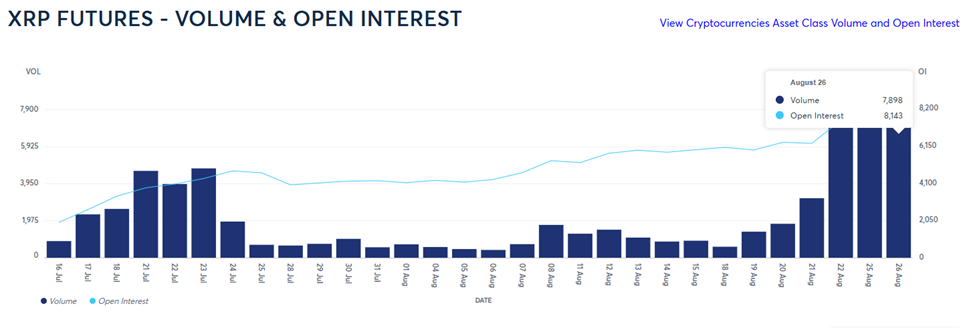

Once upon a digital time, in the glittering halls of Wall Street’s most glamorous crypto playground, the Chicago Mercantile Exchange (CME), XRP strutted onto the scene like a caffeinated squirrel in a nut store. Our beloved Ripple‘s hero of a token broke records faster than you can say “buy the rumor, sell the news,” surpassing a staggering $1 billion in open interest-faster than a Twitter hot take on a Sunday morning.

All this in just over three months since launching in May 2025. Did it take steroids? Nope, just some good old-fashioned market mania and maybe a sprinkle of speculative fairy dust.

Futures Boom Sparks the Never-Ending Speculation on Spot XRP ETF-And We’re All Eavesdropping

The CME Group, sounding like a proud parent at a crypto talent show, announced the feat on August 26, giving us all a glimpse of the maturing madness in crypto derivatives markets. Who knew that futures could grow faster than a viral meme?

“Our crypto futures just broke the $30 billion barrier, like a bragging teenager. XRP, ETH, and SOL futures each hit the $1 billion mark faster than you can say ‘Pump!’ XRP’s record-breaking sprint in just over three months signals a market ripe for the big leagues-more money, more drama,” CME gushed.

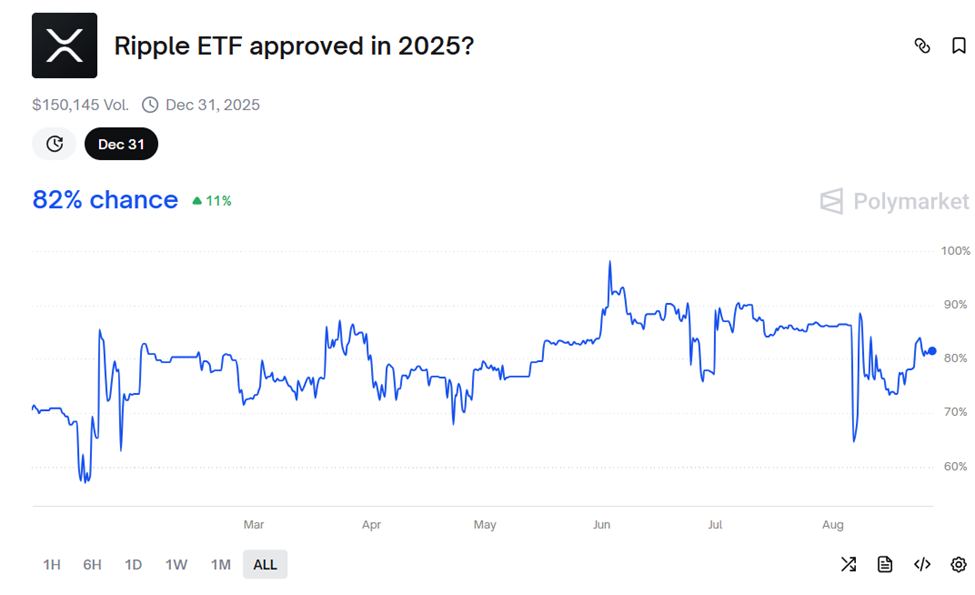

The lightning-fast ascent of XRP on the CME stage has fans and skeptics alike whispering about a spot XRP ETF. Will it happen? Will it magically turn XRP into the asset that makes billionaires out of coffee shop dreamers? The rumors are swirling faster than a gossip newsletter.

