Newsflash from the digital realms: the Bitcoin Coinbase Premium, affectionately known as the gap where the Bitcoin price on Coinbase sprints ahead of Binance, has decided to stay firmly in the green. Such a spectacle, you’d think crypto investors had started using stamina elixirs, but no-it’s the muscling American institutional traders in on the party.

Coinbase Premium Gap: As Positive As An Ankh Sign

In a sparkling pixelated post on X (formerly Twitter), frantically followed by crypto enthusiasts, our esteemed CryptoQuant community analyst Maartunn scribbled down some thoughts on this fantastical trend. This mystical metric measures the dizzying difference between Bitcoin’s price listed on Coinbase (those fortunate enough to deal in USD pairs) versus its relative on Binance (USDT pair).

Remember, Binance is to traders what a trinket shop is to tourists from all over Discworld (or just international traders). Coinbase, on the other hand, is that place where American whales congregate, perhaps for a giant brunch. So, when the Coinbase Premium Gap stays greener than a leprechaun’s Delorean, it basically means the American money movers are calling more of the shots than their global counterparts.

When this metric flaunts a positive value, it tells us that Coinbase’s iterations of Bitcoin are priced more dear than Binance’s. It’s as if Coinbase users are mustering party spirits for more buying pressure (or simply have less urge to get rid of their digital gold).

Conversely, a negative indicator would signify Binance users propping up prices, with their international flair for accumulation. They can certainly make a party worth attending, unless everyone’s just trying to pile in on the bonkers end of an overripe balloon.

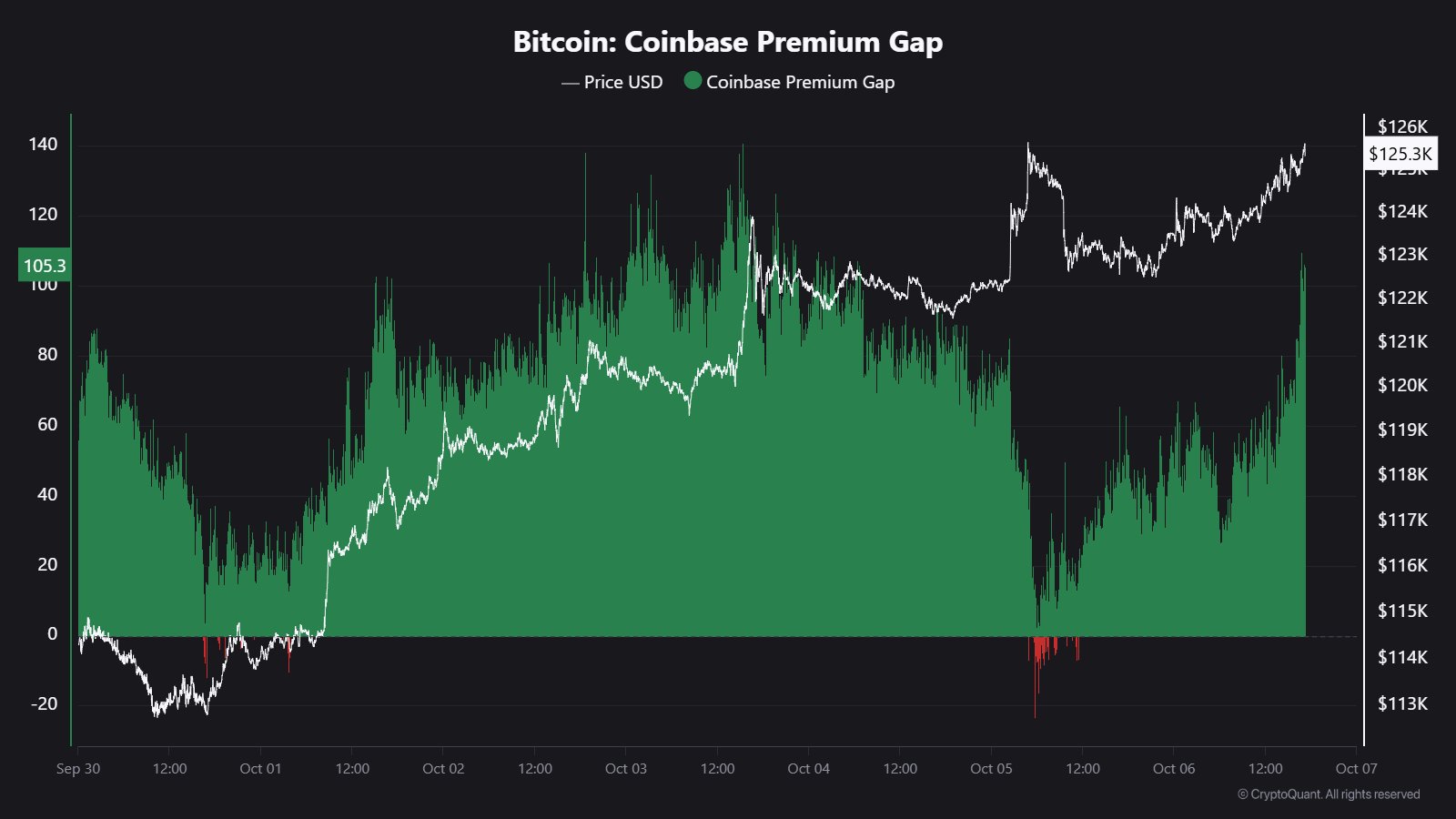

Behold the chart – drawn up by Maartunn – showing recent shenanigans with the Bitcoin Coinbase Premium Gap:

As the graph tells us more eloquently than a Wyrmen poet, Coinbase’s premium over Binance has remained at mostly positive levels lately. Which simply means, when it comes to the fray of buying crypto, Coinbase traders are wielding more gusto, dramatically sayeth the data.

The metric hit its frolicking high on October 3rd, with BTC trading at a commendable premium of $140 on Coinbase. At the weekend, the indicator restlessly tried for a cooldown, even glancing briefly at gloom during the oops-moment peak break on Saturday, but rallied again to a noticeable positive lead of $105 in the new week.

This evidently signals that brave US-based institutions are clambering on board because lifeboat holding cryptos is undoubtedly in fashion. These bold investors, much like the Patrician’s invisible ponies, have been pushing the market elevator since the last halving. If this gap decides to stick to its upbeat antics, the whole affair could go onaculchering itself with tales.

On the institutional demand front, another handy metric is the “netflow” concerning the spot exchange-traded funds (ETFs). Here, massive inflows were reported, much like a river in monsoon season, echoing the clamouring institutional accumulation.

According to Root, your favorite cycle analyst with a penchant for historical patterns, the latest week saw spot ETF inflows an astonishing 8.8 times of the new Bitcoin supply churned out from the digital depths by miners. Impressive maths for those who fancy a headline without the story, but then, we trumpet logic here, don’t we?

The Dollarcrat Waltz: BTC Price

On Monday, Bitcoin, ever the overachiever, breached the sacred $126,000 ceiling – establishing yet another fresh ATH (All-Time High). However, it then decided to tone things down a notch, currently sitting rather nicely at $124,300.

Read More

- BTC PREDICTION. BTC cryptocurrency

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

2025-10-08 05:15