The cryptocurrency market, like a weary worker, holds its breath as the U.S. Federal Reserve prepares to drop its latest decree. 🧠💸 Bitcoin, that ever-elusive dream, hovers between $114,600 and $117,100, a tightrope walk of hope and despair. 🎭 Analysts view this setup as constructive, with market sentiment at 68.8%, a level close to peak bullishness. Ah, 68.8% bullishness! A level so close to “peak” it’s practically a high-five with the moon. 🌕

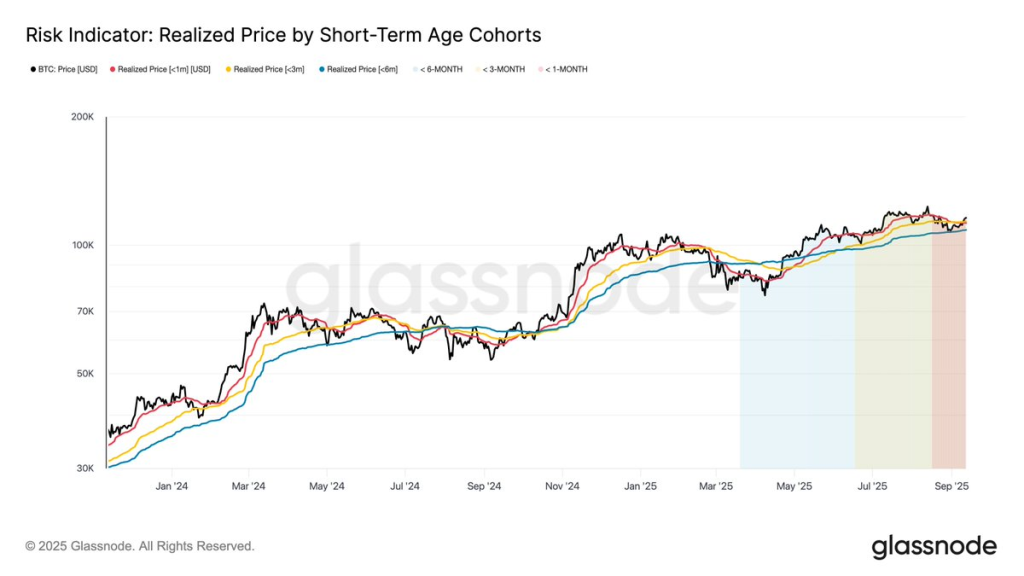

According to Glassnode, Bitcoin is respecting its short-term holder cost basis bands. Staying above the 1-month and 3-month realized price levels is seen as a sign of optimism heading into the Fed’s announcement. Glassnode whispers that Bitcoin, the stubborn mule, is respecting its cost basis bands. Staying above those levels? A sign of optimism, they say. But in a world where optimism is as rare as a free lunch, it’s a miracle. 🐴

Gold Price Today: Record Highs Before the Fed

Gold is also in focus as it trades just under $3,700 per ounce, holding firm near record highs. However, gold mining stocks dipped as investors booked profits ahead of the Fed decision. Gold, that old reliable, hovers just below $3,700, a king on his throne. But gold mining stocks? They’re playing hide and seek, ducking as investors cash in their chips. 🏆

Commenting on this divergence, economist Peter Schiff noted: “Gold remains strong even as miners take a breather. I expect buyers to come rushing back once the FOMC outcome is known.”

Schiff, the prophet of the market, declares: “Gold remains strong, miners take a nap. Buyers will return once the FOMC speaks.” A prophecy as clear as a foggy morning. 🌫️

The connection between gold and Bitcoin lies in liquidity. A Fed rate cut not only strengthens gold as a hedge but also channels speculative flows into Bitcoin and other risk assets. The bond between gold and Bitcoin? Liquidity, that fickle lover. A Fed cut strengthens gold, but also lures speculators into Bitcoin’s arms. A dance of chaos and hope. 💃🕺

What Markets Expect from Powell’s Speech Today

Traders overwhelmingly expect a 25 basis point cut, with market odds above 90%. Such a move would keep the bullish structure intact for both crypto and gold. Still, analysts warn that front-running and leverage could spark short-term volatility. Traders, like a crowd at a circus, expect a 25 bps cut with 90% certainty. But beware, the market is a wild beast. Front-running and leverage? A recipe for disaster, served with a side of chaos. 🐯

Crypto strategist Biupa explained: “A 25 bps cut may continue the uptrend, but we could still see a pullback driven by profit-taking and liquidations, not by deteriorating fundamentals.”

Biupa, the voice of reason, says: “A 25 bps cut may keep the trend, but profit-taking and liquidations could bring a pullback. Not because fundamentals are bad, but because people are greedy.” A truth as bitter as burnt coffee. ☕

For Bitcoin, the key level to watch is $117,900. A breakout could open the path toward new highs, while rejection might trigger a temporary dip toward the $113,300-$110,000 zone. Bitcoin’s key level? $117,900. A breakout, and it’s a party in the sky. Rejection? A fall into the abyss of $113,300-$110,000. The market is a fickle lover. 🎭

FED Interest Rate Expectations

While unlikely, a 50 basis point cut could shock markets. In that case, Bitcoin might briefly spike to $120,000 as retail traders rush in before a possible “sell-the-news” reversal if recession fears take hold. A 50 bps cut? Unlikely, but if it happens, Bitcoin will spike to $120k like a drunken sailor. Then, the “sell-the-news” reversal will hit harder than a Russian winter. ❄️

On the other hand, if the Fed were to skip a cut, analysts expect a sharp drop in both crypto and gold, followed by the potential for an emergency larger cut later, which could set the stage for a V-shaped recovery. If the Fed skips the cut, expect a sharp drop. Then, an emergency cut later, leading to a V-shaped recovery. Because nothing says “recovery” like a market that’s been through a tornado. 🌪️

The setup closely mirrors September 2024, when the Fed cut rates and Bitcoin initially dipped before doubling to over $100,000 by year-end. With Powell set to speak, traders are bracing for volatility. The setup? A mirror to September 2024. The Fed cuts, Bitcoin dips, then doubles. Now, with Powell’s speech, traders brace for the storm. A repeat of history, or a new tragedy? 🧠

Whether it’s the expected 25 bps cut or a surprise move, the outcome of today’s FOMC meeting could set the tone for the next major trend in Bitcoin, gold, and the broader crypto market. So, whether it’s the 25 bps cut or a surprise, the FOMC’s decision could set the tone for the next big trend. A gamble with the market’s soul. 🎰

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

What time is the FOMC announcement?

The FOMC announcement is scheduled for 2:00 PM Eastern Time (ET). This is followed by a press conference with Fed Chair Powell at 2:30 PM ET.

How will the Fed rate decision affect Bitcoin?

A 25 bps rate cut is expected to maintain Bitcoin’s bullish trend, though short-term volatility from profit-taking is likely. Key resistance is at $117,900 for a breakout.

Why is gold rising alongside Bitcoin?

Both act as liquidity-sensitive assets. Fed rate cuts weaken the dollar, boosting gold as a safe haven and Bitcoin as a speculative risk-on asset.

What happens if the Fed doesn’t cut rates?

A surprise hold could trigger short-term drops in Bitcoin and gold, but may lead to larger emergency cuts later, potentially fueling a rapid V-shaped recovery.

Is now a good time to buy Bitcoin before the Fed?

While momentum is bullish, high leverage and “sell-the-news” risk mean cautious entry near support levels ($113,300-$110,000) may be prudent post-announcement.

Read More

- BTC PREDICTION. BTC cryptocurrency

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

2025-09-17 10:12