There it was, on the morn of September 8, 2025, at the stroke of 8:30 a.m., Bitcoin stood tall at $111,979, a number that seemed to whisper promises of recovery after a tumble that left the market bruised. With a market cap of $2.23 trillion and a 24-hour trading volume of $28.57 billion, the digital gold shuffled within a narrow range of $110,690 to $112,112, as if the investors were tiptoeing around a sleeping bear 🐻, unsure if it was truly asleep or just pretending.

Bitcoin

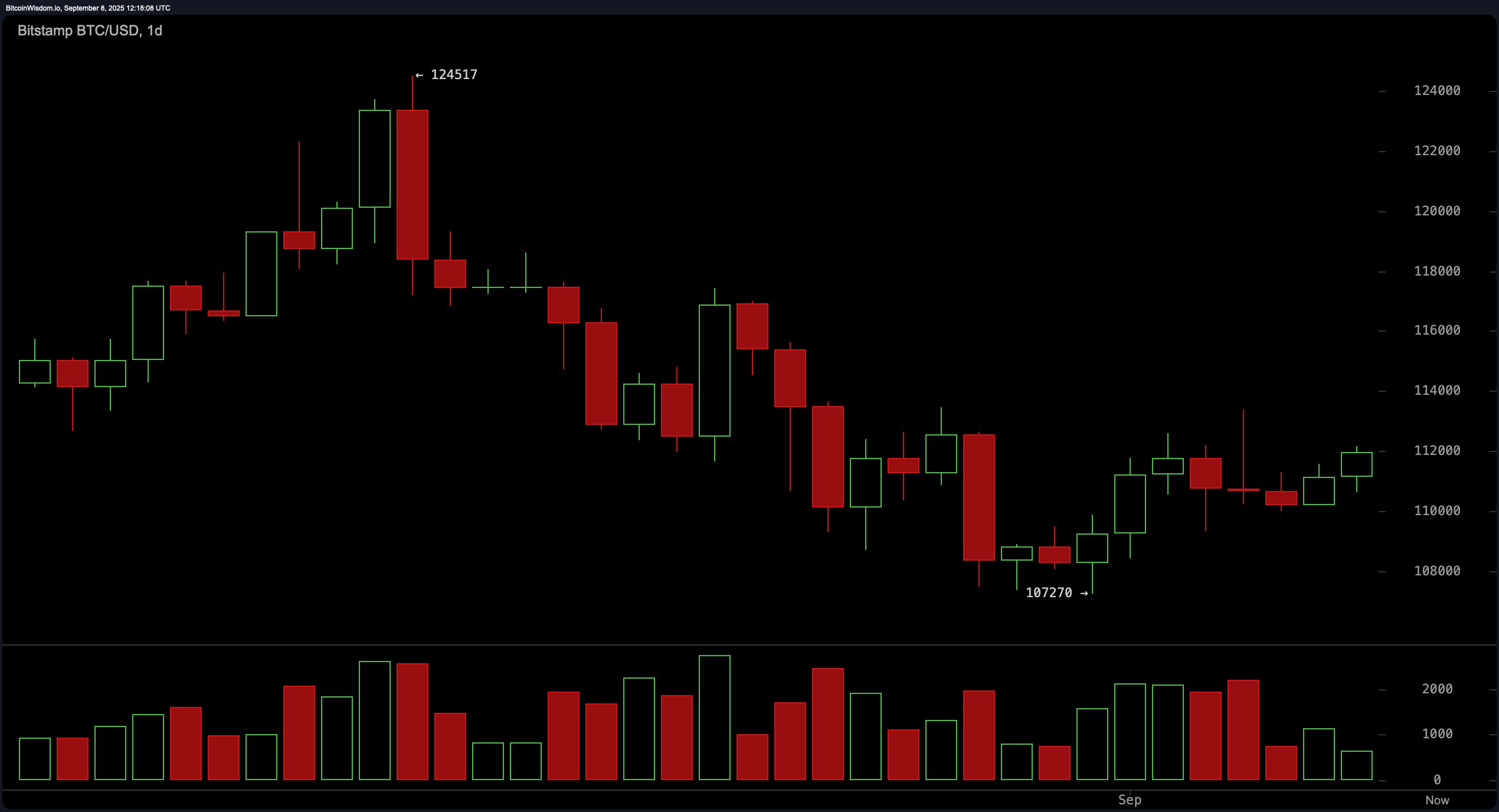

Across the vast plains of the daily, 4-hour, and 1-hour charts, Bitcoin seemed to be stitching together a recovery, though the thread was frayed and the needle rusty. The daily chart showed a bounce from the $107,000 ravine, a 14 percent climb from the recent peak of $124,500. Yet, the ascent lacked the vigor of a true bull, with volume dwindling like a campfire in the rain, hinting at either a timid demand or a bull trap waiting to snap shut. Resistance loomed like a stubborn mule at $113,500 to $114,000. A breakout above, on the back of strong volume, would be the trumpet call for the bulls, while a rejection would send the bears growling back into the fray.

The 4-hour chart, a more intimate portrait, hinted at a moderate bullish bias, with higher lows like stepping stones across a stream. Yet, a failed breakout at $113,402 earlier in the week left a scar, and the asset had been huddled between $109,000 and $112,000 since September 6, as if waiting for a sign from the heavens. Declining volume during this consolidation whispered of a breakout, but whether it would be a leap forward or a stumble backward remained anyone’s guess. For the bulls, a clean break above $113,400 with volume to match would be a green light, while a drop below $109,300 would be the bears’ victory lap.

In the short-term, the 1-hour chart painted a picture of bullish ambition, with higher highs and higher lows like a ladder leaning against the sky. The price hovered near $112,000, teetering between a bullish flag and a double top, a choice between triumph and tragedy. Volume, however, had taken a vacation, suggesting buyers were either exhausted or hesitant, a reminder that in the market, confidence is as fleeting as a summer breeze. A breakout above $112,200 on strong volume could pave the way to $113,400, while a drop below $111,000 would be a red flag for the intraday traders, a signal to tread carefully.

