Oh, what a spectacle! Investors, in their infinite wisdom, have been hoarding several altcoins like there’s no tomorrow during the last week of August. 📈 They’ve been withdrawing their assets from exchanges, causing a veritable exodus and a significant drop in reserves. What a time to be alive!

As the altcoin season becomes more discerning, the data on exchange reserves might just be the philosopher’s stone for investors looking to rejig their portfolios for the year’s final act. But who knows? Perhaps we’re all just pawns in a grander game of finance and folly. 🎭

1. Chainlink (LINK): A Tale of Links and Chains

Santiment, the ever-watchful eye of the crypto world, reveals that Chainlink’s (LINK) exchange reserves plummeted to a one-year nadir in the waning days of August. 🌚

With only 186.6 million LINK remaining on exchanges, down from 212 million in July, it seems that over 25 million LINK have found a new home in the hearts of investors in just over a month. Quite the migration, wouldn’t you say?

The launch of Chainlink Reserve in early August, much like a knight in shining armor, boosted investor morale. By August 28, the Chainlink Reserve held a modest 193,076 LINK tokens, a small but mighty fortress.

And if that wasn’t enough, Chainlink announced a partnership with the US Department of Commerce, bringing macroeconomic data such as GDP and the PCE Index on-chain. This, my friends, is the stuff of legends, further fueling the fire of accumulation. 🔥

Charts from recent times tell a tale of two months. Once, LINK reserves on exchanges swelled with each price rise, a clear sign of selling pressure. But now, as LINK’s price ascends, the reserves dwindle, a beacon of hope and optimism. 🌠

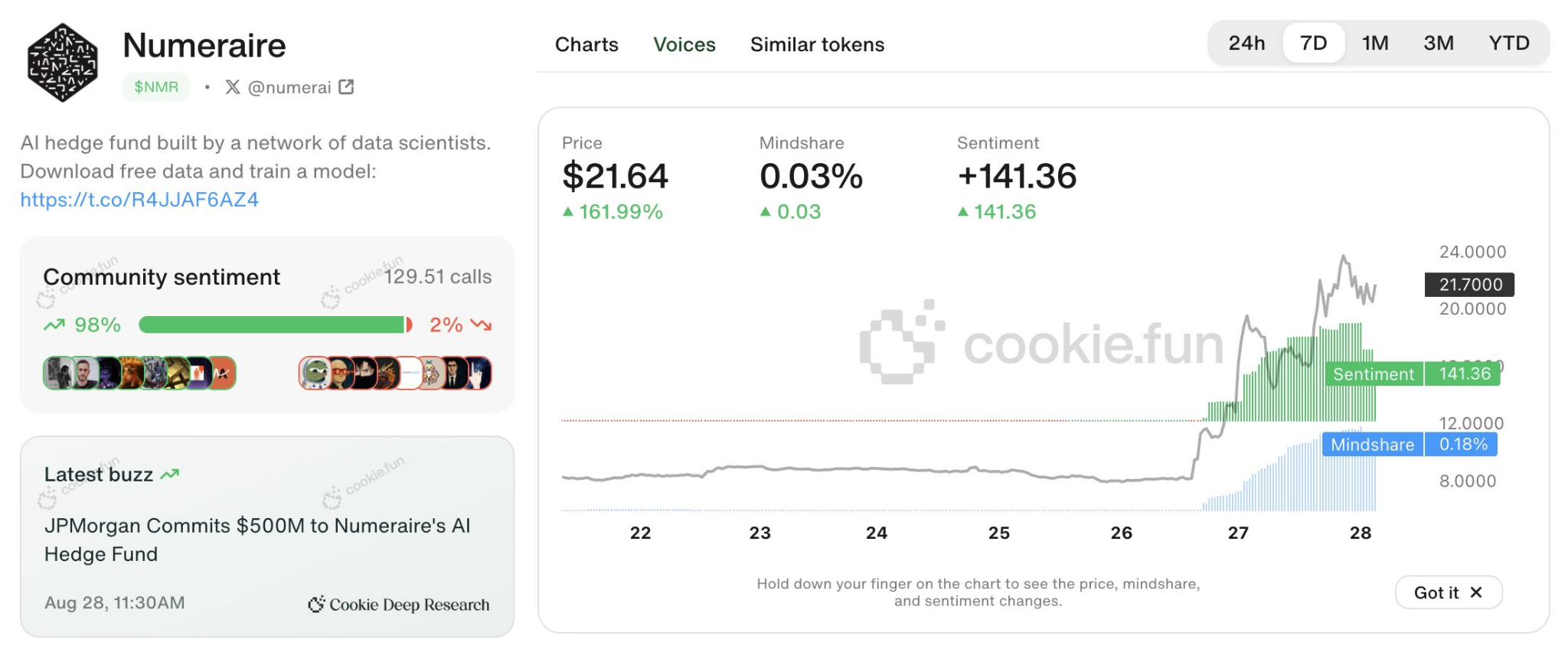

2. Numeraire (NMR): The Phoenix Rises

CoinMarketCap data paints a picture of NMR’s meteoric rise, surging 120% in the last week of August, with 24-hour trading volume skyrocketing from $460 million to over $1 billion. A true phoenix rising from the ashes of obscurity! 🌟

Santiment data, ever the historian, notes that NMR’s exchange reserves had been steadily increasing for years, a heavy burden that dragged its price from above $70 to below $7. But alas, the tide has turned.

