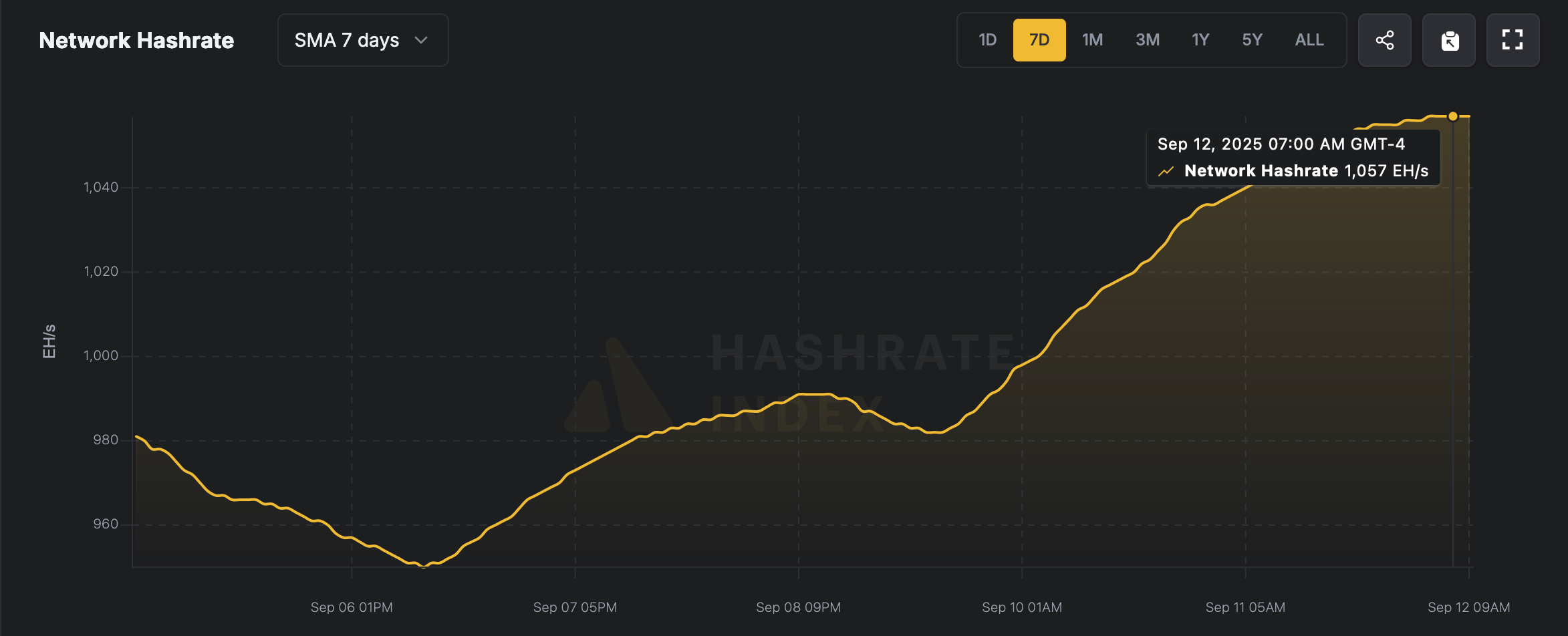

Well, well, well! Looks like Bitcoin’s raw computational muscle is getting even more jacked, as it flexes to a new record. On Friday, the network hit 1,057 exahash per second (EH/s)-or as the cool kids say, 1.057 zettahash per second (ZH). Talk about powerlifting on the blockchain!

Bitcoin’s Hashrate Flexes: A New Zettahash Milestone!

Another day, another record. On September 12, 2025, Bitcoin’s global hashrate reached an absurdly high 1,057 EH/s by 6 a.m. Eastern. By 10 a.m., things cooled down (sort of) to 1,046.39 EH/s, but block times were still racing ahead like your grandma on an electric scooter-averaging 9 minutes and 25 seconds. Who needs 10 minutes, right?

Now, let’s talk about those speedy blocks. If they keep zipping through faster than expected, miners can brace for the dreaded difficulty hike. Right now, it looks like a 6.12% increase is on the horizon, but that could all change faster than a miner switches rigs, come September 18 when the next retarget happens. The difficulty is already sitting at a record-breaking 136.04 trillion. Yikes! That’s like trying to find your lost keys in a haystack made of haystacks.

Bitcoin’s unwavering computational growth is like a fortress of steel and iron. It’s basically an armored tank against potential attacks, making any attempts at disrupting the network not just expensive, but near impossible. That’s the power of the zettahash era. It’s like having an unbreakable shield, except it’s way cooler and crypto-related.

The shortened block times are a clear sign that the mining arena is getting packed. Miners are rolling out state-of-the-art equipment just to stay in the game. It’s a live demonstration of proof-of-work (PoW) in action. Forget transaction processing-it’s like a contest to see who can flex the hardest. And every new peak just proves that Bitcoin is still the undisputed heavyweight champ of decentralized networks. Powered by innovation and endless energy. Also, a lot of caffeine.

But hold your horses! While miners may be flexing their shiny new rigs, they’re also dealing with shrinking rewards. As on-chain rewards thin out like a cheap pancake, miners have to rely on everything from BTC price spikes to efficient energy usage to stay profitable. The real question is: can they keep up with the rise in hashrates, or will they be left in the dust like the last guy holding a floppy disk?

Read More

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- ETH PREDICTION. ETH cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

2025-09-13 03:03