Many enthusiasts, with fingers crossed as if committing to a matrimonial ceremony, eagerly clutch their GRYP shares, hoping to partake in the fabled Trump family’s “Bitcoin venture.” But is it prudent to invest before American Bitcoin marries Gryphon Digital Mining in a corporate ball?

The Epic Joining of Gryphon and American Bitcoin

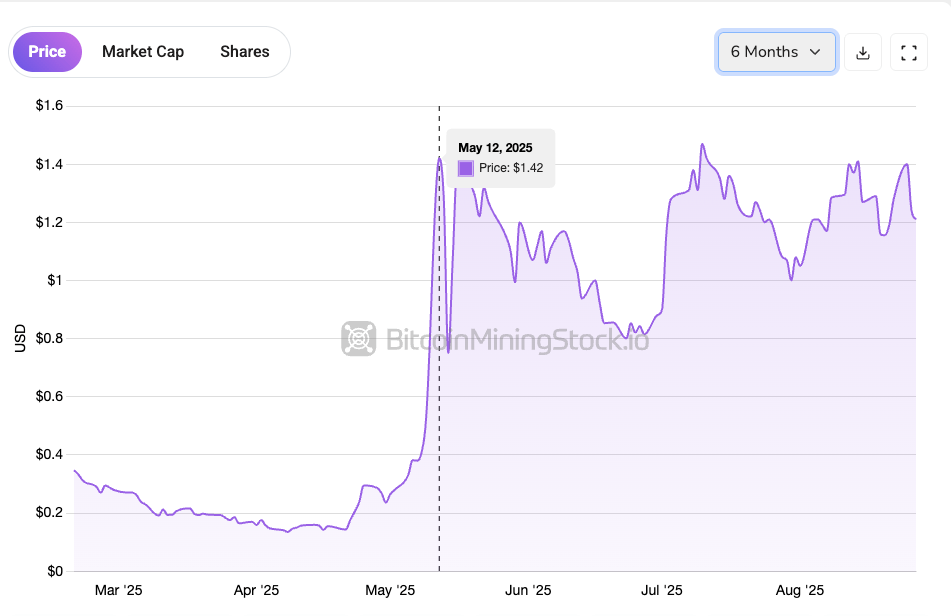

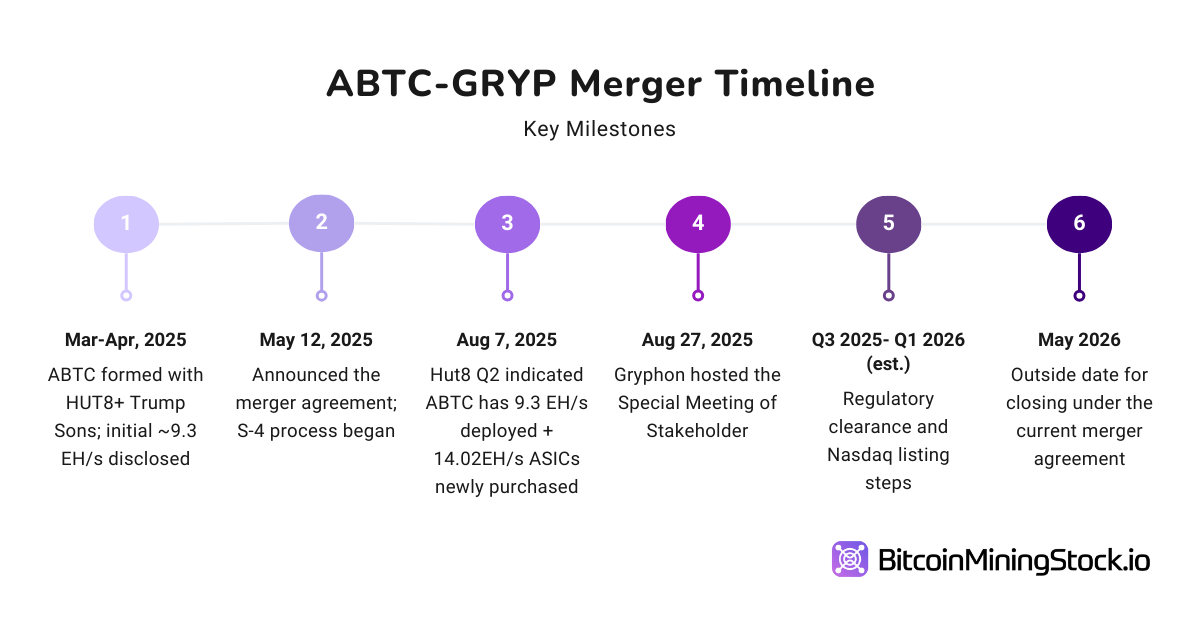

In what can only be described as a whimsical dance, Gryphon Digital Mining (GRYP), fluttering like a heraldic creature, has convened its shareholders in a special gathering. The goal? Deciding upon a merger with the newly minted American Bitcoin Corp (ABTC), orchestrated by the fraternal troupe of Eric Trump, Donald Trump Jr., and the enterprising Hut 8. Since the courtship was first trumpeted on May 12, Gryphon stock has soared over 200%, much like an over-enthusiastic maiden.

