In the grand theater of finance, where the actors are cloaked in the shadows of blockchain, Google Cloud has stepped onto the stage with its latest opus: the Google Cloud Universal Ledger, or GCUL for those who prefer brevity over elegance. This ambitious venture seeks to transform the world of global payments, promising a symphony of speed, cost-efficiency, and transparency, all while giving the established titans-Circle, Stripe, and Ripple-a run for their money. 🎭💰

Currently, GCUL is in the hush-hush phase of private testing, aiming to conquer a multi-trillion-dollar market that seems to be as elusive as a cat in a room full of rocking chairs.

What’s All about GCUL?

Rich Widmann, the maestro of Google Cloud’s Web3 strategy, describes GCUL as a Layer 1 blockchain crafted for the financial elite. It supports Python-based smart contracts, a language that, much like a good wine, is best appreciated by those with a refined palate. This platform is designed to assist banks and payment companies in modernizing their services, all while avoiding the migraines associated with traditional systems. 🍷💻

Yet, not all are singing praises. Some crypto enthusiasts argue that GCUL resembles a consortium chain more than a decentralized utopia. Google, however, assures us that the platform is:

- Simple: A single API for multiple currencies-no need for a PhD in computer science to navigate this labyrinth.

- Flexible: Scalable smart contracts (in Python, of course) for automating payments and managing digital assets-because who doesn’t love a little flexibility?

- Safe: Permissioned yet compliance-focused, employing Google’s secure technology and demanding KYC-verified accounts-because trust is earned, not given. 🔒

If the stars align, GCUL could revolutionize payments, slashing costs and minimizing errors, all while offering the luxury of 24/7 settlement. Who needs sleep, anyway?

How It Competes Against Competitors

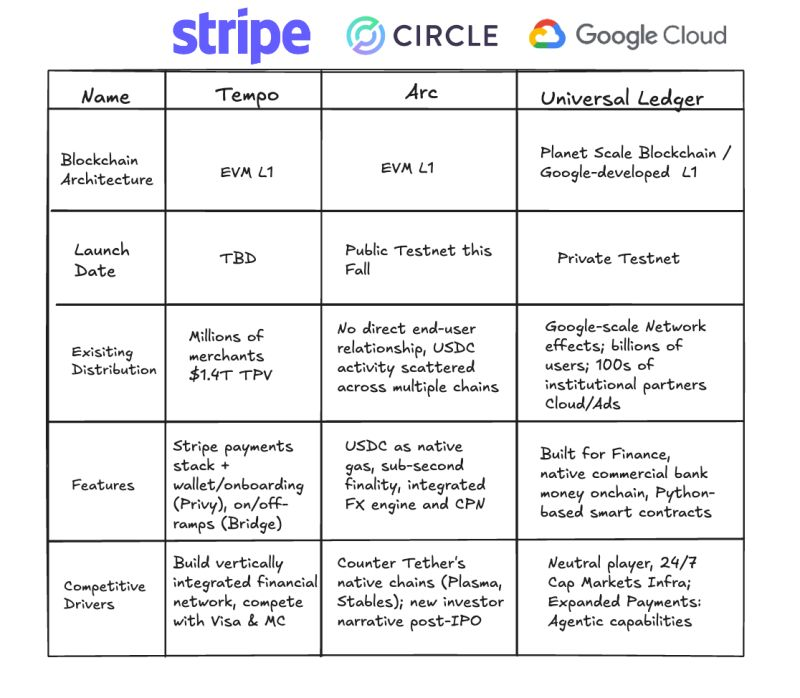

As the digital payments race heats up, with Ripple, Circle, and Stripe all vying for supremacy, Google’s GCUL aims to carve out its niche by being the neutral party in this financial free-for-all. Ripple is pushing XRP for rapid remittances, Circle has just unveiled its own blockchain, Arc, and Stripe is testing Tempo for developers. It’s like a techie version of a high-stakes poker game, and everyone’s got their chips on the table. 🃏💵

The numbers tell a tale of their own. Stablecoin volumes tripled in 2024, reaching a staggering $30 trillion in transactions, dwarfing PayPal’s $1.6 trillion and even Visa’s $13 trillion. Google hopes that GCUL can ride this wave of growth, offering low fees, compliance tools, and instant settlement-because who doesn’t love instant gratification? 🚀

Partnership with CME Group

In a dramatic unveiling back in March, Google introduced GCUL alongside the CME Group, which is already dabbling in tokenization and wholesale payments on the platform. The first phase of testing has concluded, with broader trials on the horizon later this year. If all goes according to plan, we might see new services roll out in 2026-just in time for the next tech revolution! 🎉

Read More

- GBP CHF PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- CNY JPY PREDICTION

- EUR RUB PREDICTION

- USD VND PREDICTION

- XMR PREDICTION. XMR cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- EUR ARS PREDICTION

2025-08-27 10:38