Ah, dear audience! Here we find ourselves peering into the curious world of Bitcoin, which, like a well-trained terrier, is keeping its 24-hour range quite tight-between $108,221 and $109,453, as of that fateful Sunday, August 31, 2025. And wouldn’t you know it, while our orange friend holds its breath, the derivatives positioning is puffing up like a pastry chef with a hot oven.

Derivatives Depth Continues to Swell

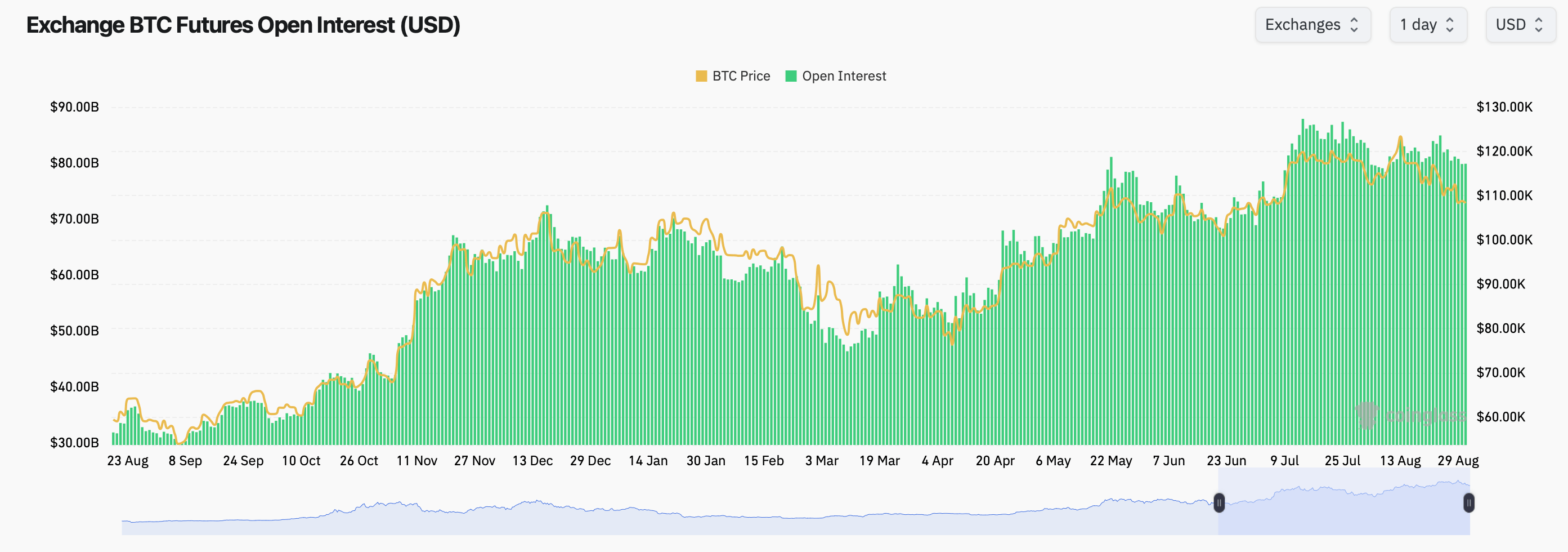

Now, those futures! My word, they remain as thick as the fog in London! The aggregate open interest in Bitcoin futures on various platforms is hovering around the mid-$80 billion area! A bit hefty, wouldn’t you agree? The good folks at CME Group are making quite the splash, flaunting a staggering 141.78K BTC in open interest, to the tune of about $15.36 billion, bless their cotton socks.

Following closely behind in this competitive race for open interest is Binance, boasting a respectable 131.14K BTC ($14.21 billion). Then there’s Bybit with a nippy 91.28K BTC ($9.89 billion) and others like Gate and Bitget, who seem intent on keeping their hats in the ring as well.

More names ring a bell: MEXC, WhiteBIT, and a gaggle of others, all vying for a slice of the Bitcoin pie. One wonders if there’s enough pie to go around! 🍰

As the price-aligned futures activity miraculously tracks the ever-steady spot tape, we see open interest reaching dizzying heights since July, despite our friend Bitcoin being confined in a snug little range this weekend. Perhaps it’s waiting for a more dramatic moment to make its grand entrance very soon-September, I hear, is quite the showstopper!

