Oh, sure, because nothing says “reliable investment” like a bunch of people typing on keyboards and hoping the SEC doesn’t throw a tantrum. 🙄 Analysts are now predicting billions in inflows, as if money grows on trees (or in crypto wallets). XRP could hit new highs? Please, I’ve seen more consistency in a goldfish’s attention span. 🐠

But hey, if you’re into “institutional interest,” go ahead and buy that narrative. 2025 is shaping up to be the year Ripple finally breaks out-or maybe just breaks your portfolio. 🤷♂️

XRP ETF Approval Seen as “Inevitable”

Garlinghouse told Bloomberg the SEC will approve an XRP ETF by year-end. Because, obviously, the SEC is just dying to hand over trillions to crypto enthusiasts. 🤡 Bitwise, Franklin Templeton, and Canary have all filed, like crypto’s version of a waiting list for a McDonald’s drive-thru. 🚗

Garlinghouse said the ETF is “inevitable,” which is code for “I’m not responsible if it crashes and burns.” 🚨 And now XRP might be in U.S. government reserves? Because nothing says “stability” like the government holding your speculative asset. 🏛️

Polymarket odds are up to 96%-because math and hope are the same thing. 🤓 Seyffart and Balchunas say 95%? Sounds like they’re just rounding up to avoid awkward questions. 🎯

Analysts Expect Up to $8 Billion in Inflows

CryptoQuant says 1-4% of XRP’s supply could vanish into ETFs in a year. That’s either a miracle or a liquidity black hole. 🕳️ At current prices, that’s $1.8B to $7.2B-because nothing says “conservative estimate” like a range that spans six figures. 🤯

Kris Marszalek predicts $4B-$8B in inflows, pushing XRP to $4-$8 by year-end. Because Ethereum took a year to get there, and who wants to be outdone by a “blue-chip” token? 🐘

CME XRP futures hit $1B in open interest? Congrats, you’ve now got a futures market bigger than my hopes for 2025. 🎉 Leveraged ETFs are booming-because nothing says “smart money” like a 10x leveraged bet on a volatile asset. 🔥

Institutional Adoption of XRP on the Rise

XRPL is getting all cozy with tokenization and stablecoins. RLUSD now has $729M in assets-because nothing says “trust” like a stablecoin that’s not actually stable. 🤪 Tokenized real-world assets surged $300M in a month? That’s either growth or a typo. 🤔

VivoPower is buying $100M in XRP for treasuries. Because nothing says “corporate responsibility” like parking cash in a crypto token. 🤝 Webus, Trident, and SBI Holdings are in too-because diversification is just code for “we’re all gambling together.” 🎲

Hidden Road processes $10B daily via XRPL. Because nothing says “liquidity” like a number that makes your head spin. 🌀

XRP Price Outlook and Technical Levels

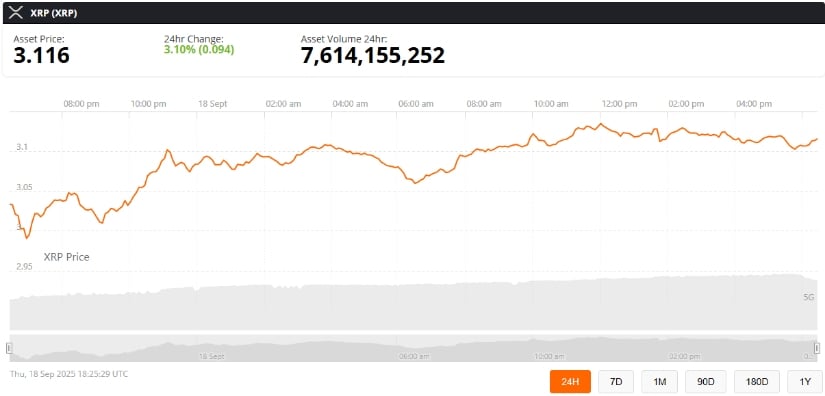

XRP is at $3.02, consolidating above its 200-day EMA. Technical indicators? More like technical excuses. 📊 A descending wedge and bullish pennant? Sounds like a bird that’s afraid to fly. 🐦

First target: $3.67-a 21% gain. Then $5, the “psychological milestone” everyone’s been waiting for. But if it drops below $2.57? Well, that’s just the universe reminding you to diversify. 🚨

Outlook: Q4 Could Be a Defining Moment for Ripple XRP

ETF optimism is at record highs? Because nothing says “caution” like a sector built on hype. Corporate treasuries are buying XRP, and XRPL is expanding into stablecoins. If the ETF hits by year-end, it’ll either be the next Bitcoin or the next “remember when we all lost money?” 🤦♂️

Will it all go to plan? Maybe. Or maybe it’ll be the crypto equivalent of a bridge to nowhere. But hey, at least the memes will be good. 🤡

Read More

- BTC PREDICTION. BTC cryptocurrency

- ETH PREDICTION. ETH cryptocurrency

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

2025-09-19 00:34