Bitcoin just did what Bitcoin does best: it soared past $125,000, broke a few records, and then casually took a little dip back down to $123,000. Oh, and gold? It’s just winking at $4,000 an ounce, while the S&P 500 is on a mad tear – up 40% in just six months. What ties all this chaos together? A US dollar that’s having the financial equivalent of a midlife crisis. It’s been a rough year for the greenback – 10% down already, and a 40% decline in purchasing power since the year 2000. No wonder everyone’s jumping on the Bitcoin bandwagon.

Analysts at The Kobeissi Letter are busy pointing out the bizarre tango between gold and the S&P 500 – a record 0.91 correlation coefficient in 2024. In other words, safe-haven gold and risky stocks are suddenly in sync. What’s that mean? Markets have zero faith that the Fed can keep the dollar afloat while also saving the economy. So what are investors doing? They’re diversifying like never before – into, well, *everything else.*

The Perfect Storm: Inflation, Cuts, and Dysfunction

Here’s the plot: The US government is on its extended vacation (shutdown, anyone?), job numbers are looking grim, and the Federal Reserve is busy cutting interest rates – just as inflation sneaks up from behind. Investors? They’re not buying the “soft landing” talk anymore. They’re hedging against the whole system looking like a faulty vending machine.

“Political dysfunction has renewed investor interest in BTC as a store-of-value monetary technology,” says Fabian Dori, CIO at Sygnum Bank. With Washington essentially closed for repairs, Bitcoin doesn’t just look like a speculative play anymore. It’s starting to resemble an insurance policy. (And who wouldn’t want that?)

Meanwhile, ETF flows are doing the market cha-cha. US-listed Bitcoin ETFs just bagged $3.24 billion in inflows – their second-best week ever – nearly catching up to November 2024’s record. This is quite the plot twist from the $902 million outflows just a week ago. Nexo analyst Iliya Kalchev thinks we could see over 100,000 BTC pulled off the market by the end of Q4. That’s double the new issuance rate. Time to hold on tight.

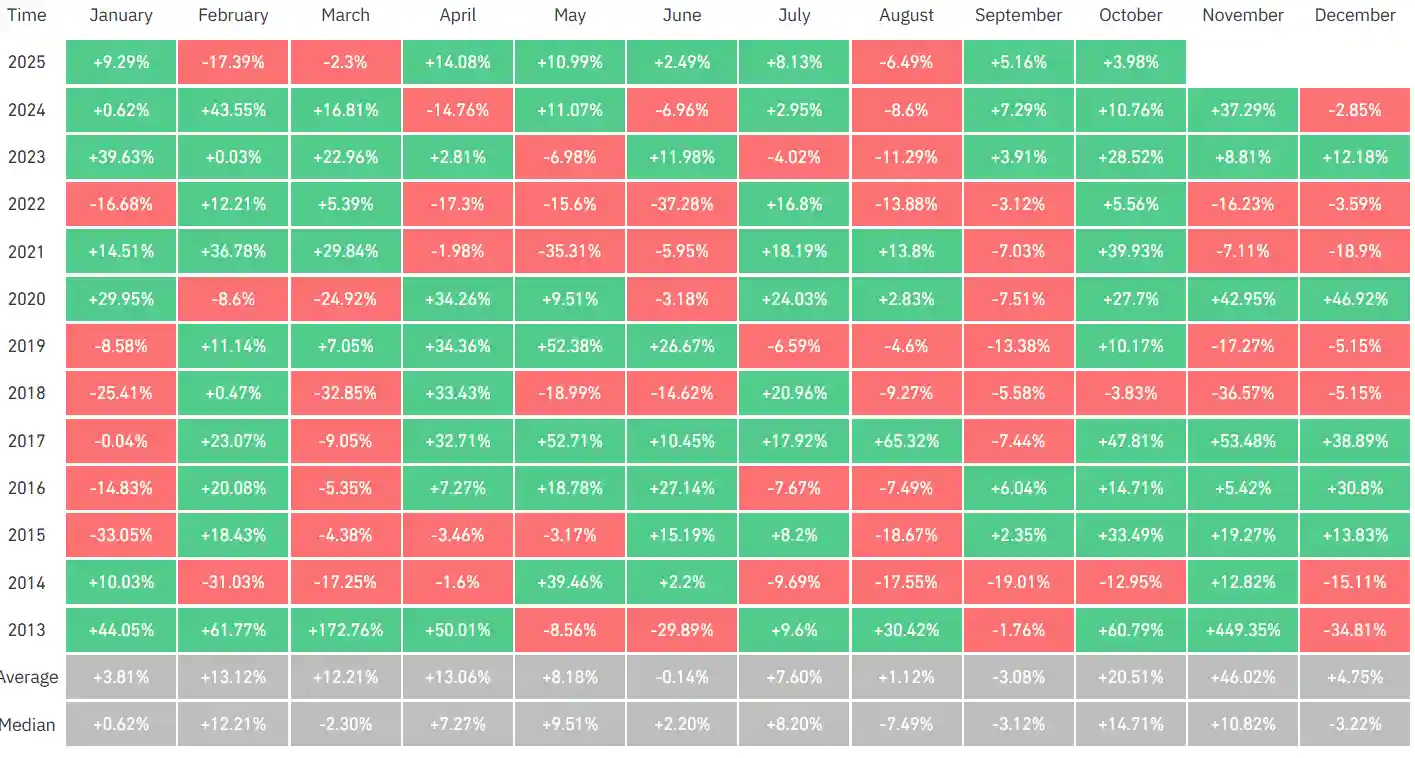

Uptober Is Doing Its Thing

It’s October, and if you’ve been in the Bitcoin game long enough, you’ll know that means “Uptober.” Historically, it’s Bitcoin’s second-best month. Why? A mix of favorable macro conditions, seasonal vibes, and ETF-driven hype. On Friday, BTC briefly hit $123,996 – its highest point since mid-August – before dipping (because of course it did).

Still, not everyone’s uncorking champagne bottles just yet. Some traders are calling this a trap for the longs, expecting a pullback to about $118,000 before the next big move. Remember, at this level, Bitcoin’s been known to drop 13%. History doesn’t repeat itself, but it certainly knows how to hum a similar tune.

The Bigger Picture: Generational Shift

This doesn’t feel like your average bull run, and that’s because it’s not. The rise of Bitcoin alongside gold and equities is no coincidence. We’re seeing a market wake up to a massive shift: a weakening dollar, aging monetary tools, and the rise of decentralized financial systems. Investors aren’t just picking between ‘safe’ and ‘risky’ assets anymore. They’re now choosing between being tied to the dollar or being free from its grip.

Bitcoin’s rise isn’t just about shiny coins and blockchains. It’s happening in a macro landscape that resembles the 1970s – just without the disco ball. Instead of gold, Bitcoin is offering global liquidity and zero central control. Oh, and it’s digital. It’s the financial equivalent of swapping out your old rotary phone for a sleek new smartphone.

So, as Jerome Powell prepares for his moment in the spotlight and the FOMC minutes loom over us, the market has already made up its mind. Should you buy Bitcoin now? If you haven’t, it’s not too late to jump on the bandwagon.

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

2025-10-05 22:10