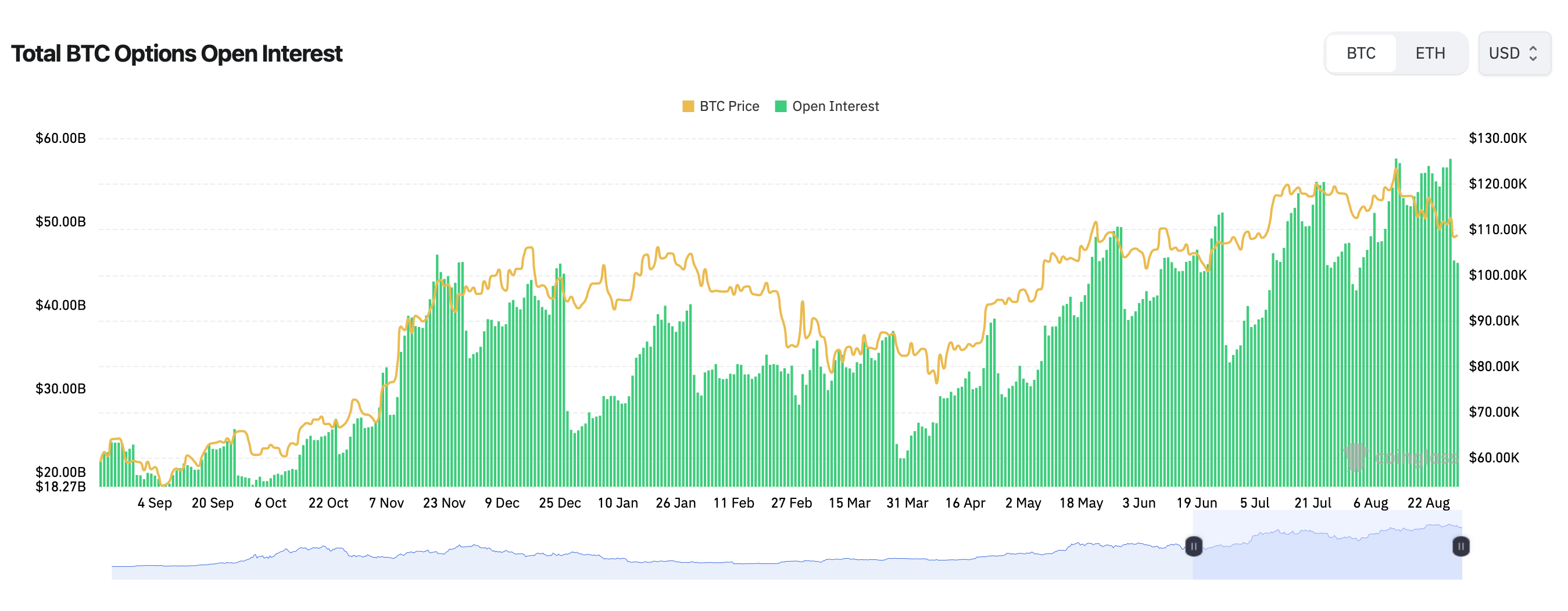

$50 Billion in Bitcoin Options Open Interest

And as if that wasn’t enough, options positioning is playing it cool as well. The grand total of Bitcoin options open interest is now perched above $50 billion, almost as if it’s vying for a place in the record books! Daily turnover in options is making itself known in the multi-billion-dollar arena. Over on Deribit, the reigning monarch of options platforms, open interest is undisguisedly skewed towards calls-223,887 BTC (59.80%) to 150,495.83 BTC (40.20%) for puts. A fascinating little gambit, indeed!

Every second trader seems to have an eye on topside exposure while keeping one cautious foot on the downside protection. The biggest open-interest players include our good friends the BTC-26SEP25-$95,000 puts and a clump of higher-strike calls floating around $140,000 to $200,000, quite a cheeky bet as we gear up for September and December bitcoin expiries. Clever chaps, those traders!

Ah, now we encounter max-pain levels. Where do they rest, you ask? Well, they cluster around the $110,000 mark for the near-term monthly cycle, which is slightly less dramatic than your aunt Edna’s holiday turkeys! The curve lifts to approximately $116,000 as we tiptoe into late October, dips toward the humbler $100,000 area for late December, and rises again into our favorite mid-2026 expiries.

When all is said and done, what a curious tableau we have! The derivatives stack reveals a hearty participation on both sides, while our beloved spot price remains as calm as a cucumber in a cool breeze. Considering they’re all fit and well concentrated at CME and Binance, and with the options leaning ever so slightly on the call side, we’re certainly built for movement-even if the price action languishes inside a $1,200 Sunday corridor! Hold onto your hats, it may just turn thrilling! 🎩

Read More

- Gold Rate Forecast

- GBP CNY PREDICTION

- EUR USD PREDICTION

- Silver Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- Brent Oil Forecast

- POL PREDICTION. POL cryptocurrency

- GBP RUB PREDICTION

- STX PREDICTION. STX cryptocurrency

- USD KZT PREDICTION

2025-08-31 19:58