Bitcoin has finally managed to escape the clutches of its “stuck between a rock and a hard place” phase, aka the MAs (moving averages) and resistance zone. It’s now galloping into the wild unknown, where liquidity sweeps and structural shifts are giving off serious bullish vibes. But don’t get too comfy-there could still be a few speed bumps along the way!

Short-term pullbacks are like that unexpected pothole you hit when you’re least expecting it. But, with the market structure now tipping toward the green side, Bitcoin seems destined to head for the $120K-$124K range. But beware, that’s where the next big ‘supply block’ is lurking like a bouncer at an exclusive club, ready to throw Bitcoin out if it gets too cocky.

Technical Analysis

By Shayan, who is absolutely certain this is all going according to plan.

The Daily Chart

Looking at the daily chart, Bitcoin has reclaimed its 100-day MA ($114K) like an overzealous puppy returning to its favorite chew toy. It surged through the middle of its consolidation range, poking its nose into the $118K zone, just under the ominous $120K-$124K supply block. This area? Oh, it’s where all the big-time orders live-so, basically, it’s the VIP section.

While there was a brief tantrum around $118K (classic Bitcoin), the medium-term outlook is still full of sunshine and rainbows. As long as Bitcoin can hold its ground above the $112K-$114K support zone-now transformed into the cozy new home for support-its path to the $120K-$124K range looks like a walk in the park.

The 4-Hour Chart

Now, let’s talk about the 4-hour chart, which paints the most glorious breakout picture. After consolidating above $114K, Bitcoin decided to break free from its downward resistance like a teenager escaping a boring family dinner. It then shot past $116K, diving straight into the $118K liquidity pool like a kid in a candy store.

If a pullback decides to join the party (because it just can’t stay away), the $114K-$115K zone is the key decision-making spot. Hold steady here, and Bitcoin could rocket into that $120K-$124K supply block. Fail to do so, and, well, the price might slip back toward $110K, but honestly, that’s less likely at the moment-momentum’s got the wheel now.

On-chain Analysis

By Shayan, because no one does liquidity like Shayan.

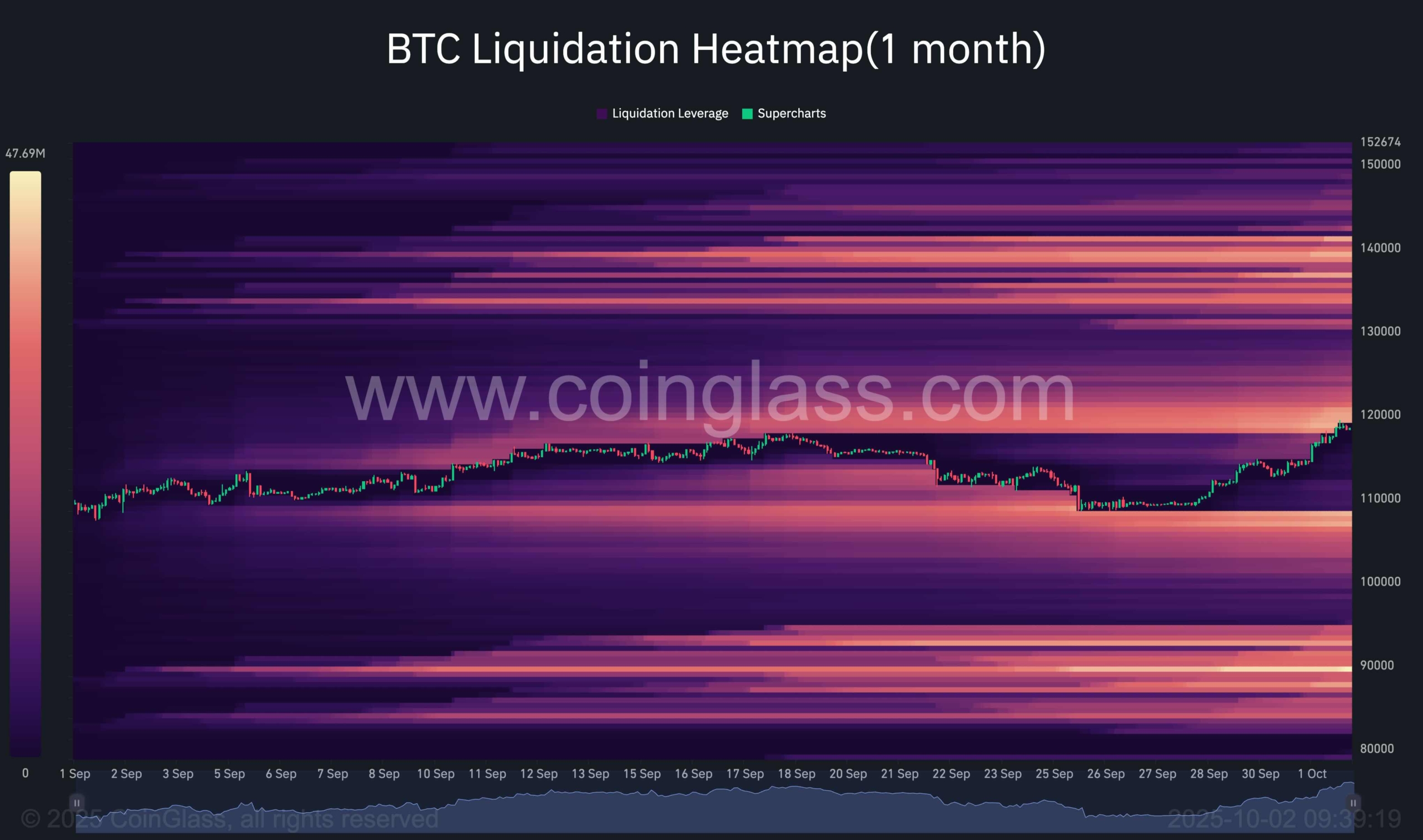

The liquidation heatmap adds some nice icing to the cake by showing just where all the action is happening. As Bitcoin rocketed from the $109K demand base to its current glory, many short positions got the boot, providing the necessary fuel for its upward blast.

And guess where all the liquidity is now? Right above $118K-$120K. This is the exact spot where the price is facing some serious resistance. It’s like a massive build-up of short positions at that level, and if Bitcoin stays above $118K, it could just sweep them all away like dust under the rug. When that happens, a surge to the $120K-$124K zone is totally on the cards-cue the fireworks!

But wait-there’s more! The heatmap also shows giant liquidity clusters just above $124K, stretching all the way to $130K-$135K. These levels are like magnets for Bitcoin, and if it can break past $120K, expect a wild rush toward those higher ranges.

On the downside? Well, there’s less liquidity to fall into compared to what’s lurking above. In short, the path of least resistance is still tilted upwards, as long as the $114K-$115K support holds. The recent rally has already flushed out a bunch of sellers, clearing the way for the market to keep its momentum going.

In conclusion, the heatmap and structural analysis both agree: Bitcoin’s in full-on bullish mode. With shorts squeezed out and liquidity stacked higher, $120K-$124K is the next big battleground. Once that’s cleared, we might just see Bitcoin heading for a rendezvous with the $130K mark.

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- Crypto Carnage: Fed’s “Hawkish Cut” Leaves Bitcoin in Tatters 🎢💸

2025-10-02 10:49