Nate Geraci, the oracle of ETF predictions and president of the ETF Store, claims XRP already has over $800 million in futures-based ETFs. Apparently, demand for spot products is like that one sock you keep losing-more underestimated than you think.

“CME says XRP futures crossed $1 billion in open interest… fastest-ever. But wait, there’s more-already $800+ million in XRP futures ETFs! Looks like demand for spot XRP ETFs is one of those things people aren’t noticing enough,” he remarked with a knowing smirk.

The crystal ball suggests an 82% chance that a Ripple-backed ETF will be greenlit before 2026. Keep your eyes peeled-unless you’re busy staring at your phone like the rest of us.

Meanwhile, XRP exists in that peculiar land of paradoxes. It’s the third-largest crypto by market cap-valued at approximately $178 billion-and on paper, it outshines giant asset managers like BlackRock, which clocks in at $176 billion. Yet, in the eyes of Wall Street’s sharper minds, XRP remains mostly the crypto equivalent of a mischievous pet-adorable but often misunderstood.

Pro-XRP lawyer John E. Deaton calls it “the most hated yet most loved crypto,” a bit like that one friend who’s both annoying and impossible to delete from your contacts. The tug-of-war between institutional doubt and retail adoration has kept XRP in the crypto drama club for ages.

Retail fans adore XRP as a utility hero with cult-like devotion, while institutional players tread cautiously due to Ripple’s ongoing legal rollercoaster with US regulators. It’s like a soap opera, but with more charts and fewer commercial breaks.

Boom or Bust? The Skeptics Và the Long-Term Dream

Not everyone is throwing confetti-some cynics whisper that XRP’s futures success might be just a flash in the pan. Critics argue that stablecoins, smart contracts, and oracle magic (hello, Chainlink!) have stolen the show, leaving XRP’s original mission of being a heroic bridge currency a bit quaint.

They say bridge tokens face a structural problem: every buy is quickly sold, canceling out demand and making it a perpetual game of musical chairs.

“The thesis?

A) Bridge currencies like XRP don’t actually *gain* value from usage-they’re just efficient transfer tools. All those buys are like a hamster wheel-running but not gaining ground.

B) …Or just more of the same,” echoes Fishy Catfish on Twitter, probably while sipping something fishy but fashionable.

The XRP Ledger, meanwhile, is being gently teased for having less flair than its flashier, more feature-packed cousins. Meanwhile, impatient investors keep checking their screens, craving a price surge to match the hype.

“Still not enough to make my wallet fat. Frustrated beyond reason,” laments Dean Nielson, echoing the collective sentiment of many a hodler.

As of now, XRP dances around $3.00-up slightly more than 3% in the last day or so. Not quite the moonshot, but enough to keep the thrill alive for the digital crowd.

This giant leap to $1 billion in open interest suggests a lot of people are throwing capital into XRP-whether to gamble, hedge, or … maybe just to see if regulators will finally give the green light to a spot ETF. A yes or no from the authorities could turn XRP into the ultimate party or just another rollercoaster ride. Stay tuned-the crypto soap opera continues, with lots of drama, humor, and yes, perhaps a little chaos for good measure.

Read More

- ETH PREDICTION. ETH cryptocurrency

- GBP CHF PREDICTION

- USD VND PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- EUR RUB PREDICTION

- XMR PREDICTION. XMR cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- CNY JPY PREDICTION

- EUR ARS PREDICTION

- EUR CLP PREDICTION

2025-08-27 10:57