Bitcoin, the ever-cryptic digital diva, seems to have found her happy place at $114K, while stocks are throwing themselves off cliffs like melodramatic poets. Tech stocks, in particular, appear to have forgotten how to tech. Oops.

Traditional Markets Throw a Tantrum, Bitcoin Sips Tea Calmly ☕

Ah, Bitcoin (BTC), that enigmatic beast of numbers and code, decided to hover around $114K on Wednesday afternoon. Meanwhile, the stock market flailed like a fish out of water across all major indices for the second day in a row. And let’s not forget Palantir Technologies (Nasdaq: PLTR), which decided to shed 2% in 24 hours and over 15% in five days. Poor thing-it’s like watching someone try to parallel park in a clown car. 🚗🤡

Both stock and crypto markets have been wading through what can only be described as financial soup this week. But lo and behold, digital assets are currently flexing their superiority over traditional markets. According to Coinmarketcap, the broader crypto ecosystem managed to climb 1.48%. Meanwhile, the S&P 500 and Nasdaq sulked in the red corner, and the Dow… well, it just sort of stood there, pretending to care. Very dramatic. 🍿

Bitcoin herself has apparently hit a bottom at $113K and is now lounging comfortably, like a cat on a windowsill. Her correlation with stocks has spiked again, because apparently, even cryptos want to be part of the mainstream cool kids’ club. Speaking of which, U.S. Federal Reserve Governor Michelle Bowman recently suggested the central bank should dip its toes into crypto. Why? So staff can “better understand it.” Because nothing screams “financial expertise” like buying things you don’t fully grasp. 🤷♀️

“Our approach should consider allowing Federal Reserve staff to hold de minimus amounts of crypto or other types of digital assets so they can achieve a working understanding of the underlying functionality,” Bowman said during a speech at the 2025 Wyoming Blockchain Symposium. Translation: “Let my people buy some Dogecoin so they stop asking me what blockchain is.” She even compared it to skiing-because who wouldn’t trust a non-skier to teach them how to ski? 🎿

