What to know:

So, you’re reading Crypto Long & Short, huh? Our weekly newsletter is like the best-kept secret for professional investors. Sign up here to get it in your inbox every Wednesday. Or don’t. Your call.

Emails zoom around the globe faster than a New York minute, but money? Oh no, it’s like a tortoise on a Sunday stroll. Payments can take days, especially if you’re trying to send cash across borders. And don’t even get me started on weekends or holidays. It’s like money is on vacation while we’re all just sitting here, waiting. Trillions of dollars are just sitting there, twiddling their thumbs, not earning a dime. What a waste!

This isn’t just a minor inconvenience; it’s a full-blown systemic drag. For companies and financial institutions, waiting for liquidity is like waiting for a bus that never comes. Higher costs, constrained working capital-it’s like trying to run a marathon with a rock in your shoe. And in a world that wants everything in real-time, this is just unacceptable!

Stablecoins as the catalyst

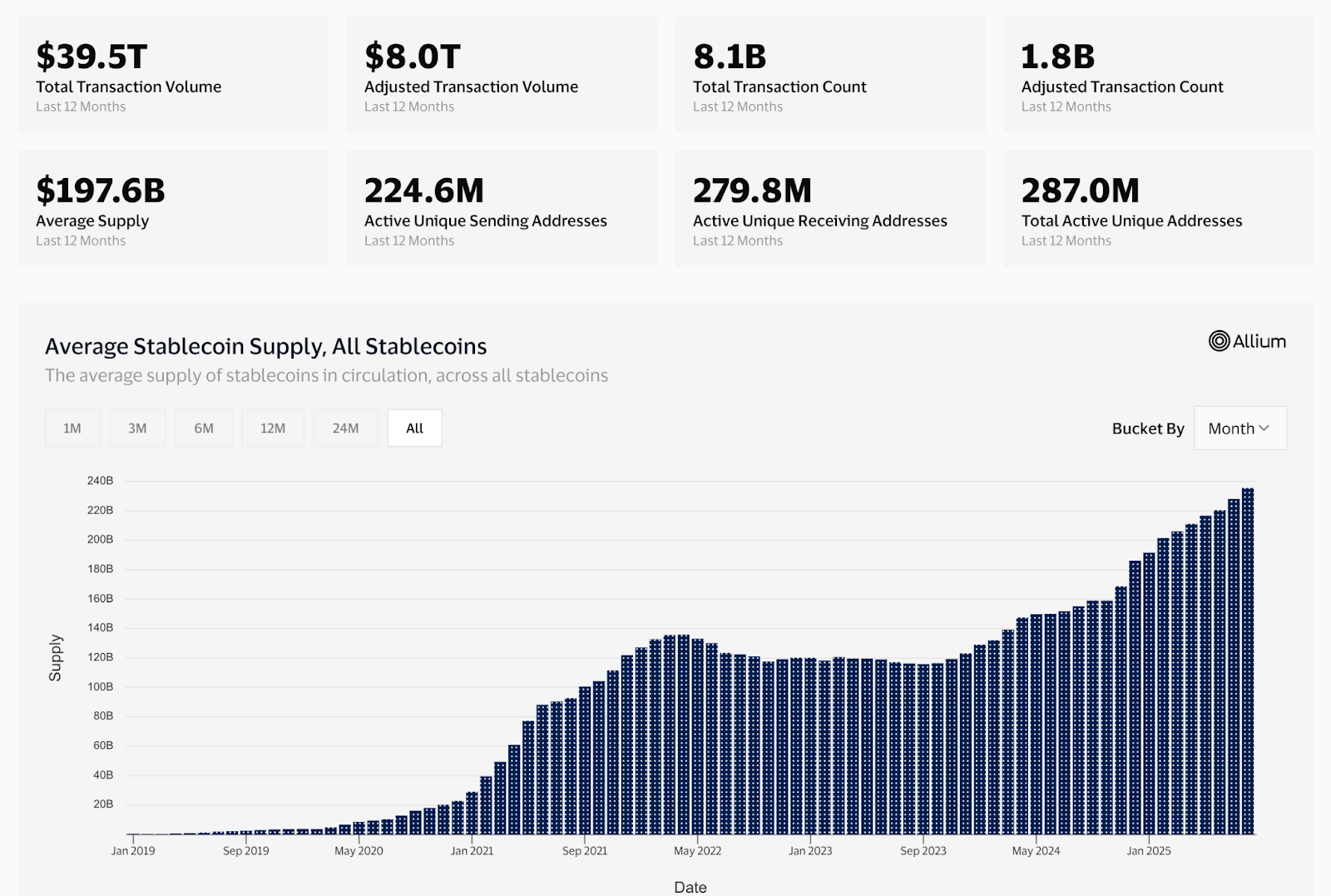

Enter stablecoins, the superheroes of the financial world! They’ve shown us that money can move at the speed of the internet. Today, we’re talking trillions of dollars settling instantly on blockchain rails. But here’s the kicker: stablecoins only solve half the problem. They’re like a great appetizer but leave you hungry for the main course.

Sure, they’re fast, but they don’t earn you anything. Stablecoin balances are like that friend who always borrows money but never pays you back-hundreds of billions just sitting there, earning nada. Meanwhile, tokenized treasury assets and money market funds are out there making money like it’s going out of style. But guess what? Subscriptions and redemptions are still stuck in the slow lane, running on T+2 timelines. It’s like trying to get a cab in the rain-good luck with that!

