Pray, allow me to impart the most extraordinary news: FalconX, that paragon of institutional crypto prime brokerage, has deigned to acquire 21Shares, the grand doyen of crypto ETP platforms. A union so bold, it could only be described as a marriage of convenience-and capital! 🤑

FalconX Sweeps 21Shares Off Its Feet in a Whirlwind Acquisition 💃🕺

In a press release that has set the ton abuzz, FalconX has announced its intention to acquire 21Shares. FalconX, you must know, is the very essence of sophistication in the crypto world, offering its esteemed clients-numbering over 2,000 institutions-a smorgasbord of services: deep global liquidity, derivatives, financing, custody, and settlement. Oh, and did I mention they’ve facilitated over $2 trillion in trading volume? Quite the catch, indeed! 💼✨

As for 21Shares, it is the undisputed belle of the ball in the realm of crypto exchange-traded funds and products (ETFs/ETPs). These, my dear reader, are the very epitome of modern investment-allowing one to dabble in digital assets without the bother of owning them directly. How convenient! 🧐📈

For those delicate souls who find crypto exchanges and wallets rather daunting, ETFs and ETPs offer a more regulated and familiar path to investment. 21Shares, with its 55 products and over $11 billion in assets under management, is quite the prize. And now, it shall be wed to FalconX’s institutional-grade infrastructure. A match made in financial heaven, or so they say! 💍💸

The press release, with all the flourish of a society announcement, declares:

Together, the two firms will accelerate the creation of tailored investment products that meet growing institutional and retail demand for regulated digital asset exposure.

How very forward-thinking! 🌟

Fear not, for 21Shares shall retain its independence, with Russell Barlow, its current CEO, remaining at the helm. He shall collaborate closely with FalconX’s leadership to advance their shared vision for the digital asset ecosystem. “No changes to the construction or investment objectives of the existing 21Shares ETPs (Europe) or ETFs (US) are planned,” the release assures us. How reassuring! 🙇♂️

In other news, the Bitcoin derivatives landscape has been undergoing a most intriguing transformation, as noted by the ever-observant Glassnode. The Futures market, once the undisputed leader, now finds itself rivaled by the Options market in terms of Open Interest. Oh, the drama of it all! 🎭

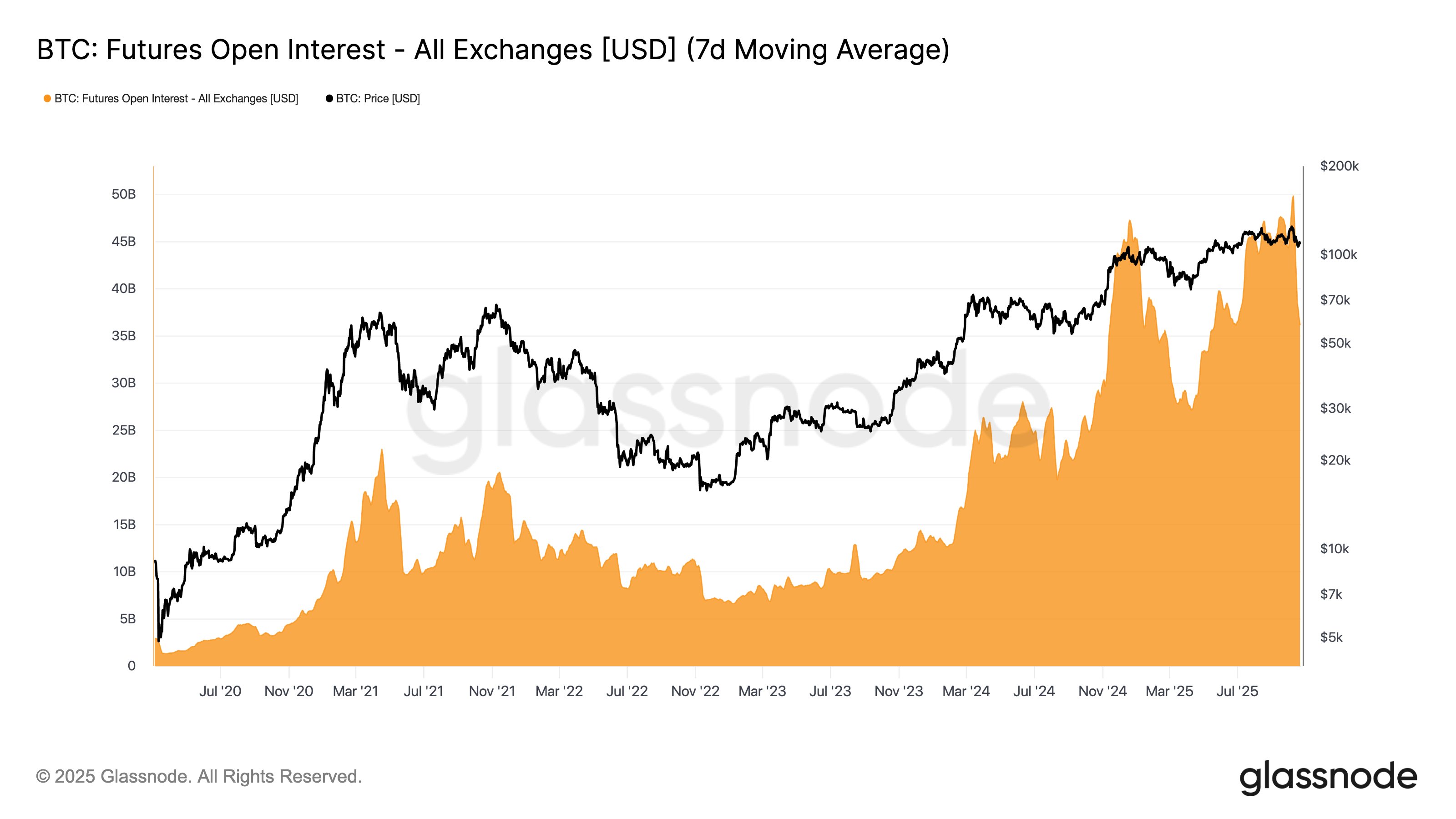

Behold, a chart illustrating the trend in Futures Open Interest:

