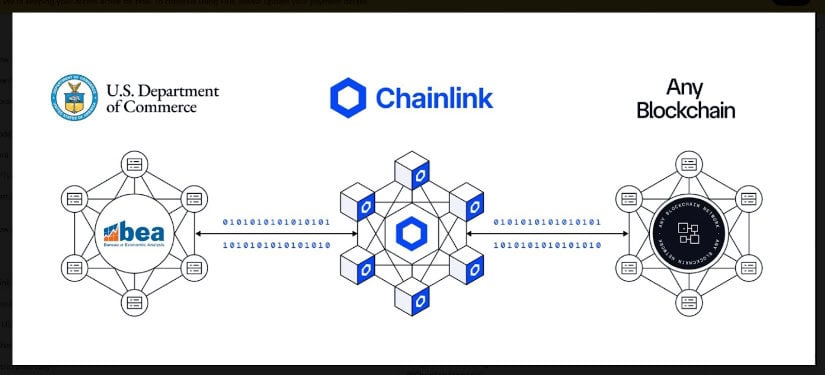

In the dim echoes of bureaucratic corridors, a new conspiracy unfolds-a digital revolution disguised as financial innovation. Chainlink, that humble oracle, now dares to claim it will bring the mighty U.S. Bureau of Economic Analysis’s sacred data-GDP, inflation, consumption-straight onto the blockchain. Yes, the very numbers that once kept ivory-tower economists busy, now accessible on-chain, like some Orwellian dream mixed with a twist of Silicon Valley hubris.

This scheme guarantees, of course, “greater transparency,” which is just a fancy way of saying, “We’ll make your data more accessible, even if nobody fully understands what it means.” Decentralized finance (DeFi) and big institutions get a shiny new tool-an Orwellian beacon of truth or maybe just a reason to watch the prices climb as everyone bets on a miracle rally. Ah, the promise of reliability-because nothing says trust like feeding government stats into a blockchain that can’t even decide if it’s morning or evening. 🚀🤡

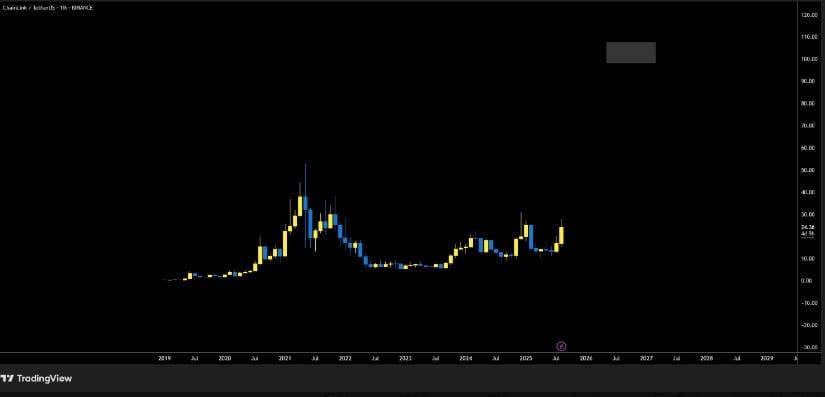

Analysts, ever so serious, hint that this could supercharge institutional adoption, and lo and behold, the price of LINK hovers near $24, whispering sweet nothings about reaching that elusive hundred. Such a number, once only dreamed of in the feverish minds of altcoin enthusiasts, now appears on the horizon-like a mirage in the desert of reality. This move, they say, cements Chainlink’s role as the backbone for “next-generation” financial applications-because who doesn’t love a bit of techno-luminescent magic fueled by some good old government data?

On-chain Macroeconomic Data: The Big Brother Edition

The partnership, a masterstroke of bureaucratic genius, places official macroeconomic stats-GDP, inflation, and consumption-on the blockchain. Naturally, this will allow the data to flow directly into decentralized systems-cutting out the middleman or, more accurately, every middleman who didn’t get the memo. According to analyst Quinten, this signals a seismic shift-no longer will Wall Street and government bureaus be the sole keepers of economic truth. Now, it’s all on-chain, transparent, verifiable, and probably just as confusing as before, but hey, at least it’s “decentralized.”

Building a Reliable, Foolproof Financial Fortress

With official government stats feeding directly into the blockchain, the reliability improves-because nothing screams stability like trusting data that can be hacked, altered, or just mistaken. Smart contracts, DeFi platforms, global markets-soon they’ll all be more accurate or so the story goes. Quinten quips that this is more than tech; it’s a “redefinition of transparency”-which sounds suspiciously like a phrase cooked up in a PR office somewhere, designed to lull us into a false sense of security while the markets dance on the edge of chaos.

Price Fantasies and Technical Jargon

Crypto Bullet, not really a comic book hero but close enough, suggests LINK could hit $100, a number that seems mind-blowingly optimistic considering its current $24 state. The chart, that mystical black-and-white picture of hope, hints at the past-an accumulation phase leading to a breakout. If the stars align-and market sentiment remains bullish-maybe, just maybe, Chainlink will waltz back into triple digits. A goal worth a chuckle or a prayer, depending on your outlook.

The Short-Term Circus: Volatility Galore

Yesterday’s price was a rollercoaster-opens near $24, dips slightly, then rockets close to $25.50, as traders play their games. The breakout? Resistance stubbornly stands firm, much like a stubborn mule blocking progress. Profit-takers, always eager to rain on the parade, swiftly erased gains, closing at $24.33-a modest 2.23% increase with over a billion dollars traded. Ah, the thrill of chaos, support at $24.55, resistance at $25.50-our favorite dance of hope and despair. Stay tuned; another attempt at glory might just be around the corner. 🎭💸

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Brent Oil Forecast

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- Silver Rate Forecast

- EUR AUD PREDICTION

- USD JPY PREDICTION

- POL PREDICTION. POL cryptocurrency

2025-08-29 20:10