Markets

What to know:

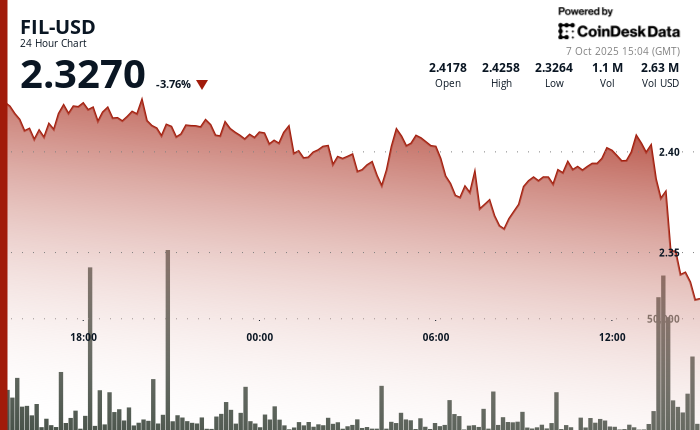

- FIL slipped 4% amid a broader decline in crypto markets.

- The token broke through many support levels as selling pressure intensified.

Ah, Filecoin-like the great heroes of yore, it too has met its fall from grace. The token, once buoyed by the hopes of crypto enthusiasts, slipped by 4%, driven not by fortune but by a relentless storm of selling pressure that smashed through several support levels. $2.39? Gone. $2.37? No longer standing. $2.36? Well, that was the final straw, my dear reader. All of this occurred during the bustling Tuesday morning trading hours, when the U.S. markets were awake and ready for business-or perhaps, chaos. According to the ever-omniscient CoinDesk Research, the technical analysis model confirms this: it was a disaster of biblical proportions.

And what do we see as the floodwaters rise? Panic. A cascade of orders flooding the market, with 530,000 contracts traded in a single minute. It was the crypto equivalent of the Tower of Babel-what a mess. This sudden burst of trading, no doubt, was driven by institutional liquidations-those who saw the ship sinking and, well, didn’t want to go down with it. The volume spike at the end of the day only solidified the idea of capitulation. Panic, thy name is Filecoin.

Meanwhile, in the land of protocol updates and AI initiatives, Filecoin continued to try and tell us how great it was. Sure, the network made strides in the tech world, with preparations for the FIL Dev Summit 7 underway. But even the grandest of summits can’t save you when the market’s tide pulls you under.

At the time of writing, Filecoin is trading at $2.31, a staggering 4.4% lower than before. And don’t look now, the broader market is also tumbling, with the CoinDesk 20 down 3.4%. What a joyous day for crypto enthusiasts. If only we had a sip of vodka to wash down this bitter pill.

Technical Analysis:

- Resistance levels at $2.41-$2.42 maintained firmness during early trading sessions before subsequent breakdown.

- Multiple support thresholds breached at $2.39, $2.37, and $2.36 indicating technical vulnerability.

- Volume surge to 5.67 million during selloff confirms institutional liquidation patterns.

- Single-minute volume peak of 530,000 suggests panic selling and capitulation.

Read More

- BTC PREDICTION. BTC cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- ETH PREDICTION. ETH cryptocurrency

2025-10-07 19:15