The twelve-member Federal Open Market Committee (FOMC) will hold its closed-door two-day interest rate meeting on Tuesday, emerging Wednesday afternoon.

Market Awaits Fed Verdict, Bitcoin Holds Its Breath

Monday saw the Nasdaq, S&P 500, and even gold hit all-time highs, but bitcoin has climbed up more cautiously as the crypto market braces for what may be the first interest rate cut in 2025 after the Fed emerges from its two-day meeting, which starts today and ends with Fed Chair Jerome Powell’s press conference tomorrow. It’s like watching a toddler learn to walk while everyone’s holding their breath-except the toddler is wearing a suit and has a PhD in economics.

Powell has held the line and kept rates steady since December 2024 despite being chastened by the Trump administration for being overly hawkish. The Fed has a dual mandate of maximum employment and stable prices, which usually translates to an inflation rate of around 2% and the “lowest level of unemployment that the economy can sustain.” The most recent Consumer Price Index (CPI) came in at 2.9% annualized last week, much higher than the recommended 2% target. Imagine if your parents told you to keep your room clean and your grades up, but then you accidentally spilled paint everywhere and got a C in math. “Not your fault,” you say. “It’s just… chaos management.”

But markets brushed off Thursday’s spike in inflation, focusing instead on the surge in new unemployment claims, which most economists predict will compel the Fed to lower rates as a counter to a potential economic slowdown. The anticipation for a rate cut subsequently triggered an across-the-board rally, but now it appears bitcoin traders are taking a wait-and-see approach in case the central bank surprises markets and once again decides to maintain the current policy rate. Like waiting for a magician to reveal their trick, but the trick is just “here’s a rabbit… and also, sorry, inflation is still a problem.”

“For Fed Chair Jerome Powell, the risk management considerations may go beyond balancing employment and inflation risks,” said J.P. Morgan Chief U.S. Economist Michael Feroli. “We now see the path of least resistance is to pull forward the next cut of 25 bp to the September meeting.” Feroli’s probably also betting on whether Powell will wear a tie or a scarf to the press conference. The stakes are high, folks.

