Oh, great. Another day, another cryptocurrency plummeting faster than my motivation to go to the gym. Sui price is currently hugging $3.40 like it’s some kind of life raft in a sea of despair, down 3.91% in just 24 hours. Its market cap? A casual $11.94 billion-because who *doesn’t* need an extra few billion lying around? Meanwhile, trading volume has nosedived by 10.5%, landing at $1.62 billion. And don’t get me started on how far this token has fallen from its ATH (All-Time High) of $5.35; it’s now chilling more than 36% below that magical number. Traders are apparently “weighing weakening technical momentum” and “softening ecosystem data,” which sounds suspiciously like they’re trying to justify their bad decisions with big words. Classic. 😏

What Does the On-Chain Say? Or Rather, What Doesn’t It Say?

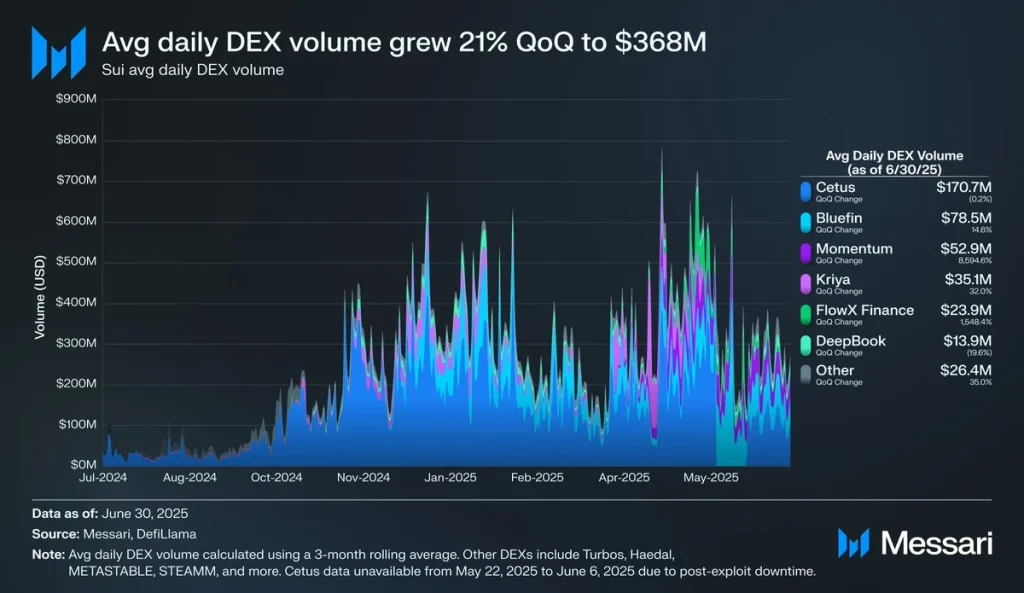

Ah yes, the infamous “on-chain performance.” Turns out Sui’s blockchain activity has been as exciting as watching paint dry recently. According to Messari (whoever they are), average daily DEX volume grew 21% quarter-on-quarter to $368 million-but before you break out the champagne, let’s talk about the fine print. Platforms like Momentum skyrocketed 8,594%. Yes, you read that right: EIGHT THOUSAND PERCENT. 🚀 Meanwhile, FlowX Finance soared 1,548%. But hold your applause because Cetus, the so-called “largest DEX,” stayed flat at $170.7 million. Flatlining is not exactly what we call thrilling entertainment.

And if that wasn’t depressing enough, Total Value Locked (TVL)-which I assume measures how much money people have tied up in these things-dropped 11% last week to $3.4 billion. That’s less user engagement than my Instagram account during tax season. Oh, and futures open interest? Down 31% since late July, now sitting at $1.84 billion. Long liquidations hit $5.64 million on August 20th, proving once again that traders’ confidence is as fragile as my ability to resist cookies. 🍪

Sui Price Analysis: Spoiler Alert, It’s Not Good

Technically speaking-and when do we ever understand anything technical?-SUI broke below its 50-day moving average ($3.69) and pivot point ($3.46). Congrats, team, you’ve officially entered Bear Market Territory™️. The MACD histogram says -0.0293, confirming bearish momentum stronger than my coffee addiction. Immediate support for Sui sits near $3.32, with a crucial level at $3.27. If it closes below that, buckle up, buttercup, because we could see another 10-15% drop into the abyss of $2.90-$3.00. Resistance levels? They’re hanging out at $3.52, $3.69, and $4.07, but honestly, who cares when everything feels doomed? The RSI near 41 hints at oversold territory, but buyers seem too busy binge-watching Netflix to stage a comeback. 🐻❄️

FAQs: Because You’re Probably Still Confused

Why is SUI price down today? Well, dear reader, it dipped below key technical levels thanks to falling TVL, reduced futures open interest, and long liquidations totaling $5.64 million. In other words, chaos reigns supreme. 👑

What key levels should I watch for Sui? Support zones are chilling at $3.32 and $3.27, while resistance parties hard at $3.52, $3.69, and $4.07. So basically, pick your poison.

Could SUI rebound soon? While the RSI suggests oversold conditions, a real rebound requires a sustained close above $3.52. Until then, prepare yourself emotionally for more disappointment. 💔

Read More

- BTC PREDICTION. BTC cryptocurrency

- USD MYR PREDICTION

- GBP CHF PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- USD VND PREDICTION

- GBP CNY PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- CNY JPY PREDICTION

- EUR USD PREDICTION

2025-08-26 11:25