Ah, Bitcoin – once the darling of dreamers and digital desperados, delivering fortunes to those cunning (or lucky) souls who dared to dive in a decade ago. Now, the miners themselves, those iron-hearted beasts crunching numbers in scorching data dens, seem to have stumbled upon a new mother lode: Artificial Intelligence.

You see, the very guts of Bitcoin mining infrastructure – cold racks, humming machines, and the endless thirst for power – now stand poised like a grinder’s wheel sharpening a blade, ready to slice through the dense fog of today’s tech chaos and shine bright in the AI dawn.

When Investors Start Calling Bitcoin Miners “AI Companies” – What’s Next? Robots with Pickaxes? 🤔

Frank Holmes, the wizened Executive Chairman and Co-founder of Hive Digital, told the restless scribblers at BeInCrypto that cranking a data center alive from barren ground takes a solid three years – wrestling permits, dodging red tape, and coaxing concrete to cooperate.

But! If you’ve already built your fortress for Bitcoin mining, transforming it into an AI hive? Nine months. That’s less than a baby’s gestation or a Netflix binge… take your pick.

“Infrastructure’s in place? Nine months to upgrade. Simple as brewing your morning coffee,” Holmes quipped, no doubt amused by the prospect.

Hive waves a flag over $600 million in market value, though they’re no longer just counting coins. They brandish the title of “vertically integrated, renewable-powered AI infrastructure company,” and Wall Street neckties nod sagely in agreement.

With price targets dangling like ripe fruit from $6 to $12, and the stock hitching a ride at around $3 today, early pilgrims smell the scent of a 300% upside. Mmm, sweet potential!

Institutional predators are circling too. Citadel Securities casually announced a 5.4% stake in Hive-like dropping a giant elephant gently into a pond-and with Hive planting its flag in the U.S., the Russell 2000 beckons at the end of its pilgrimage.

Holmes tiptoed out a confession: retail investors lit the initial fire for Hive’s ascent. And when the big sharks warm their fins, expect a feeding frenzy and some juicy stock surges.

Even Kevin O’Leary – “Mr. Wonderful,” possibly the world’s most charming shark with a penchant for colorful metaphors – threw his lot in with Bitzero, a Bitcoin mining and power outfit.

In an exclusive podcast, O’Leary philosophized: “Had I been around 300 years ago, investing in gold would have had me digging dirt and sewing jeans for the miners instead of just clutching nuggets. Owning Bitzero is the modern equivalent – mining Bitcoin AND running power. Double whammy.”

The AI Bonanza for Bitcoin Miners: Bigger Than Your Grandma’s Quilt 🧵

Everyone knows AI’s the shiny toy of the century, but few grasp just how gargantuan this beast will become. Tech giants are the titans, and a single handshake with these colossi can launch a miner’s stock into the stratosphere.

Take TeraWulf, which shot up nearly 60% in one day after nabbing a $3.2 billion contract with Alphabet – the other company that wants to watch you while you watch it.

TeraWulf is betting big on building what might be the U.S.’s largest data center playground, backed by tech’s finest minds @core42_ai @fluidstackio @Google $WULF

with @PaulBPrager @SullyCNBC @CNBC @PowerLunch

Limited electricity, limited data centers. Yet unlimited dreams! Crypto miners are in pole position to sign more blockbuster deals.

But here’s the kicker: the real jackpot might not be Facebook’s cousin or Google’s new crush, but rather militaries and governments craving AI for drones, robotic warriors, and driverless tanks – because who doesn’t want a self-driving war machine? 🚀🤖

“Money’s flooding into AI like vodka at a Russian wedding. Drones need brains, and brains need data centers – and soon, sovereign data centers will be the new castles,” Holmes predicted with a glint in his eye.

Bitcoin Miners: The Sleeping Giants of the Data Center World 🦍

Despite their starring role in this tech drama, Bitcoin miners remain the wallflowers at the investor’s ball. Their valuations sit embarrassingly low compared to their data center cousins. It’s as if the party forgot they showed up, wearing AI blazers under their mining helmets.

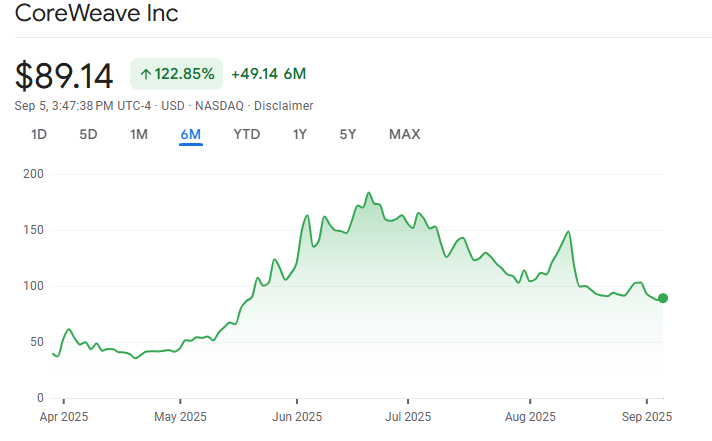

“Typical data center ETFs rock 20 times EBITDA like a boss, while our miners barely clear 2 times,” Holmes grunted. “But mark my words, the slow dance will end – Core Scientific proved it at 14 times, CoreWeave stunned at 40, and our data centers? In five years, golden assets.”

CoreWeave’s rise from humble Atlantic Crypto to a $50 billion behemoth after embracing AI is the stuff of legend, or at least good whiskey talk.

Unlike the dotcom days when eyeballs ruled but wallets stayed shut, AI’s revenue streams gush faster than a Volga river spring flood.

OpenAI jumped from zilch to a billion dollars per month in revenues faster than you can say “singularity.”

Hive’s stock has danced more than twice as high since 2025 lows. Not to be outdone, IREN and Cipher Mining have also been happily hopping upward, defying gravity and common sense alike.

With experts like Holmes waving the flag, one can’t help but feel these spikes are only opening fireworks for what’s to come. Time to grab popcorn-or mining rigs-and enjoy the show. 🎆

Read More

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

2025-09-05 23:13