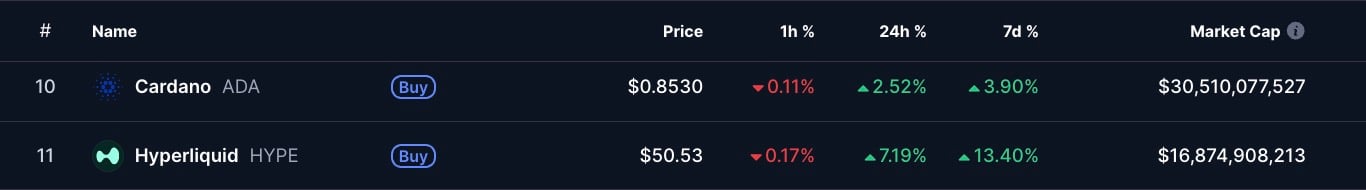

Ah, Cardano (ADA) – the crypto that keeps hanging on to its spot in the top 10 like a guest at a party who was never really invited but refuses to leave. The reason? Hyperliquid (HYPE), which is swiftly catching up, and is currently worth a sprightly $16.88 billion, just behind Cardano’s relatively geriatric $30.44 billion, according to CoinMarketCap. In crypto terms, that’s like watching a vintage car trying to race against a shiny new sports model. Spoiler alert: the sports car wins.

In fact, HYPE’s daily DEX turnover is a breezy $361 million, whereas Cardano’s is more like the change you find between the couch cushions at a modest $2.89 million, per DefiLlama. It’s still moving, but with the grace of a dinosaur – clinging to life by muscle memory rather than innovation.

Cardano’s existential crisis, my dear readers, is glaring. The network lacks a stablecoin, any competitive DeFi activity, and – hold onto your hats – real fee revenue. Yet it clings to its top-10 slot with the tenacity of a pet rock, while Hyperliquid is busy building the very mechanisms that will make its tokens soar. Cardano’s survival now seems more like inertia than anything else. It’s the crypto equivalent of a moth refusing to acknowledge the light bulb is burnt out.

The price charts this year are a study in contrasts. HYPE has catapulted upwards by a dizzying 254.9%, while ADA has been on a leisurely decline, falling 29.7%. One line’s heading toward the moon, while the other is practically gathering dust at the bottom. It’s almost as though liquidity and adoption are moving in opposite directions. How quaint.

The Core Problem

Ah, the stablecoin gap. Even Charles Hoskinson, the master of the long game, has reluctantly admitted it. Cardano doesn’t have one. But don’t you worry your little head, Hyperliquid is getting ready to launch USDH in collaboration with Paxos, the company behind Binance‘s $25 billion BUSD. Meanwhile, Hyperliquid is already handling a cool $5.5 billion in stable liquidity, much to the delight of Circle.

If Hyperliquid launches its own stablecoin, they could potentially reinvest $200-220 million a year into their ecosystem. If adoption grows (a big if, but hey, anything’s possible), they could scale that up to over $1 billion in annual buybacks of HYPE. Meanwhile, Cardano is still organizing workshops and endless discussions, but precious little gets shipped. It’s a decentralized utopia where three entities still reign supreme, which seems about as decentralized as a board meeting at the Monopoly company.

Hoskinson may continue to sell us the dream that Cardano is playing the long game, but let’s be real here: every long game turns into a short one if nothing ever comes to fruition. So, while Cardano ponders its next move, Hyperliquid is out there redefining the game. How delightful.

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

2025-09-08 17:46