Oscillator readings, those fickle oracles of the market, were as indecisive as a donkey at a crossroads. The RSI at 49, stochastic at 57, CCI at 5, ADX at 16, and awesome oscillator at −2,930 all shrugged their shoulders, offering no clear direction. Yet, the momentum indicator at 3,615 and the MACD at −1,170 flashed buy signals, like a wink from a friend in a crowded room, hinting at latent energy waiting to burst forth if only the volume would cooperate.

Moving averages, those wise old sages of the market, painted a picture as nuanced as a Steinbeck novel. Short-term signals leaned bullish, with the 10-day and 20-day moving averages whispering buy. Yet, the 30-day and 50-day averages grumbled of selling pressure, while the 100-day averages were split, one bullish, the other bearish. The 200-day averages, however, stood firm, pointing to long-term bullishness, a reminder that beneath the chaos, there was strength in Bitcoin’s macro structure.

In the end, the technical landscape on September 8 was a cautious optimist, like a farmer eyeing the sky before planting his crops. Key resistance loomed just above, and swing traders were advised to wait for a confirmed close above $114,000 on high volume before making their move. Intraday traders could watch the breakout levels at $112,200 and $113,400 for scalping opportunities, but tight stop-loss placement was essential, especially below $111,000 and $109,300, to guard against the market’s whims.

Bull Verdict:

If Bitcoin breaks decisively above the $113,400-$114,000 resistance zone on strong volume, the technicals suggest a bullish march toward $117,000. Short-term moving averages and upward momentum indicators hint at latent strength, positioning Bitcoin for a potential trend reversal and renewed upside. 🌞

Bear Verdict:

Failure to break above the $113,400-$114,000 resistance, coupled with declining volume and neutral oscillator signals, could embolden the bears. A drop below key support at $111,000 or $109,300 would confirm bearish momentum, potentially driving Bitcoin back toward the $107,000 support or lower. 🌧️

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- ETH PREDICTION. ETH cryptocurrency

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

2025-09-08 15:59