Alas, the price of PEPE coin has taken a most distressing turn, descending nearly 40% from its September heights, as a most ominous head and shoulders pattern looms, threatening further woes for its devoted holders. 🤡

- PEPE’s price has continued its lamentable descent on the weekly timeframe, a most unflattering sight.

- Whales and discerning investors have begun their hasty exodus, leaving behind a trail of despair.

- A bearish head and shoulders pattern, a most dreaded omen, is forming on the PEPE/USDT weekly chart.

According to the esteemed crypto.news, Pepe (PEPE) coin plummeted to a 6-month low of $0.0000063 on Friday, Oct. 17, before managing a feeble recovery to $0.0000072 at the time of this writing. At this price, the altcoin is down 40% from its September peak, a most grievous loss, and has plunged nearly 66% from its highest point earlier this year, a calamity of epic proportions. 📉

Pepe’s price dipped 33% to $0.0000062 on Oct. 11 after U.S. President Donald Trump announced new tariffs on Chinese exports, reigniting fears of a trade war between the two great powers. A most unfortunate development, indeed. 🇺🇸🇨🇳

The back-and-forth between Washington and Beijing has unsettled global risk markets, including crypto, with several major cryptocurrencies shedding over 20% from their monthly gains as investors adopt a risk-averse stance, much to the dismay of hopeful speculators. 🤷♂️

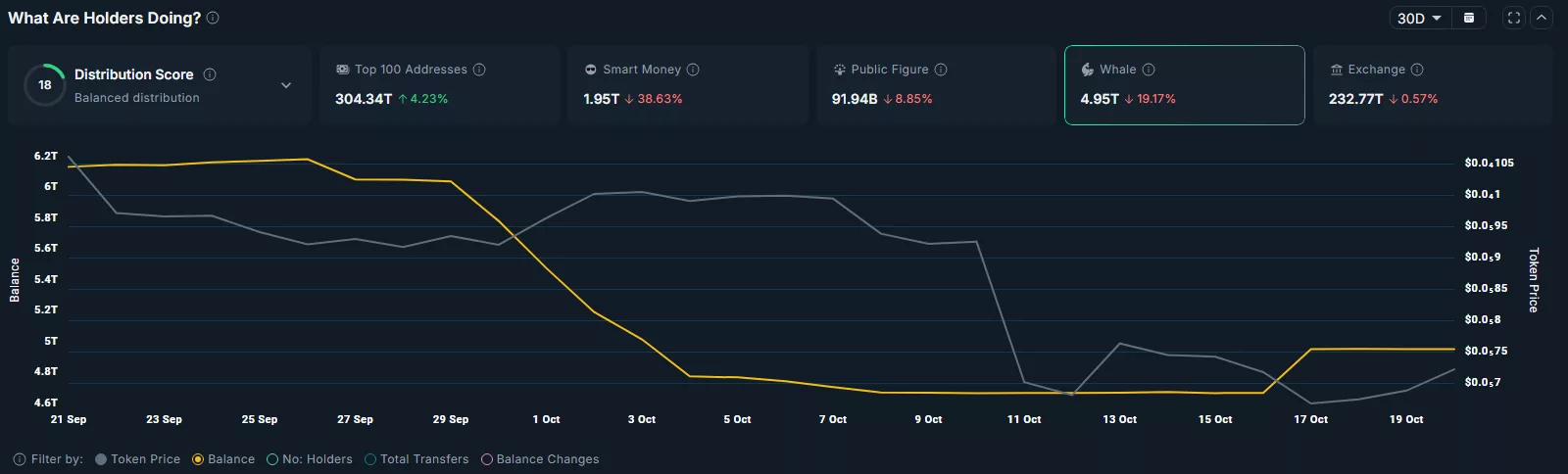

Data from the Blockchain analytics platform Nansen reveals that Pepe’s price decline has been exacerbated by a steady exodus of smart money and whale investors. Over the past 30 days, the total number of tokens held by smart money wallets has dropped by 38.6% to 1.95 trillion. At the same time, whale holdings have fallen from 6.13 trillion to 4.95 trillion during the same period, a most alarming trend. 🧠💸

Such large-scale exits, one might say, signal a market in a state of uncertainty, as investors adopt a wait-and-watch approach, hoping for clearer signs of stability before daring to reenter. A most prudent strategy, though fraught with anxiety. 🕵️♀️

If the selling continues, it could begin to weigh on retail investor sentiment, potentially triggering a broader wave of panic selling driven by fear rather than fundamentals. A most tragic outcome for the unwary. 🙃

Pepe Price Analysis, with All Due Formality

On the weekly chart, Pepe coin price has formed a textbook multi-year head and shoulders pattern, with the neckline hovering near $0.0000070 and the head topping out around $0.000028. This structure is often viewed as a strong bearish reversal signal, especially if the price breaks below the neckline with confirmation from other indicators. A most dire prognosis, indeed. 🧠

PEPE’s MACD line had crossed below the signal line when writing, which is a telltale sign that bearish momentum was gaining strength. Sellers assessing charts based on this signal may continue to apply pressure in the coming sessions, a most vexing prospect. 📈

Meanwhile, the RSI on the weekly timeframe was also heading downwards and had breached the neutral mark at 50, further reinforcing the bearish outlook among traders. A most disheartening development. 🤯

For now, the key support level to watch is at $0.0000070, which aligns with the 23.6% Fibonacci retracement. It stands 44% below the current price, a most daunting chasm. 🌪️

A clear break below this level, supported by rising trading volume, could open the doors for a deeper decline toward $0.0000040, particularly if overall market sentiment remains negative. A most harrowing prospect for the faint of heart. 💀

On the flip side, if bulls manage to defend the neckline and push prices higher, the first major resistance sits at $0.0000090. Decisively reclaiming that level could mark the end of the current downtrend and potentially signal an early shift in momentum in favor of buyers. A glimmer of hope, though fleeting. 🌟

Read More

- EUR USD PREDICTION

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

2025-10-20 14:09