Overview of Market Metrics

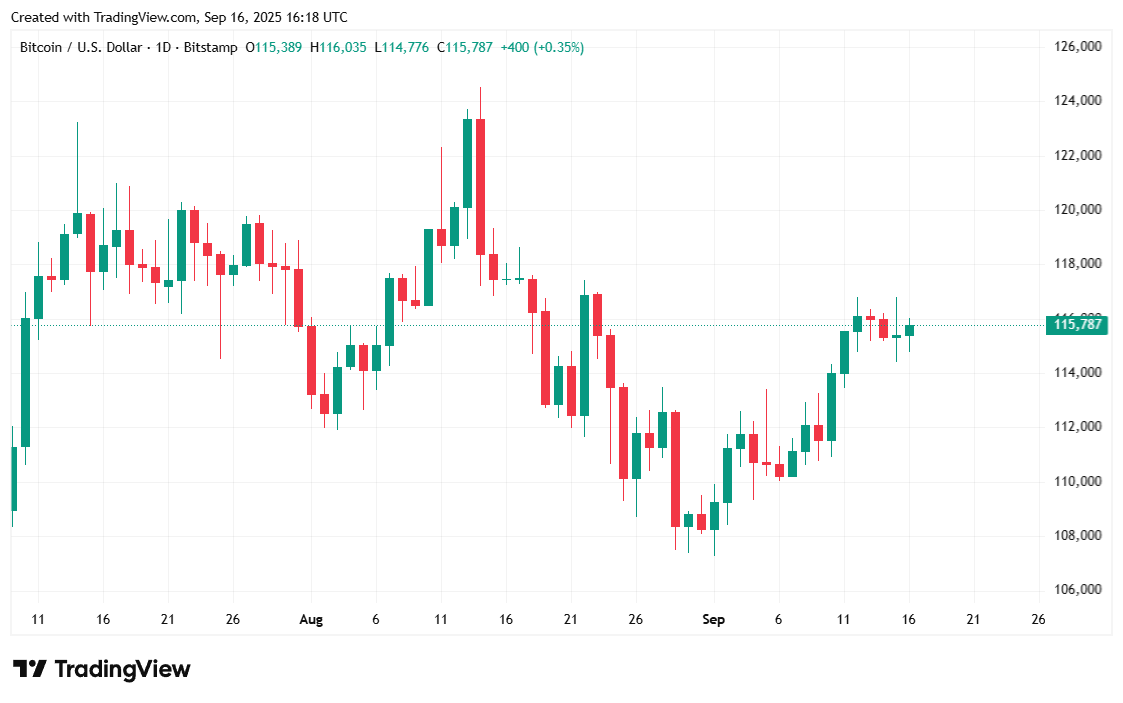

Bitcoin was trading at $115,921.47 at the time of writing, up by 0.89% over 24 hours according to Coinmarketcap. The cryptocurrency’s price has fluctuated between $114,662.18 and $116,063.26 since Monday. It’s like a rollercoaster that only goes up 0.89% and then whispers, “Don’t worry, we’re still a good investment.”

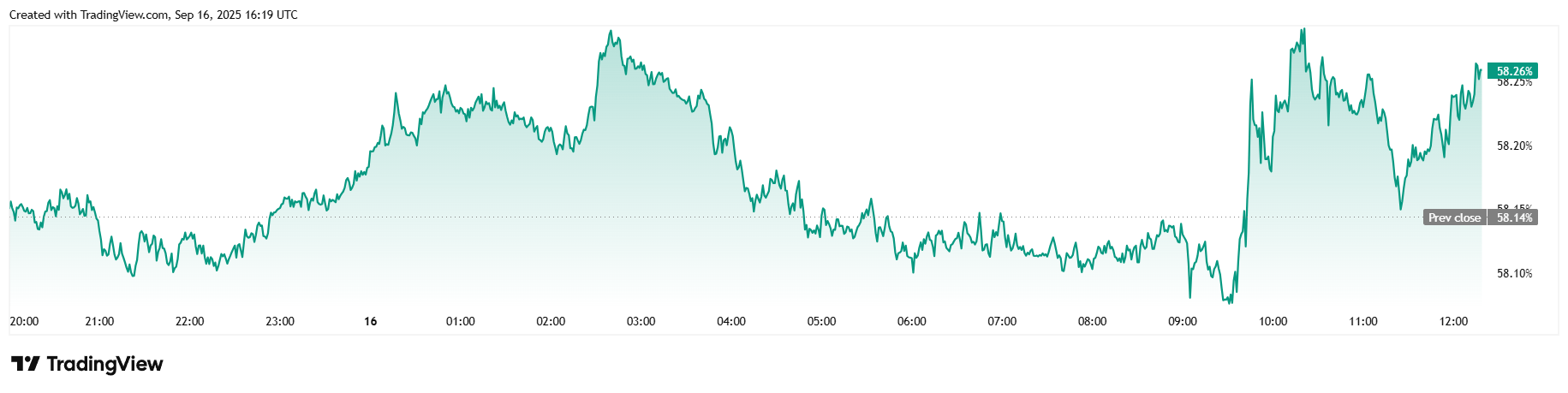

Twenty-four-hour trading volume fell 15.48% to $41.71 billion but market capitalization rose 0.94% to $2.3 trillion, in line with the increase in price. Bitcoin dominance also increased slightly, rising 0.22% since yesterday to reach 58.25%. It’s like being the most popular kid in school, but only just barely.

Total bitcoin futures open interest was down slightly by 0.93% at $82.38 billion according to Coinglass. Bitcoin liquidations totaled $15.70 million, with shorts dominating that figure at $9.05 million in liquidations. The remaining $6.64 million in longs completed the overall liquidations picture. It’s like a poker game where everyone’s bluffing, but the pot is just a bowl of alphabet soup.

Read More

- BTC PREDICTION. BTC cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- ETH PREDICTION. ETH cryptocurrency

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

2025-09-16 20:58