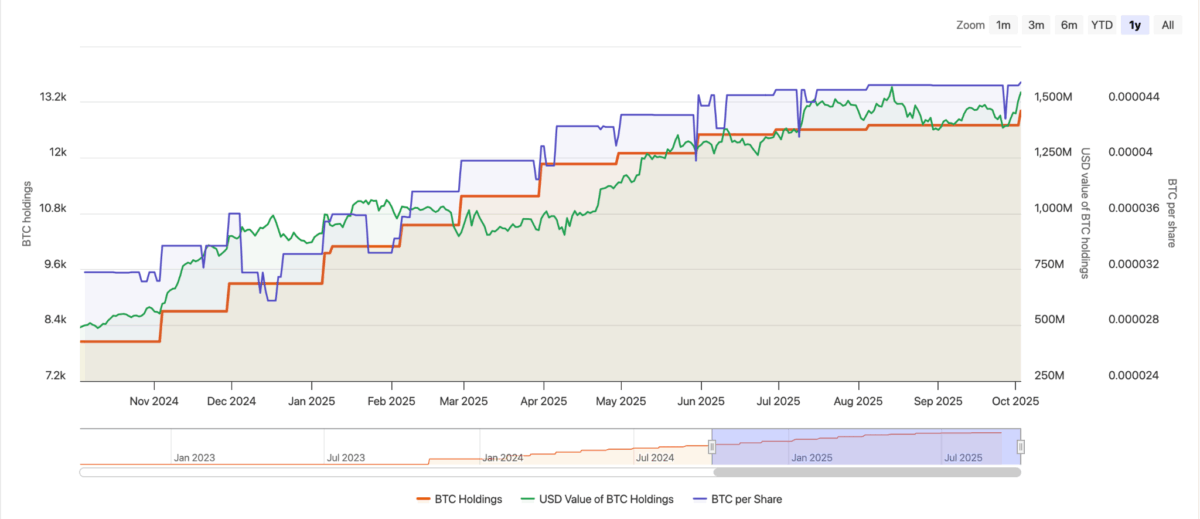

So, CleanSpark (ticker: CLSK, because what else would it be?) has just upped its stash of Bitcoin to a whopping 13,011 BTC. That’s right-after their September “production update” (fancy speak for “we made some more digital gold”), they proudly announced this on a Friday, the perfect day to flex. Last month alone, they conjured 629 BTC, which, thanks to some sneaky wizardry, is 27% more than a year ago. Their mining machines also got about 26% more efficient. Because apparently, Bitcoin miners aren’t just bashing keyboards; they’ve got their act together.

September wasn’t just any month-it was the grand finale of a fiscal year that would make even the most cynical spreadsheet nerd swoon. CleanSpark hit a massive 50 exahashes per second (EH/s)-which, if you don’t know, sounds like the name of a sci-fi weapon but is actually something very, very fast. They also gobbled up GRIID Infrastructure (because who doesn’t want to own things?), boosted their Bitcoin-backed credit line by $200 million, and started dabbling in derivatives to hedge volatility. In layman’s terms: they’re playing Wall Street with digital pennies and feeling pretty smug about it.

– CleanSpark Inc. (@CleanSpark_Inc) October 3, 2025

Daily output? Nearly 21 BTC. Peak production? 21.7 BTC. That’s a lot of electronic digging. So far this year, they’ve pulled out 5,925 BTC from the digital mine-and yes, they sold some too: 445 BTC raked in $48.7 million (at an average price of $109,568 per BTC). Sounds like they’re running a Bitcoin lemonade stand, only with slightly more electricity and data centers.

Speaking of data centers, CleanSpark is juggling 241,934 machines scattered across the U.S., humming along at an eye-watering efficiency of 16.07 joules per terahash (try saying that five times fast). They’ve got 1.03 gigawatts of power lined up and are currently using 808 megawatts-enough juice to keep a small city entertained, or power a modest number of refrigerators filled with unused crypto enthusiasm. CEO Matt Schultz says they’re entering “a new chapter,” which probably means bigger things, or at least better coffee in the boardroom.

The Treasury Tango: How to Mine Bitcoin Without Losing Your Shirt

This announcement piggybacks on CleanSpark’s August earnings news, where Q3 revenue soared to a record-breaking $198.6 million-nearly double from last year-which presumably impressed the analysts who usually just squint at numbers and mumble. Net income hit $257.4 million, proving that you can actually make money mining Bitcoin, even when everyone else is digging in the dirt too.

CFO Gary Vecchiarelli made sure to clarify that their operating expenses were fully covered by Bitcoin production. In other words, they don’t have to dip into their couch cushions to pay the power bills. Meanwhile, the treasury hit a new high above 13,000 BTC, placing them 9th on the list of the world’s biggest Bitcoin holders. Take a moment to imagine the kind of poker games they could fund with that kind of bankroll.

All this production and financial juggling underlines a subtle but important shift in crypto mining: it’s no longer just about digging for digital gold like a caffeinated prospector. No, these days it’s about running a tight financial ship, leveraging Bitcoin-backed credit, derivatives, and treasury strategies to look more like seasoned capital managers than basement nerds with fancy rigs.

With competitors like Riot and IREN also hopping on the treasury management bandwagon, the real question is not “who has the fastest machines?” but “who can manage their Bitcoin pile best when the halving hits and the stakes get higher?” Stay tuned, crypto fans-things are just getting interesting. 🚀💰

Read More

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

2025-10-03 21:36