So, here’s the deal: Bitcoin (BTC) is basically getting a VIP pass from institutional buyers-think billionaires, hedge funds, and probably that one guy at your gym who insists on “investing in the future.” ETF inflows? Oh, they’re soaring to all-time highs. Hong Kim, the Co-Founder and CTO of BitwiseInvest, is out here casually mentioning that Bitcoin ETFs are pumping “$5-10 billion EVERY. SINGLE. QUARTER. No biggie. 🙄

But wait-Kim calls this an “unstoppable secular trend.” It’s like Bitcoin is having its glow-up, and the four-year cycle can’t even throw a tantrum to stop it. According to him, 2026? It’s looking like another *chef’s kiss* year. Kim even dropped a chart on X that shows a sharp, uninterrupted rise in ETF inflows from early 2024 to mid-2025-like a straight line up. No detours.

the most important chart to understand bitcoin’s price movement from here

bitcoin ETFs are bringing in $5-10 billion every quarter of new buying pressure into bitcoin like clockwork. absolutely no signs of slowing down

this is the unstoppable secular trend that even the “4 year…

– Hong Kim (@hongkim__) October 8, 2025

Let’s break it down. In just 18 months, ETF inflows have gone from “lol, nothing” to a staggering $60 billion. That’s like getting a credit limit increase so big, you’re just… *wow*. More institutions are now seeing Bitcoin as a safe haven asset. Meanwhile, between January and July 2025, big boys made massive buys thanks to the new spot ETFs and clearer global crypto regulations. And who doesn’t love a little regulatory clarity to make you feel *fancy*?

ETF Assets Go Through The Roof-And Confidence? Even Higher

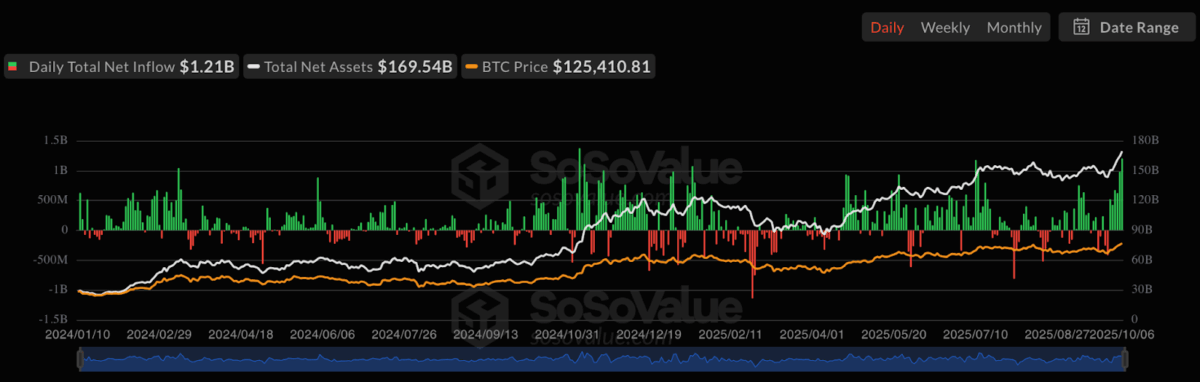

But wait-there’s more! According to the geniuses over at SoSoValue, daily ETF inflows are smashing records, climbing to $1.21 billion. Total Bitcoin ETF assets? A glorious $169.54 billion. And trading volume? *Hoo boy*, it’s crossing $5 billion daily and hit $8 billion just 24 hours ago. It’s like the Bitcoin party has officially moved into the mansion, and no one wants to leave.

The chart? Oh, it’s beautiful. The white line is straight up, showing steady growth. The orange line? That’s Bitcoin’s price, chilling near $125,410. Green bars? Everywhere. Red bars? Hardly even exist. It’s like watching the stock market’s version of a slow-motion victory dance.

Kim and Elliot Andrews (who spoke at Token49 in Singapore, because they’re that cool) also pointed out that institutions are basically *replacing* retail traders. So, goodbye, average Joe-hello, Wall Street. Kim even mentioned Bitcoin ETFs hauled in $30 billion in their first year and forecasted the momentum would keep going. *Spoiler alert*: He’s probably right. 🙃

James Butterfill of CoinShares dropped this gem: “This level of investment shows that digital assets are becoming a legit alternative during uncertain times.” Deutsche Bank is even predicting Bitcoin will be chilling next to gold on central bank balance sheets by 2030. We’re basically in a sci-fi movie now. 💰

In conclusion, Bitcoin’s ETF inflows are the ultimate proof that big institutions are taking over. A little macroeconomic uncertainty? Bring it on. Bitcoin is riding the long-term wave, and if you’re not on this train yet, what are you even doing with your life? 🚀

As of this moment, Bitcoin is sitting at $121,709 with a cool $81.6 billion in daily trading volume. The whole crypto market? At $4.16 trillion, though it’s eased off a tiny 2% in the last 24 hours. *Yawn.*

Read More

- BTC PREDICTION. BTC cryptocurrency

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

2025-10-08 13:36