The cryptocurrency has experienced a remarkable rise ever since the United States Federal government decided to take a nap at midnight on Wednesday due to a rather childish squabble between the two major political parties.

Federal Impasse Pushes Bitcoin Toward Record High

Day three of the government shutdown, and it seems the markets didn’t get the memo. While stocks are mostly doing well, the tech sector, however, seems to have forgotten its way-Palantir Technologies (Nasdaq: PLTR) dropped a cool 7% on Friday. Meanwhile, the broader crypto market has ballooned to nearly $4.2 trillion, a 1.48% jump from yesterday, and Bitcoin (BTC) is practically sniffing its all-time high from behind the curtain. Only $2,000 to go, give or take a hundred or so. 💰

The U.S. government ran out of play money at midnight on Wednesday, yet again, forcing the fifteenth shutdown since 1980. A few weak attempts by Senate Republicans and Democrats to avoid the mess with temporary funding bills, but of course, none passed, leaving millions of federal employees twiddling their thumbs. The last shutdown in 2018, courtesy of the Trump administration, was the longest ever-lasting 35 days and costing an estimated $3 billion (not that anyone’s counting).

But let’s not forget, shortly after the government threw in the towel, ADP, a human resources firm, provided a not-so-flattering report about the previous Federal interest rate policies. Turns out, the private sector lost 32,000 jobs-an eyebrow-raising figure, considering economists were expecting a gain of 45,000. But here’s the twist: that didn’t scare the investors away! Quite the opposite. In fact, they’re now more enthusiastic about the prospect of further rate cuts later this year. And so, Bitcoin continues to gallop toward that all-time high. 🚀

“BTC will print a fresh all-time-high next week and probably hit my forecast for Q3 of USD 135,000 shortly thereafter,” said Geoffrey Kendrick, head of digital assets research at Standard Chartered Bank. “The shutdown matters this time. Back in 2018, Bitcoin was in a different place, and we didn’t see the same kind of reaction.” Well, thanks for the advice, Geoffrey. That’s some next-level analysis right there. 🙄

Overview of Market Metrics

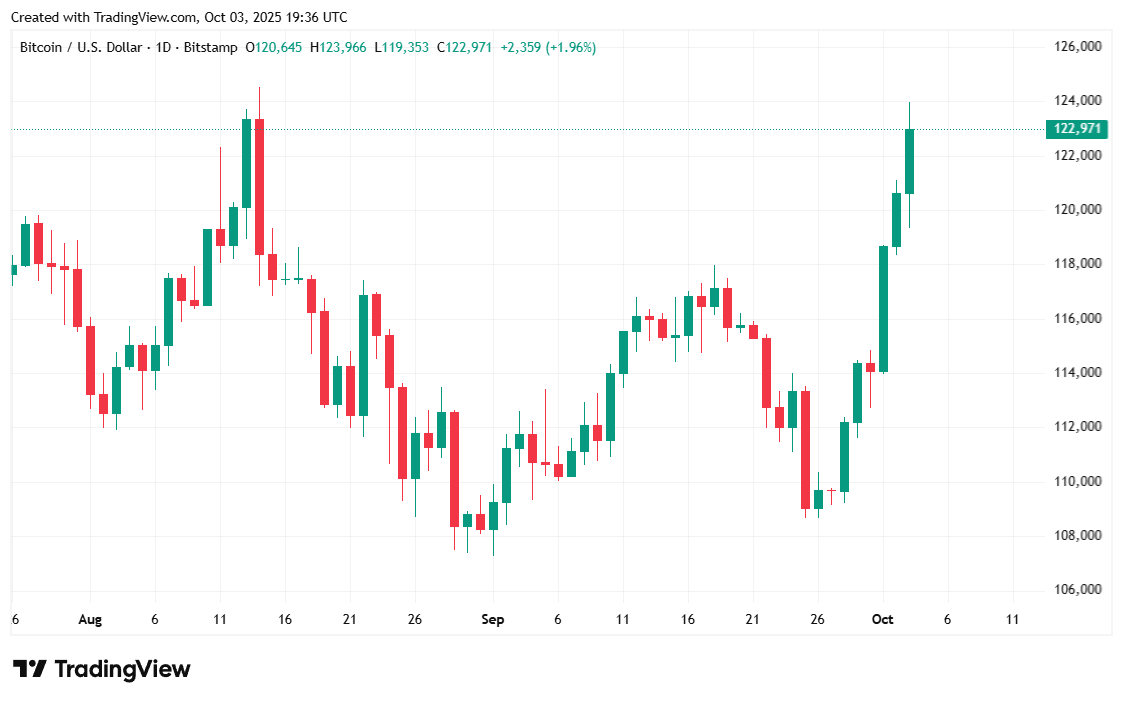

Bitcoin was priced at $122,958.26 at the time of reporting, up 1.62% over 24 hours and also up 12.55% over seven days, according to Coinmarketcap’s data. The digital asset has been dancing between $119,344.31 and $123,944.70 since yesterday. 😎

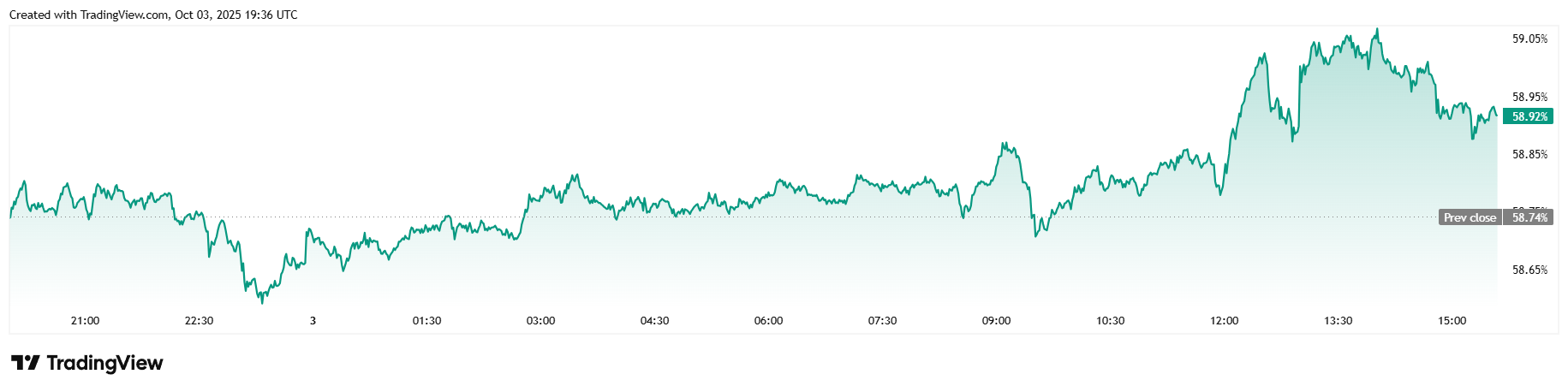

The 24-hour trading volume jumped 19.25% to $87.09 billion, and market capitalization rose 1.44% to $2.44 trillion. Bitcoin dominance rose 0.31% to 58.91%, as it outperformed much of the altcoin market.

Total Bitcoin futures open interest was up 1.03% over 24 hours at $89.63 billion, and Bitcoin liquidations jumped to $211.58 million since yesterday. Most of that came from short liquidations, which tipped the scales at $153.36 million, with the rest coming from longs. 🍿

Read More

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

2025-10-03 23:43