Convergence and composability

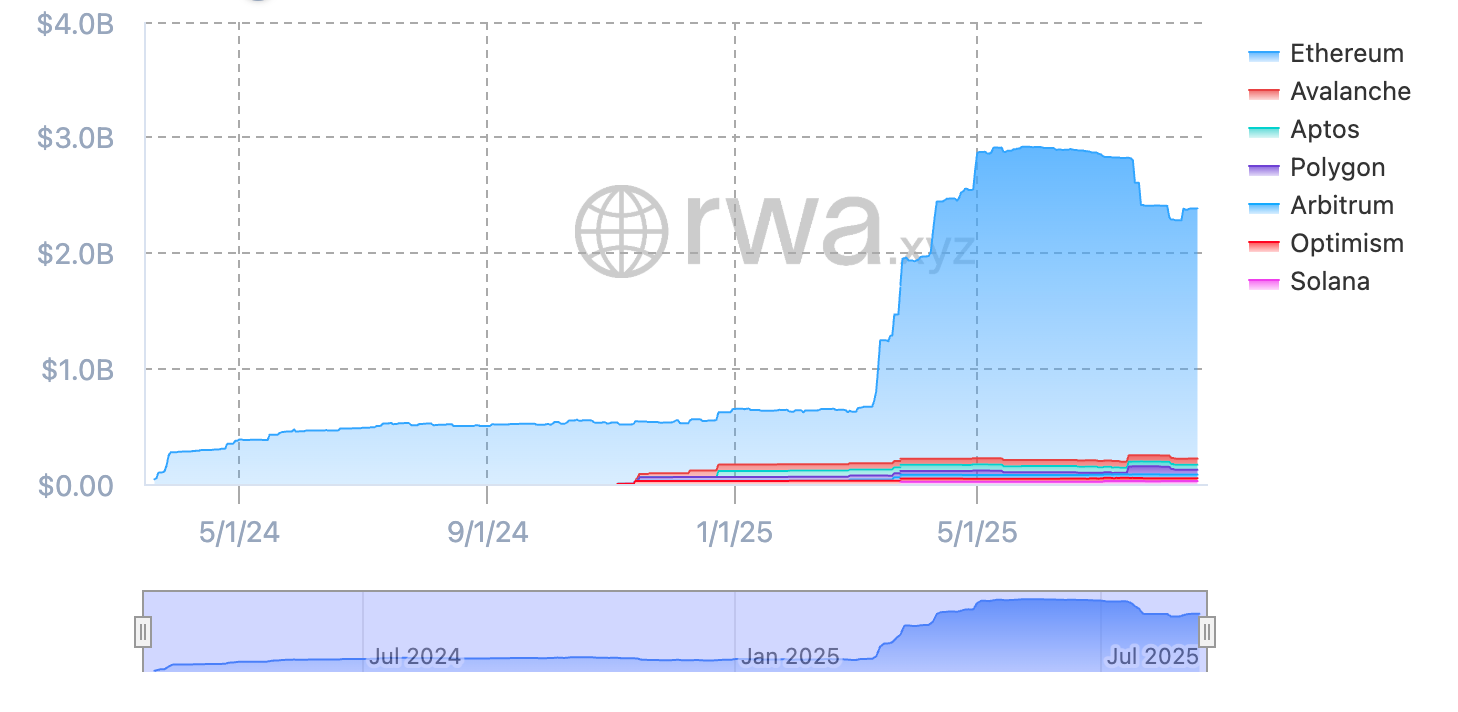

Now, we’re on the brink of something big-convergence! The big players are finally getting in on the action. BlackRock’s BUIDL is sitting pretty with over $2 billion in assets. That’s right, folks, we’re talking serious cash here!

These tokenized funds can transfer and settle instantly, like a well-oiled machine. But here’s the catch: we need some connective tissue. Without a neutral infrastructure to enable atomic, 24/7 swaps between stablecoins and tokenized treasuries, we’re just digitizing the same old problems. It’s like putting a fresh coat of paint on a rusty car-looks good, but it’s still a clunker!

The stakes

The stakes are huge, people! In the U.S. alone, non-interest-bearing bank deposits are sitting at nearly $4 trillion. If even a tiny fraction of that were swept into tokenized treasuries, we’d unlock hundreds of billions in yield. That’s not just a minor efficiency; it’s a seismic shift in global finance!

But here’s the kicker: we need open, neutral, and compliant infrastructure. Proprietary walled gardens might work for one institution, but we need everyone on the same page. Just like global payment networks needed interoperable standards, tokenized markets need shared rails for liquidity. It’s not rocket science, folks!

The path forward

The liquidity gap isn’t some unavoidable fate. The tools are out there: tokenized risk-free assets, programmable money, and smart contracts that can enforce trustless, instant settlement. What we need now is urgency-like a fire drill in a crowded theater-from institutions, technologists, and policymakers to bridge this gap.

The future of finance isn’t just about faster payments. It’s about a world where capital is never idle, where the trade-off between liquidity and yield disappears, and where we rebuild the foundations of financial markets for an always-on, global economy. Sounds great, right?

That future is closer than you think. Those who jump on this train will define the next era of financial markets; those who hesitate? Well, they’ll be left at the station, wondering what just happened.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.

Read More

- BTC PREDICTION. BTC cryptocurrency

- Gold Rate Forecast

- USD MYR PREDICTION

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- EUR USD PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- USD VND PREDICTION

- EUR ILS PREDICTION

- EUR JPY PREDICTION

2025-08-20 20:25