Ah, dear reader, imagine the scene: Ethena Labs’ darling stablecoin, USDe, was quietly sipping its gin at the one-dollar bar when, quite suddenly, the universe decided to play a practical joke. Friday’s little faux pas saw USDe slip off its plinth and waddle down to a humble 65 cents-just in time for a crypto market crash that made the Wall Street Wombles look like a bunch of idle bums.

This entire kerfuffle, sparked by a Trumpian tariff tantrum on China-because what’s life without a bit of geopolitical spice-sent the crypto masses into a frenzy. Investors, in a bid to save their bacon, hot-footed it to the safety of gold and U.S. Treasuries, leaving the poor little USDe to flail in the breeze. Binance, ever the seasoned chessplayer, watched as USDe did its impersonation of a sinking ship, nose-diving to 65 cents before cheerily bouncing back like a rubber ball on a hot tin roof. This ‘synthetic dollar,’ as they charmingly call it, boasts a market cap close to $14 billion-probably enough to buy a small country or at least a really fancy yacht.

The Great Market Meltdown: $16 Billion Vanishes Into Thin Air

Now, hold your hats, folks, because this is where the fun really begins. According to Coinglass-who undoubtedly hold a secret stockpile of popcorn-over $16 billion worth of bullish crypto positions evaporated faster than ice cream on a summer picnic. Over 1.6 million traders found themselves with egg on their faces-an event so colossal it’s probably going to be a chapter in the history books or at least the back pages of tomorrow’s tabloid.

Binance, with its usual air of calm, announced it was reviewing the chaos and promising “appropriate compensation measures”-probably some late-night freebie trading lessons or maybe a lovely set of branded coffee mugs. Three stablecoins, including our errant USDe, briefly lost their footing-reminding everyone that in crypto, nothing is ever guaranteed, especially stability.

Ethena Labs, ever the picture of reassurance, came out swinging with a statement that USDe was “over-collateralized,” which is banker-speak for “we’ve got more than enough money to pay the piper.” They assured everyone that their mint and redeem operations remained operational, likely while humming a tune and pretending all was well. The dip, they claimed, was just a product of “turbulent market conditions and widespread liquidations”-which is crypto-speak for “we’re all in this mad storm together, folks.”

The Wayward Yield and The Drama of the Digital Dosh

Now, for those of you keeping score at home, USDe offers a charming 5.5% yield. This comes from a fancy ‘basis trade’-an act so delicate it makes ballet look clumsy-profiting from differences between spot and futures markets. But even this elegant dance was put to the test when markets crashed faster than a soufflé in a hurricane. Ether’s hourly funding rate sank to depths not seen since the 2024 yen-carry trade blast from the past, leaving USDe holders clutching their virtual pearls.

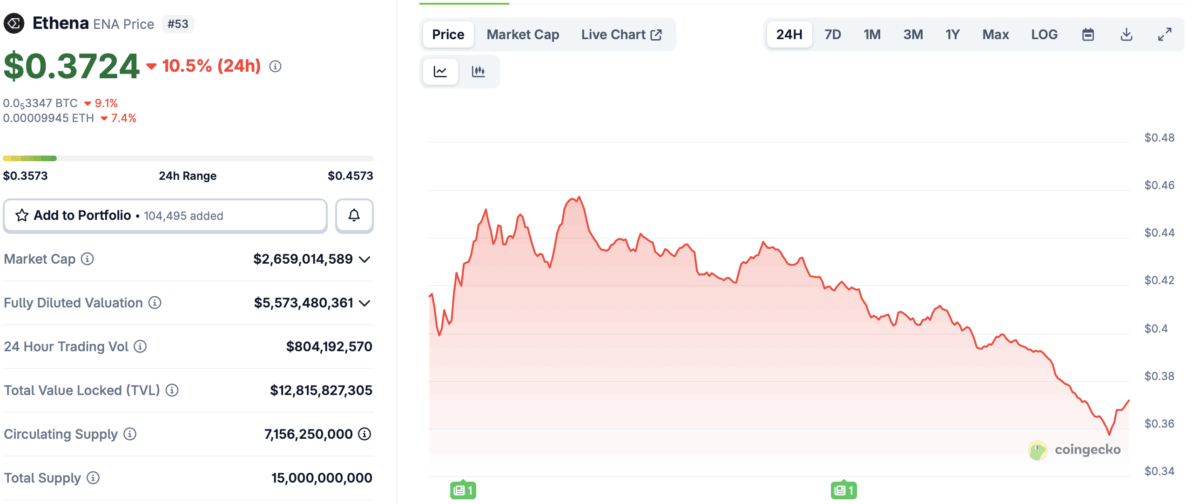

Meanwhile, Ethena’s governance token, ENA, decided to take a dive of up to 43%, giving traders whiplash and causing quite a flap in the crypto saloon. It’s recovered a smidge, from a miserable $0.3724, though it still languishes 10% in the red-proof that even tokens have feelings, or at least a quirky sense of humor.

Despite the brief reprieve, the market’s jitters over that fleeting depeg serve as a reminder that in the world of digital coin, stability is just a charming myth-like a unicorn or a polite politician. Onward, brave investors, and may your doses of digital dough be steadier than this particular rollercoaster! 🎢💰

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- ETH PREDICTION. ETH cryptocurrency

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

2025-10-12 01:25