Ah, dear reader, let us delve into the labyrinthine corridors of that enigmatic creature known as Bitcoin, which has quite recently clawed its way out of the wretched pit of its downtrend. Yes, indeed! It has touched the sacred grounds of key support and finds itself nestling in a comforting embrace of consolidation – a veritable prelude to the raucous revelry of upward surge. How charmingly ironic, is it not? 😏

The Tale of Breakout and Retest

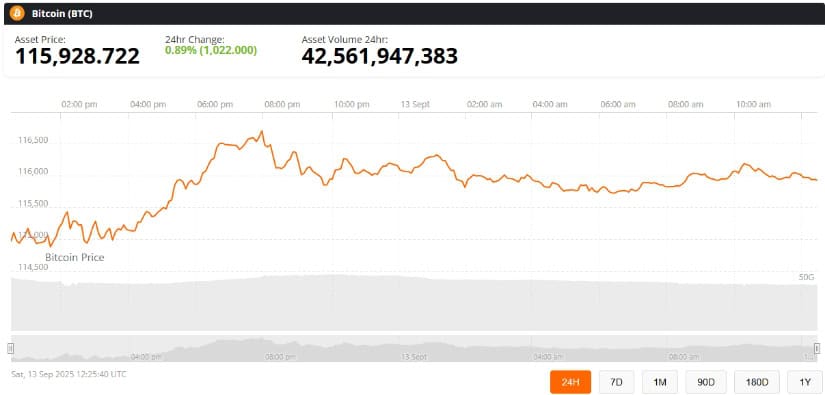

In the murky depths of TradingView’s latest revelations, our beloved BTC has broken free from its shackles of former resistance and ventured forth to retest the exalted $115,000, now adorned as its new sanctuary. The “breakout + retest” charade is precisely what the textbooks had foretold – a *textbook* bullish signal, almost as if the universe conspired to shift the tides from despair to hope. But hold your horses! 🐎

As long as our jovial BTC maintains its lofty position above the golden threshold of $115,000, the bullish projections might still hold water. Alas, should a daily candle dare to close beneath this cherished line, we may be thrust into a tumultuous abyss of deeper corrections. Oh, the cruel twists of fate! 🎭

The Grand Price Pursuits of BTC

Now, with a reversal that rings like a bell through the halls of fate, our gaze turns to the horizon of price targets. The lofty summits of $117,200, $119,400, and the grand prize of $123,000 loom ahead, beckoning like sirens to traders weary from profit-seeking voyages. Ah, but what fickleness lies in the hearts of men and markets alike!

Should the winds of buying pressure continue to blow, predictions whisper sweet nothings of a push towards the magical land of $120K-$123K in the coming weeks. But take heed, dear traders, and keep an observant eye on the volume and order book data! For weakness in zeal may usher in a tempest of pullbacks – a risk most unsettling, wouldn’t you agree? 👀

The Macrocosm’s Influence

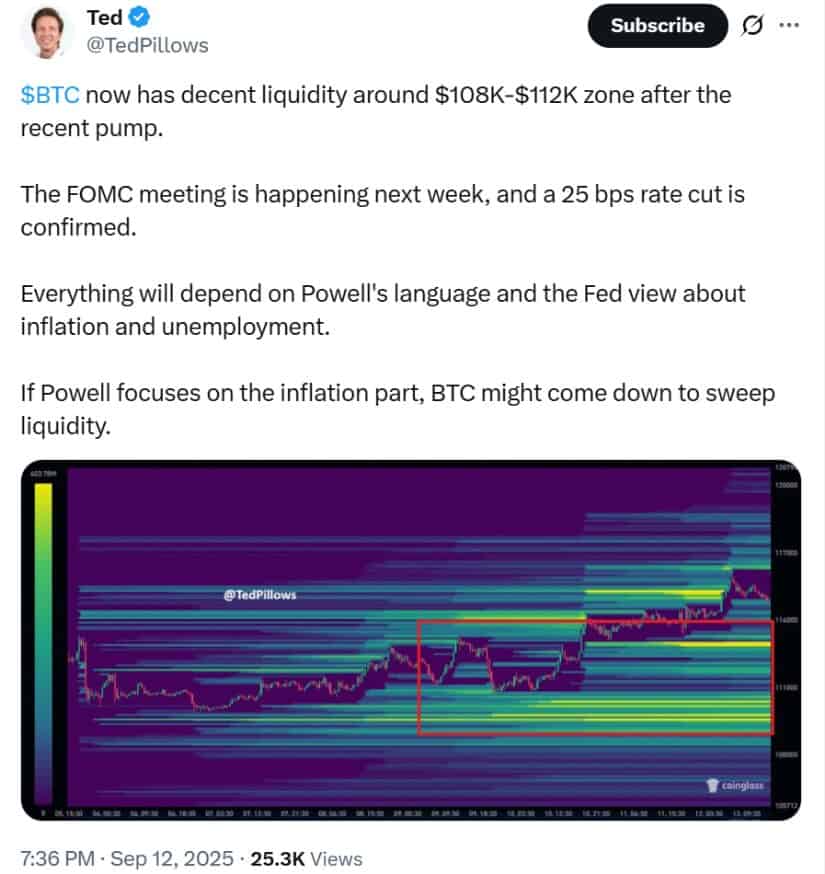

Yet, beyond the sacred scriptures of technical analysis, we must grapple with the broader strokes of our economic canvas. The Federal Open Market Committee (FOMC), in its infinite wisdom, prepares to convene on September 17, 2025. The air hums with the anticipation of a 25-basis-point cut, sending ripples through our beloved Bitcoin’s fate. Could it truly be that 61% of economists have wagered on Chair Jerome Powell’s steadfastness against the ebbing tides of inflation? Oh, the delectable irony! 📉

This fateful decision may very well stir the pot of volatility, as rate cuts gleefully sway the liquidity and risk appetite within this chaotic crypto realm. Beware, for as sentiment drifts toward caution, we might witness the stark traverse through Bitcoin’s liquidity zone nestled between $108K and $112K. Ah, the audacity of fate! 🤔

Long-Term Visions and Perils

Yet, amidst all this turmoil, a glimmer of optimistic fervor persists, driven by whispers of a bullish engulfing candlestick formation on the horizon. An enchanting study from the 2023 Journal of Financial Markets professed a 68% success rate for this alluring pattern in confirming major reversals – if only it were supported by robust trading volume. How delightfully hopeful! 🌟

Standard Chartered steps forth in their declarations of appetite for aggressive rate cuts, and lo, Bitcoin’s market cap ascends, like Icarus reaching for the sun, having risen by $110 billion as our dear BTC flirted with the splendid $116,000 on September 12, 2025. Should momentum waltz in our favor, visions of retesting the all-time high – or even flirting with the absurd projections of $1 million by the decade’s end – may dazzle the mind! How everything is so comically intertwined! 🥳

Read More

- BTC PREDICTION. BTC cryptocurrency

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- ETH PREDICTION. ETH cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

2025-09-14 00:26