As you can see, Bitcoin Futures Open Interest peaked above $20 billion during the 2021 bull market and recently reached a high of about $50 billion. Quite the rollercoaster, is it not? 🎢

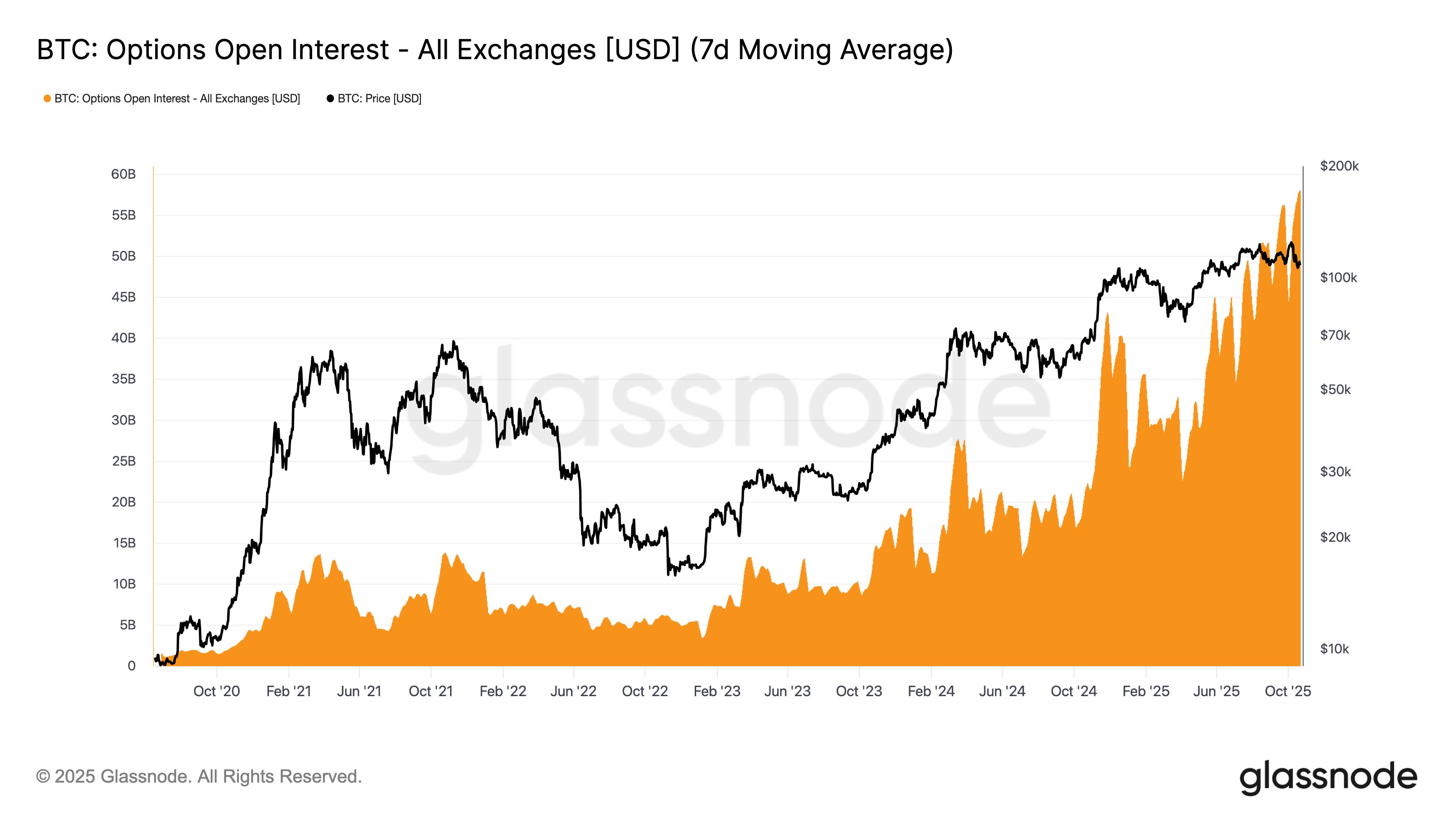

Meanwhile, the Options Open Interest, once a mere shadow, now boasts a 7-day moving average value floating around a new all-time high of more than $55 billion. Who would have thought? 🤯

Glassnode explains, with all the gravitas of a seasoned commentator:

Markets are shifting toward defined-risk and volatility strategies, meaning options flows, rather than futures liquidations, are becoming a more influential force in shaping price action.

How very modern! 🌪️

Bitcoin Price: A Tale of Fluctuations 📉📈

At the time of writing, Bitcoin is floating around $107,800, down over 4% in the last 24 hours. A slight dip, but one must remember, the crypto world is ever full of surprises! 🪙💨

And so, my dear reader, we conclude this tale of acquisitions, market shifts, and digital fortunes. Until next time, may your investments be wise and your wit sharper than a well-crafted retort! 🌟✨

Read More

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Crypto Carnage: Fed’s “Hawkish Cut” Leaves Bitcoin in Tatters 🎢💸

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

2025-10-23 14:13