

- BTC PREDICTION. BTC cryptocurrency

- Gold Rate Forecast

- USD MYR PREDICTION

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- EUR USD PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- USD VND PREDICTION

- EUR ILS PREDICTION

- EUR JPY PREDICTION

2025-08-20 20:02