Some investors, ever the eager beavers, ponder: Should I buy more Gryphon shares to secure a substantial share in the Trump’s Bitcoin escapade? Oh, the conundrum!

Let us delve into the madness:

What Is This American Bitcoin?

American Bitcoin Corp. burst onto the scene on Mar 31, 2025, when the brave scion of Hut 8 handed over all its noble ASIC miners to American Data Centers Inc. (ADC)* for an elevated 80% stake. Like a phoenix reborn, ADC was swift to adopt the name American Bitcoin Corp. Since Apr 1, 2025, these miners operated under the proud banner of “American Bitcoin” within its computational fortresses. The company, not one to shy away from spectacle, has amassed $220.1 million, acquired a hefty ~1,726 Bitcoin, and gathered a formidable array of ~16,299 new-gen ASICs. Additional treasures include an agreement to claim up to 17,280 units of U3S21EXPH ASIC miners from Hut 8’s offspring, Zephyr.

In this menagerie, Eric Trump assumes the role of Chief Strategy Officer, bringing to this chaotic fair his legion of admirers, considerable fundraising prowess, and intimate access to political perfumes. They speak of him, and his brother Donald Jr., who are regaled as narrators and custodians of imperial connections from corners of international fancy to politically nourished funds.

Enter the illustrious two-tycoon twin bees Tyler and Cameron Winklevoss-who, with hearts beating for American Bitcoin, contributed not with peso but in pure Bitcoin, during a widely anticipated private placement.

As the tale is unraveled by Hut 8’s chieftain during the midsummer festivities, ABTC parades a sprawling hash rate of 9.3 EH/s, with eager eyes anticipating 14.02 EH/s to join upon deployment of their new mechanical hounds.

The Mosaic of the Merger Deal

On a day reminiscent of Mayflower departures, Gryphon Digital Mining serenaded its cohorts with the definitive proclamation of a union with American Bitcoin. Eschewing the tedious formalities of a direct listing, this corporate approach linked hands in a two-step, stock-for-stock waltz, thus bypassing the watchful eyes of regulatory overseers.

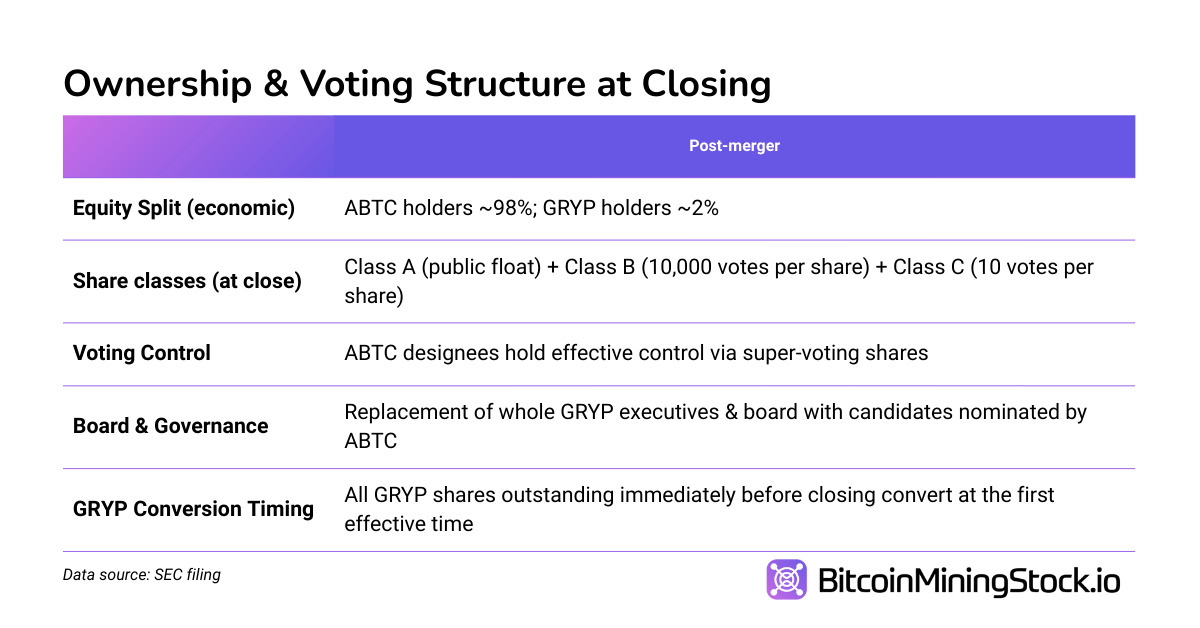

At the grand nuptials, old shares would transmute into newborn Class A shares. Those bearing Gryphon shares might fatten their purses with about 2% of the company’s full equity. The remaining throne of 98%, alas, is reserved for the cozy family of ABTC-including, with grandeur, the Trump lineage, Hut 8, and other avant-garde backers.

