In a world where fear is lurking like a bad hair day in crypto markets, one could almost hear the wise whispers of “Smart money is accumulating” – and guess what? It’s not just a whisper. Data is doing the talking, and it’s saying that the latest dip in Litecoin (LTC) might not be the end of the world, but the start of something much bigger. Historical patterns, on-chain data, and technical wizardry all hint that this could be less of a collapse and more of a spark for a legendary comeback.

Litecoin Takes a Dive, But History Thinks This Is Just a Rewind

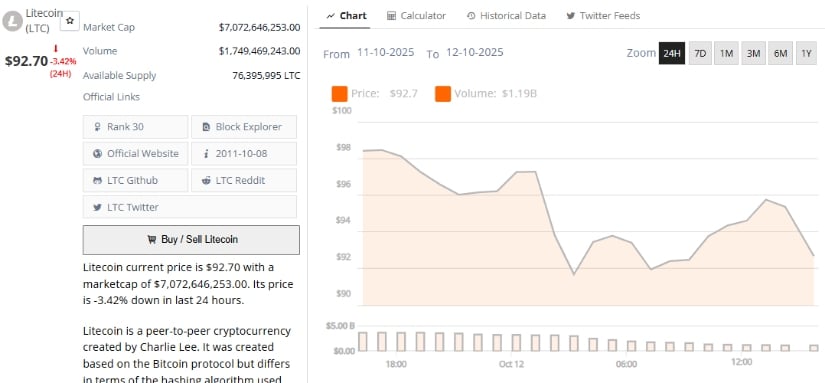

On October 10, 2025, Litecoin (LTC) went on a 23% joyride from $134 to $85. Oops! But hey, that’s what happens when a crypto market-wide liquidation shakes up almost $19 billion in open positions, right? The sell-off was triggered by US-China tariff drama – because that’s exactly what every crypto investor needs right now – another international conflict to spice things up. The nerves were real, but here’s where it gets interesting: some analysts think this crash might be setting the stage for a parabolic rally, just like the good ol’ days of 2017, when a similar drop was followed by a sprint to over $375.

Crypto trader @DMinimilian did the math (probably more than we ever will), pointing out nearly identical candlestick patterns on the weekly chart. “Litecoin in 2017 had a big flush before it went parabolic,” he casually dropped on X. So, there’s that. History might be about to have a déjà vu moment.

Data Shows Accumulation, Not Panic

Let’s be real. This dip might look like a storm, but on-chain metrics are showing a calm before the storm. Analyst Erica Hazel pointed out that over $10.5 million worth of LTC left exchanges during this little downturn – a sign that people are playing the long game, not freaking out. “When coins leave exchanges, it’s usually because people are hoarding them like squirrels before winter,” she quipped. “Textbook accumulation, not capitulation.”

And wait, there’s more! Trading volume surged by 125%, while Litecoin’s Relative Strength Index (RSI) was making its way to oversold territory. All these signs are pointing to a quiet accumulation, with “smart money” sitting back and licking its chops, waiting for the right time to pounce.

Wedge Breakout – Bullish Dreams Await

Trader CustomizedTrader noticed a juicy technical setup that looks like a classic breakout waiting to happen. Litecoin’s weekly chart is showcasing a massive descending wedge – a historically bullish pattern. The price is now dancing around the $130 to $150 zone, testing the upper boundary. If LTC manages to break through this resistance, the Fibonacci projections are sending some bold signals – a potential long-term target near $650. Crazy? Maybe. But similar breakouts have fueled previous Litecoin bull runs, especially during Litecoin halving events, when supply shrinks, and the hype train accelerates.

Analyst Perspective: From Recovery to Full-Blown Rally?

Earlier this month, market analyst Arman Shaban pointed out that Litecoin had already clawed its way back from $115 to $133, gaining over 30% since his last analysis. If momentum holds, he sees the next bullish targets around $155, $200, and even $268. Is Litecoin ready to turn into a rocket ship? Shaban seems to think so.

“Litecoin has regained strength above key moving averages, and RSI momentum is showing improvement,” he said, tossing in a sprinkle of history to back it up. “These conditions have usually come before parabolic expansions.” So, could Litecoin be preparing for a new “to the moon” moment? Only time will tell, but the signs are pretty convincing.

What Lies Ahead for Litecoin?

Looking at the bigger picture, the combination of accumulation signals, potential wedge breakouts, and historical déjà vu is setting Litecoin up for a thrilling ride as we head into the final quarter of the year. But, of course, speculators are still waiting for the confirmation light to turn green – especially with the buzz around a possible Litecoin ETF (LTC ETF), which could bring institutional investors to the party.

But hold your horses! On-chain data shows heavy long positions, so don’t be surprised if volatility takes one last swing before the true trend reveals itself. For now, analysts are cautiously optimistic. While short-term risks still lurk like a lurking cat, the majority think Litecoin might be quietly positioning itself for its next big cycle, just like before its legendary 2017 run.

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

2025-10-12 23:38