Market Metrics: A Tale of Numbers and Nonsense

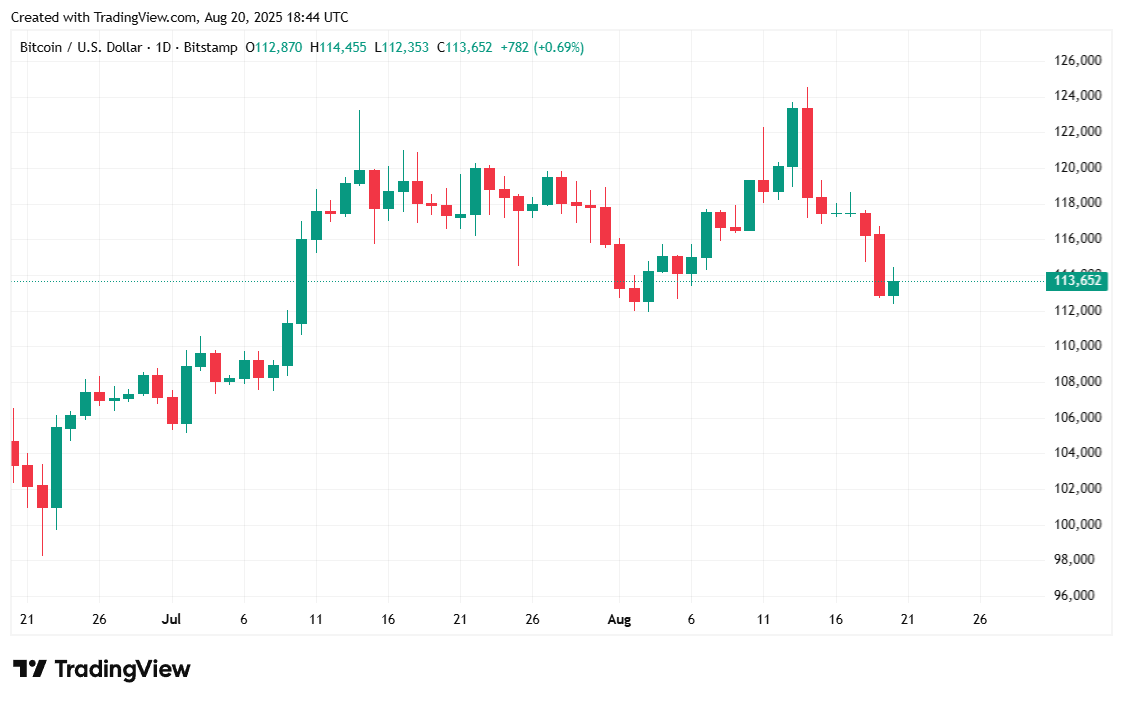

At the time of reporting, Bitcoin was trading at $113,611.92. That’s about as exciting as watching paint dry, though she did manage to edge up by 0.14% over 24 hours. Over the week, however, she’s down by 6.67%, proving that even queens take hits sometimes. Her price has been yo-yoing between $112,387.96 and $114,443.24 since Tuesday, which is either thrilling or mildly concerning, depending on your caffeine intake. ☕📉

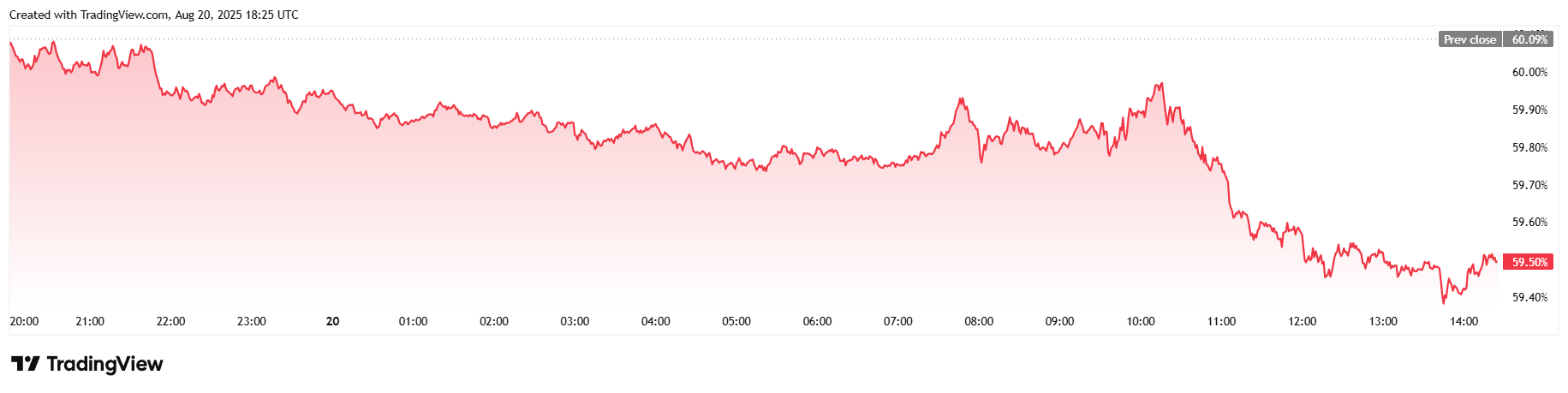

Trading volume edged higher to $71.13 billion, up 2.6% in 24 hours. Market capitalization barely budged, rising a measly 0.16%. Meanwhile, Bitcoin dominance fell 0.98% since yesterday, settling at 59.50%. It’s almost like the market is saying, “We’re bored, but we’ll keep pretending.” 📉🎭

Total bitcoin futures open interest dropped for the second day in a row, sliding to $80.61 billion-a 0.72% decrease. Coinglass data revealed that bitcoin liquidations reached $107.66 million, with long and short liquidations balancing out at $48.49 million and $59.17 million, respectively. Clearly, no one knows what they’re doing, and everyone’s fine with that. Classic crypto chaos. 🤷♂️💸

Read More

- BTC PREDICTION. BTC cryptocurrency

- Gold Rate Forecast

- USD TRY PREDICTION

- USD MYR PREDICTION

- EUR USD PREDICTION

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- EUR JPY PREDICTION

- Silver Rate Forecast

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

- Brent Oil Forecast

2025-08-20 23:15