By the last week of August, NMR’s exchange reserves had fallen to 1.61 million, a reduction of about 350,000 tokens compared to earlier this year. Though not a monumental decrease, it marks a significant turning point, hinting at a potential accumulation outside exchanges. 🌱

Adding fuel to the fire, Numeraire announced that JPMorgan, one of the world’s largest allocators to quantitative strategies, committed a staggering $500 million in fund capacity. This news, like a bolt of lightning, revived positive sentiment. 🚀

“JP Morgan committed half a billion to Numerai. Mindshare and sentiment jumped from near flatline to soaring levels after the news broke, and $NMR followed, climbing over 160% since. Indication of Wall Street’s growing influence on the crypto markets?” Cookie DAO stated, with a twinkle in its eye. 🌠

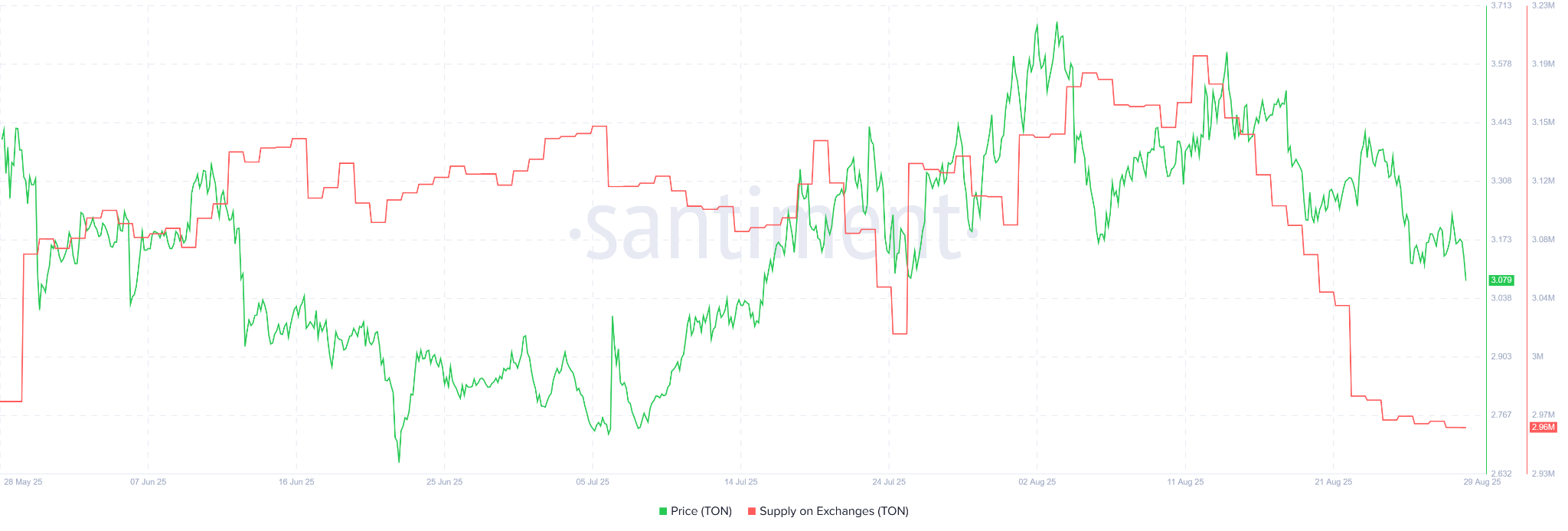

3. Toncoin (TON): The Tonic of the Times

Santiment data, always the bearer of news, shows that Toncoin’s (TON) exchange reserves dipped to 2.96 million in late August, the lowest level in three months, down from 3.2 million just a week prior. 📉

Despite TON’s price lingering around $3 for most of the year, this off-exchange accumulation hints at the dawn of a new era. 🌄

The reserve decline coincided with Verb Technology (NASDAQ: VERB) unveiling the TON Treasury strategy, aiming to own more than 5% of Toncoin’s circulating supply. The company’s $558 million private placement, with over 110 institutional and crypto investors, will primarily fund the purchase of TON as its primary treasury reserve asset. A bold move indeed! 💪

And if that weren’t enough, Robinhood, the platform of the people, listed Toncoin in the final week of August, opening the gates to a flood of US investor capital. 🌊

“Toncoin just listed on Robinhood. And it comes as no surprise. 36.2 million new users onboarded. Monthly active wallets on ton_blockchain have soared to 12.4 million, an impressive 110× growth. TVL rose from $537,000 in early January to a record $773 million by July. Over $1 billion USDT issued in circulation, the fastest milestone in Tether’s history.” – Mario Nawfal, founder of IBC Group, said, with a flourish of his quill. 🌟

The decline in the exchange reserves of these three altcoins is a testament to the growing influence of US financial institutions and regulators. It suggests that projects with real strength and substance are more likely to find their place in the sun through strategic partnerships with government agencies and major financial entities. But then again, isn’t that always the way of the world? 🌍

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- Brent Oil Forecast

- BTC PREDICTION. BTC cryptocurrency

- Silver Rate Forecast

- GBP CNY PREDICTION

- EUR AUD PREDICTION

- USD JPY PREDICTION

- POL PREDICTION. POL cryptocurrency

- CNY JPY PREDICTION

2025-08-29 18:28