Oh, the little dramas of the digital bazaar! It appears a rather peculiar schism is unfolding in the world of crypto-liquidity-a sort of hoarding instinct, if you will. Stablecoin exchanges are positively bulging with reserves, reaching heights unseen, even as the general enthusiasm for adding to the crypto menagerie wanes. Cryptoquant’s analysts, those meticulous observers of the byte stream, have penned a report detailing this…situation.

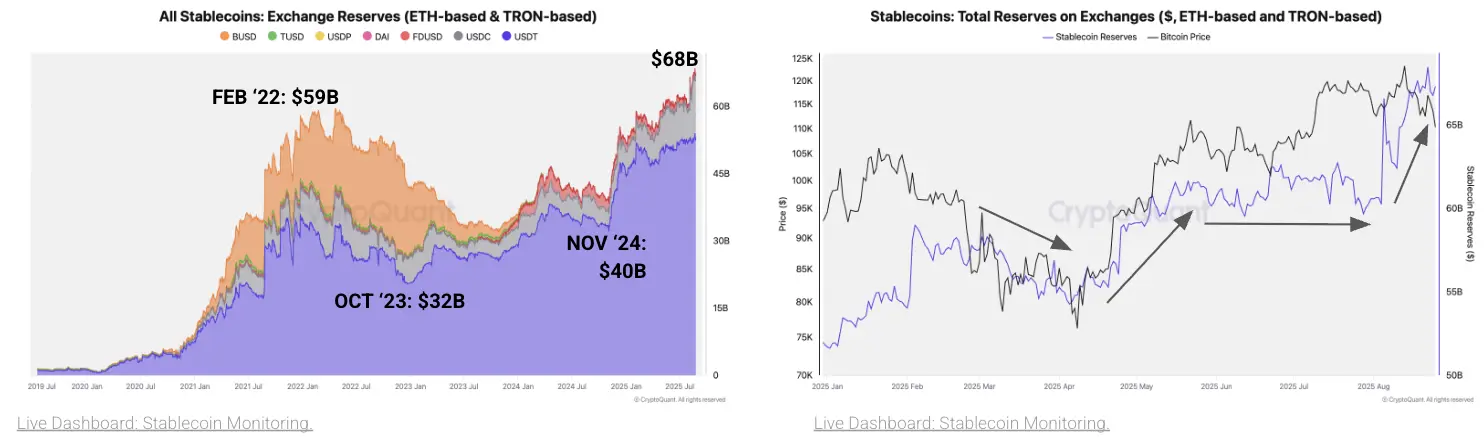

Stablecoin Exchange Reserves Climb to $68B

These keen-eyed folks at Cryptoquant and their data-gleaned from cryptoquant.com-reveal that the repositories of our dear stablecoins have swelled to a rather imposing $68 billion. Quite a pile, wouldn’t you say? And yet, the market capitalization, that rather vulgar display of numerical growth, has slowed to a leisurely pace. The combined holdings on those centralized exchanges peaked on August 22nd, a monument to inactivity, largely composed (as these things often are) of $53 billion in tether (USDT) and a comparatively demure $13 billion in USDC. A curious imbalance, don’t you think?

This surpasses the previous record of $59 billion, a comparatively modest sum, set back in February 2022. But despite this accumulation-this digital squirrel-like behavior-the weekly growth of stablecoin market capitalization has…deflated. A mere $1.1 billion per week, a pathetically small increment compared to the $4-8 billion frolic we witnessed during bitcoin’s late-2024 jaunt.

The analysts, with a knowing tilt of the head, point out that USDT’s 60-day growth has become…listless, a mere $10 billion compared to the almost indecent $21 billion of December 2024. And, crucially, the current expansion rate now dips *under* the 30-day moving average. Why, it’s practically begging for a correction. A sigh, really. A digital sigh.

The researchers, with the gravity of those studying a particularly fascinating insect, stress that these exchange-held stablecoins are a potential harbinger of purchasing power. Historically, these bulging reserves have buoyed digital asset prices by ensuring a predictable and rather comforting liquidity. But with issuance slowing, the liquidity conditions are…well, supportive, but lack the punch of earlier this year. Like a gently waved hand instead of a vigorous shove.

The report, with its characteristic understatement, suggests that markets might prefer a period of consolidation-a polite pause for breath-rather than another of those ‘extended parabolic moves.’ Cryptoquant’s market strategists conclude that, whilst the overall landscape remains broadly optimistic, the diminishing momentum suggests that the exhilarating winds of late 2024 have…subsided. A most anticlimactic realization, wouldn’t you agree? 🙄

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- USD VND PREDICTION

- Brent Oil Forecast

- POL PREDICTION. POL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- EUR KRW PREDICTION

2025-08-30 03:58