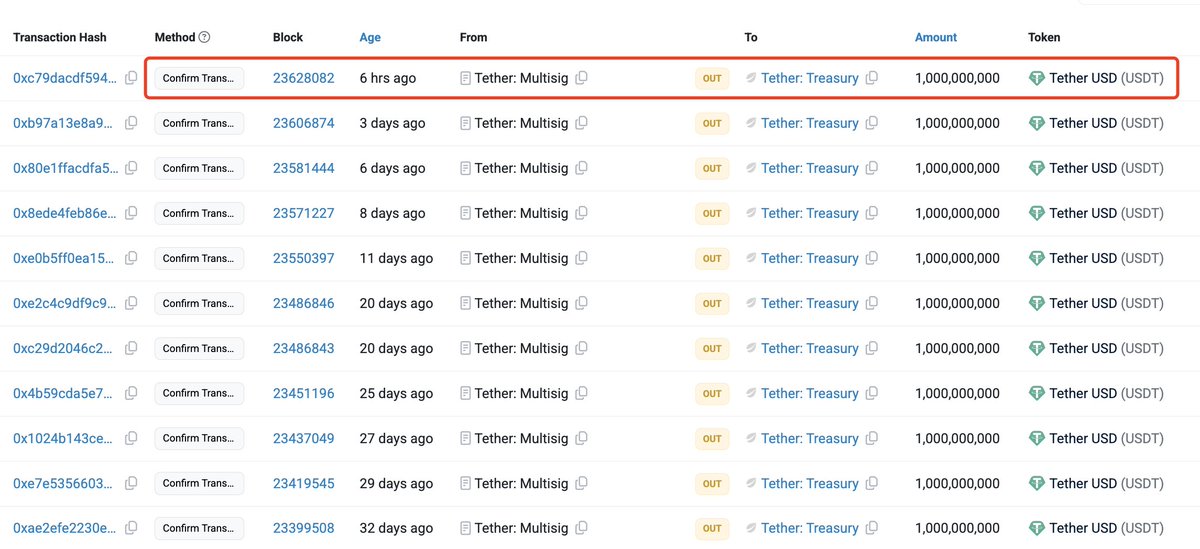

Oh, great. Tether just conjured another billion USDT out of the crypto aether-because when you’re feeling anxious, nothing says “calm down” like watching someone print digital monopoly money with zero oversight and the confidence of a man who’s never once Google-searched “inflation.” Bitcoin, poor confused soul, is currently doing its best wobbly flamingo impression, teetering just above $108K, while altcoins are collapsing like a Jenga tower held together by hope and expired Twitter tips.

Now, I’m not an economist (thank god), but even I know this: when you flood the market with boatloads of stablecoins, it’s usually either a prelude to a rally… or a panic move that says, “Everyone’s out, we’re bringing in the backup cash so the party doesn’t end in total silence and someone crying in the bathroom.”

These mints? They’re like giving a shot of espresso to a sleep-deprived trader who hasn’t seen sunlight since 2021. Suddenly he’s blinking at the screen, muttering about “support levels” and “risk appetite,” while his portfolio continues to bleed value like a paper cut in a salt mine.

Bitcoin is clinging to $110K like it’s the last open gas station on a deserted highway. Investors are staring at it like, “Make it mean something, bro.” Meanwhile altcoins are down double digits, which, at this point, feels less like a market correction and more like nature reclaiming what man lost to greed and bad memes.

Still, we whisper the ancient crypto prayer: “Where there’s liquidity, there’s hope.” Or at least a chance for a relief rally so brief you blink and miss it-like a sneeze in church. But hey, maybe this time it’ll stick? Stranger things have happened. Like, say, me willingly attending a family reunion.

A Liquidity Wave That Could Shake the Market

According to Lookonchain (yes, that’s a real name, and no, I don’t know what they “look on”), Tether and Circle have minted over $7 billion in stablecoins since the October 10 market crash. That’s seven billion digital dollars conjured into existence while the rest of us were just trying to figure out how to mute our in-laws on Zoom.

Now, I should clarify: stablecoin mints aren’t the same as buying Bitcoin. They’re more like quietly stocking the bar before a party, hoping someone shows up and starts ordering $500 cosmos. It’s not direct demand, but boy howdy, it sure sets the mood.

This flood of fresh liquidity is meant to calm nerves, grease the wheels, and possibly prevent another bloodbath that liquidates more leveraged longs than a bad breakup text. Historically, big mints like this have preceded market recoveries. Or, you know, wild pump-and-dump chaos that makes you question every life choice since high school. So… cautiously optimistic?

But here’s the thing: liquidity can be a two-headed beast, like a hydrant with commitment issues. It can spark a joyful relief rally-or a violent whip-saw that sends traders fleeing to farms to raise goats in peace. One minute you’re up 10%, the next you’re Googling “how to survive off-grid without Wi-Fi.”

Bitcoin’s sitting there like a nervous first-date diner, trying not to spill anything over $108K-$110K. Will it break out? Break down? Break down crying? Only time-and apparently Tether’s printing schedule-will tell.

Tether’s USDT Dominance Rebounds As Traders Seek Stability

USDT dominance has climbed back to 5.06%, which, in human terms, means people are sprinting to the stablecoin emergency bunker while yelling, “Secure the perimeter! We’ve lost the altcoin front lines!”

The weekly chart shows a dramatic rebound from 4.6%, now flirting with the 100-week moving average like it’s a middle-school dance and someone finally asked. This surge? Classic “flight to safety” behavior. Traders are dumping experimental coins with names like “ShibaFlokiInuMoon” and retreating to USDT-the financial equivalent of hiding under the covers with a flashlight and a bag of slightly stale gummies.

Historically, when USDT dominance climbs, it means people are scared, bored, or both. They’ve given up on making sense of the market and are just waiting for someone-anyone-to say, “It’s over. You can come out now.”

Right now, a breakout above 5.2% could send dominance soaring toward 6%, last seen during previous market meltdowns. If it fails? Well, maybe we’re stabilizing. Or maybe it’s just the calm before someone sets off a firework in the popcorn factory. Either way, popcorn-or in this case, USDT-remains essential.

So enjoy the show, folks. We’re all just riding this rollercoaster blindfolded, hoping it loops fewer times than my therapist says I do in conversation.

Read More

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Crypto Carnage: Fed’s “Hawkish Cut” Leaves Bitcoin in Tatters 🎢💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Gold Rate Forecast

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

2025-10-23 03:22