The offspring of this union would be adorned with a multi-class share tapestry, whereby Class B shares would sit atop the hierarchy, brandishing ten-thousand votes each. Expectations herald Hut 8 as the eventual stewards, controlling a princely 64.37% of equity and an imposing 80% of the decision’s power.

After the passage of legal betrothals, the moniker would metamorphose to American Bitcoin Corp, and it would don the ticker “ABTC,” trading upon the Nasdaq stage as a free-standing entity, strategically intertwined, yet financially independent from Hut 8’s coffers.

Is a Modest 2% Slice of the Grand Pie Fair?

The verified fairness of distributing merely 2% of this proverbial delicacy-a percentage that provokes the mind to a sense of culinary injustice-is contingent upon the valuation feast prepared for each participant. The opinion of worth offered by Marshall & Stevens in the season of renewal deems it equitable for Gryphon, drawing upon past trading performances and tangible assets, without engaging in conjectural futures or intricate cash-flow manuscripts.

For the promise to be met, the nascent American Bitcoin’s equivalence in fortunes might soar close to

$5 billion

with the sun of listing over the venture-should the original investor not wish to behold a vain mirage.

When all is put to scrutiny, while the meager 2% seems sensible under certain illuminations of listing-based on the outlook of our current discussions-the heightening expectations veiled within GRYP’s value are indeed startling.

Am I to Clench More of Gryphon’s Shares Before the Wedding?

Should an assembly of investors clutch more GRYP, viewing it as a prelude to the Trumps’ opulent wager in Bitcoin? Alas, the decision leans not merely on the appeal of future bliss but also must reckon with the fickle hand of fate and the anticipation of time’s unforgiving passage.

Should destiny favor the merger, clutching more Gryphon shares would endow them with a correspondingly greater slice of the coveted 2% ABTC equity banquet. Nevertheless, one must tread carefully, for the path to the altar is fraught with uncertainty, and the regulatory overseers lie in wait. Any digression within the gentle rhythm of the timeline until May 2026’s finale could see the wistful sentiments of ABTC’s treasury narrative wither in the absence of Bitcoin’s benevolence.

But, if the bet placed by the Trumps is matched with the securing of further mechanized troves through the ebullient currency exchange of Bitcoin-using their name as a banner for fresh capital-and riding upon the whimsical warhorse of a bullish Bitcoin market, the glittering spoils may far outweigh the risks. For the early comers under Gryphon’s wing, the skies may yet turn a gilded hue.

And of course, there remains the shadow of termination-an abject failure of a joining. The marriage dashed before bloom, Gryphon might be consigned to odd fortunes, perhaps demanding a parting sum or left to the vagaries of liquidity, which recent oracular quills forecast dimly, as evidenced by their recent financial parchments.

To procure additional GRYP becomes an act of high drama and speculation-each actor must choose their role based upon their trust in this narrative’s cast, the promises of future treasure, and the eminence of Trump and co.’s treasury tale within the realms of digital coinage.

A Concluding Whimsy

This union of Gryphon and American Bitcoin is surely an aria, distinct from the common mining arias. It evokes the high drama of nobles (the Trump scions), the strategic divestiture from a stalwart (Hut 8), and an ambitious saga-“Mine & Treasury” combined-attempting to outshine the previous champions in the mining space, while garnished with lofty political fragrance and the buzz of fellowship.

Should the pages of history mark this event as a triumphant saga, each actor shall glean disparate treasures. For Hut 8, the cleaving bestows upon them a chance to reshape their core, free of the yoke of their balance sheet while in sight of the treasures of Bitcoin yet to be found. For American Bitcoin, it is a swift mount to the Nasdaq citadel and a hoarder of capital through the reversed amalgamation, circumventing the tedious journey of listing or public offering. For Gryphon, amidst its fears of oblivion from delisting threats and insignificance, it catches a lifeline for a discreet passage from its tribulations.

So, shall the hopeful invest in the prospect of GRYP, hoping to gain a sliver of ABTC’s great banquet? Attend to this: that 2% holds fast, its future worth bet upon not just execution, but also the humors of the market and the dynamics that shall emerge once the merger is woven into history.

Though the multitude of petals makes the blossoming uncertain, the promise-the unpredicted and destitute-lingers robust. This tale winks from the corner, begging for watchful eyes to discern its unfolding.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- Brent Oil Forecast

- EUR USD PREDICTION

- POL PREDICTION. POL cryptocurrency

- STX PREDICTION. STX cryptocurrency

- USD KZT PREDICTION

- EUR KRW PREDICTION

2025-08-31 15:00