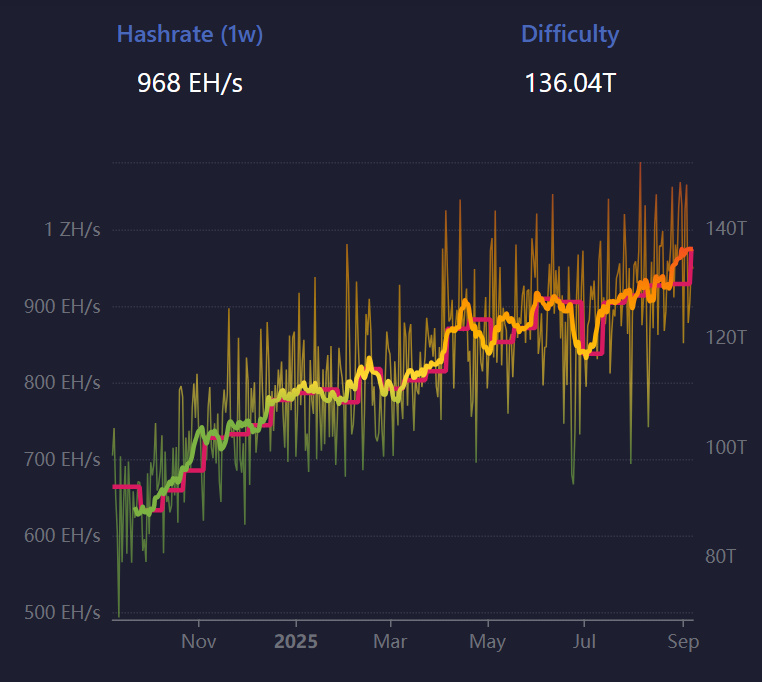

Ah, Bitcoin mining difficulty has soared to a staggering 136 trillion-a new record high! 🎉 But wait, there’s no champagne here. Instead, miners are drowning in despair as revenues plummet faster than their GPUs can hash.

At block height 913,248 (yes, we’re keeping count), the difficulty rose by 4% from 129.6 trillion, marking its fifth consecutive increase since June. Mempool provided these figures with all the enthusiasm of a tax auditor delivering bad news. And so, dear reader, let us reflect on this tragedy-turned-comedy.

When Algorithms Attack: The Struggles of Modern-Day Miners 🪓

Bitcoin’s difficulty adjustment mechanism-oh, how cleverly designed it is! Every 2,016 blocks (roughly every two weeks), the system recalibrates itself like some cosmic overlord ensuring order amidst chaos. A rise? More miners have joined the fray, armed with dreams and expensive hardware. A drop? Well, someone gave up-or went bankrupt. Either way, stability reigns supreme.

But now, our brave miners face not only an ever-growing horde of competitors but also shrinking rewards. Hashprice-the metric that measures revenue per unit of computing power-has tumbled to $51. Yes, you read that right. It’s the lowest it’s been since June, which feels like ancient history in crypto years.

Hashrate Index informs us (with palpable glee) that August was particularly brutal. The average hashprice for the month stood at $56.44, down 5% from July. Meanwhile, transaction fees offered scant relief. On average, miners collected a measly 0.025 BTC per block-a 19.6% decline from July. In dollar terms, this amounted to just $2,904 daily, the lowest since early 2013. Truly, the glory days are behind them.

And so, we arrive at the crux of the matter: Bitcoin miners find themselves trapped between Scylla and Charybdis. Record-high difficulty levels gnaw at their profits while dwindling revenues threaten their very existence. Will they persevere through sheer grit and determination? Or will they succumb to the merciless algorithmic beast?

In conclusion, unless Bitcoin’s price skyrockets (ha!) or users suddenly decide to send each other more transactions (good luck with that), miners may need divine intervention-or at least a hefty loan-to survive the year. After all, who needs sleep when you can mine Bitcoin? 🤪

Read More

- BTC PREDICTION. BTC cryptocurrency

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Litecoin’s Wild Ride: $131 or Bust? 🚀💰

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

2025-09-07 20:26