Singapore and the United Arab Emirates have ascended to the throne of crypto supremacy, their digital crowns gleaming with the sheen of regulatory alchemy 🦜💸. A study, presumably written by a team of overworked monkeys, declares them the undisputed kings of the blockchain jungle.

Henley & Partners, that paragon of financial wisdom, and industry trackers, who likely count their own wallets, have crowned Singapore as the #1 crypto kingdom. Meanwhile, the UAE, with its zero-tax sorcery, boasts ownership rates that would make a medieval alchemist weep with envy 🧙♂️.

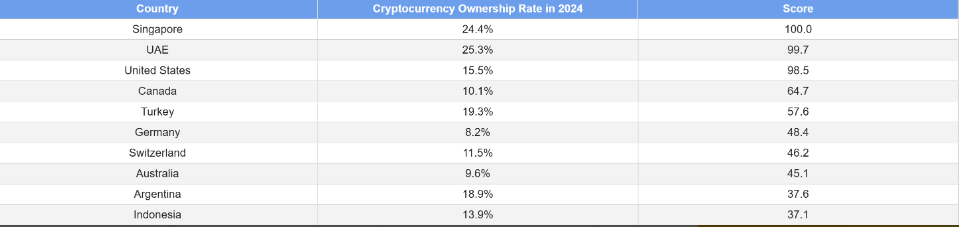

24.4% of Singapore’s population owns crypto-nearly double the previous year’s figure. The UAE, ever the showman, clocks in at 25.3%, a number that would make even a magician’s rabbit blush. The global average? A mere 12.7%, which is roughly the amount of wisdom in a toddler’s bedtime story 🧠👶.

Singapore’s Policy: A Dance of Regulatory Ballet

Singapore’s success is a masterclass in “let’s regulate this thing but also let it run wild.” Regulatory sandboxes, licensing for exchanges, and a banking system that’s “open to digital currency firms” (read: “we’ll pretend we understand this”) are the secret sauce. It’s like a masquerade ball where everyone’s wearing a mask and no one knows the rules 🎭.

The ApeX Protocol study reveals that 24.4% of Singaporeans own digital assets-up from 11% last year. A surge so dramatic, it’s as if the entire population discovered a portal to a parallel universe where crypto is the only currency 🕰️.

And let’s not forget the 2,000 crypto searches per 100,000 people. Singapore’s internet is more active than a squirrel on a caffeine binge 🐿️⚡. The country is basically a crypto version of a 24/7 casino, but with fewer slot machines and more memes.

UAE’s Tax Edge: A Zero-Tax Utopia?

The UAE, ever the shrewd investor, has crafted a tax-free utopia. Their zero-tax stance on trading, staking, mining, or selling Bitcoin? It’s like a magician revealing their trick-everyone’s stunned, but no one’s stopping to ask how it’s done 🕵️♂️.

Dubai’s Virtual Assets Regulatory Authority (VARA) has created licensing paths so convoluted, they’d make a labyrinth look like a straight line. Special zones for digital asset firms? More like a playground for the wealthy, where rules are optional and profits are mandatory 🏗️💰.

Henley & Partners, that beacon of impartiality, lists the UAE among the top crypto jurisdictions. Their policies? A masterstroke of “let’s make this as easy as possible for the rich.” It’s no wonder 25.3% of the population owns crypto-because who wouldn’t want to join the party if the taxman isn’t knocking? 🎉

Ownership Numbers And What They Mean

The global crypto user base? A maze of methodologies and half-truths. Some studies count any wallet with activity, others ask people if they own crypto. It’s like trying to count the number of stars in the sky with a blindfold and a spoon 🌌🥄. The numbers are as reliable as a fortune cookie’s prediction.

In some countries, crypto is an investment; in others, it’s a payment method or savings tool. The methods vary so wildly, it’s like comparing apples to quantum physics 🍎⚛️. The conclusion? The crypto world is a madcap dance, and everyone’s trying to keep up-while wearing clown shoes.

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- ETH PREDICTION. ETH cryptocurrency

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

2025-09-30 08:14