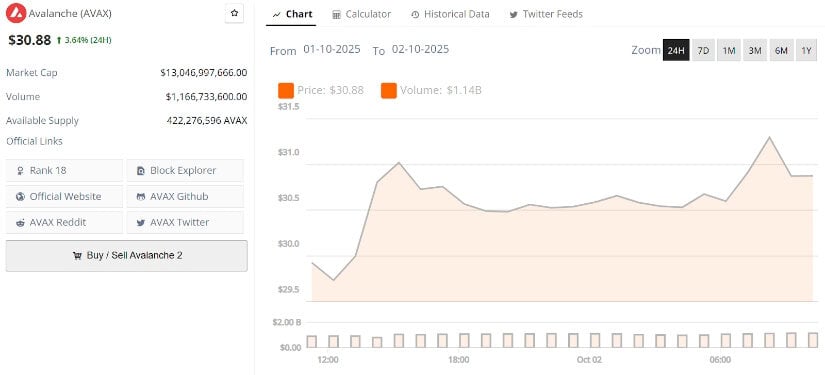

Well, well, would you look at that! AVAX price is prancing about like Bertie at a country dance after reclaiming the $30 mark, with the bulls showing more gumption than a prizefighter in a cucumber farm. This rebound isn’t your run-of-the-mill jitterbug – it’s got volume backing it like Jeeves backs Bertie’s harebrained schemes, and the structure’s improving faster than a Drones Club member’s excuses for losing money. The chaps holding the reins now have every reason to lean bullish, taut and confident. 🎩🐂

AVAX Crypto Bulls: Now With Extra Aggression and Possibly a Spot of Bluster

The price shenanigans of AVAX have turned from “Oh dear” to “By Jove!” upon recapturing the $30 landmark. Short-term charts reflect buyers defending higher lows with the tenacity of a terrier with a bone. The breakout from that pesky descending trendline-Quine’s chart highlighting the whole rigmarole-suggests bulls are hacking back territory like an intrepid explorer in a hedge maze. The volume, that faithful sidekick, has been supportive enough to suggest this is no mere bull trap (and thank heavens for that, lest we all buy the farm).

There’s an ascending support line underneath providing a base as solid as Aunt Agatha’s scowl, keeping momentum intact so long as the $29 to $30 area isn’t treated like yesterday’s crumpets. If this jolly structure holds and grows, we might just see a stiff march towards $33 to $35-where sellers have been known to lurk, like those long-lost relations at a family reunion. Holding that momentum would signal AVAX has entered a new short-term expansion phase, and that, old bean, is better than a poke in the eye with a sharp stick.

Technical Setup: Fancy Fibonacci Figures and Bullish Scribbles

On the more leisurely timeframes (where one can sit back with a cucumber sandwich and a spot of Earl Grey), AVAX’s price structure is neatly aligning with Fibonacci extension targets that the Value Trader’s chart obligingly points out. Picture a rising trendline lounging against key moving averages like a cat on a sunny windowsill, bolstering the bullish case. The 1.618 Fibonacci extension perches near $35 like a cheeky sparrow, with even loftier projections eyeing $40 and $47 as milestones to conquer.

This veritable conclave of technical signals indicates AVAX is poised for a progressive upside, provided current support zones don’t get cold feet. A clearance of $32 on robust volume would be the first nod of approval, possibly triggering a rally to those Fib targets. It’s as if the momentum has decided to throw its lot in with the buyers, and the AVAX Price Prediction is shaping up more bullish than a bulldog at a sausage festival. 🐂📈

On-Chain Milestones: Big Numbers with a Dash of Gravitas

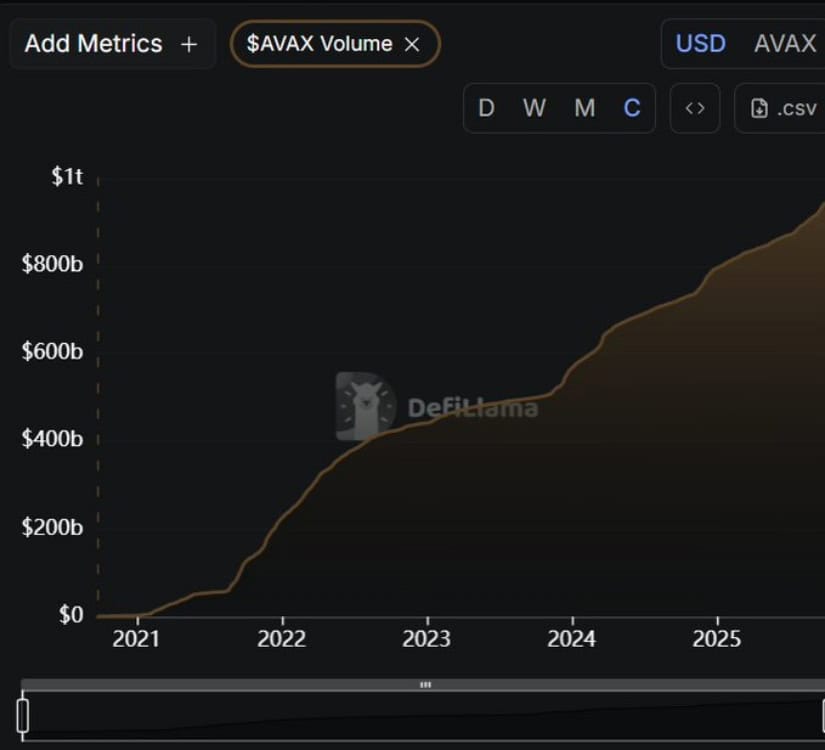

Turning to the on-chain theatrics, AVAX has legged it past a smashing milestone: cumulative trading volume has swelled to a staggering $946 billion. Marc Shawn Brown gives this impressive number a nod, likening it to the ongoing expansion of AVAX’s role in decentralized finance and trading ecosystems. Sustained volume growth is the liquidity equivalent of a stiff brandy after a long day-it provides stability and keeps the party going.

This milestone isn’t just a figment of the imagination-it shows Avalanche isn’t content to rest on its laurels. The network’s technical sturdiness is matched by solid fundamental credentials, allowing rallies to sprout from genuine economic activity rather than the usual speculative shenanigans. Such metrics are often the harbingers of a prolonged bull cycle, which is jolly good news if you’ve been waiting on tenterhooks.

Key Levels to Mind: The Market’s Game of “You Shall Not Pass” and “Full Steam Ahead”

Market sage CW8900 has thrown together a bouquet of key checkpoints to keep an eye on for AVAX’s next leg up. The first hurdle sits around the $32.7 mark-which, if vaults are cleared here, paves the way for a sprint to $40 and then $47, neat as a pin and as impressive as a butler doing the Highland Fling. Stretching even further, there’s talk of a $70 test if momentum gathers enough steam.

Downside-wise, holding firm at $28.5 remains *de rigueur* for maintaining that bullish structure. Should it falter, AVAX risks sliding back into consolidation quicker than one can say “Dash it all!” For now, though, the scales tip cheerfully towards the bulls, bolstered by both on-chain growth and technical flair blazing the trail to loftier price ambitions.

Final Musings: AVAX’s Dance with Destiny

AVAX is currently juggling a robust technical rebound with equally impressive on-chain achievements as if it were a seasoned circus act. The bulls have reclaimed the short-term charts with aplomb, while higher timeframes point like a kindly but firm maitre d’ towards $40 to $47 extensions. The near-trillion-dollar cumulative volume adds the kind of gravitas one doesn’t find in everyday bake sales, suggesting this network’s momentum is more steady waltz than fleeting jitterbug.

If support holds and resistance levels get toppled like a stacked row of bowler hats, AVAX might well establish itself as a prime pick heading into Q4. With technical clarity, burgeoning volume, and a bullish crowd rallying like it’s the last dance at the Drones Club, AVAX presents a most tempting case for a continued upward shimmy. 🎩📊🚀

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

2025-10-02 12:40