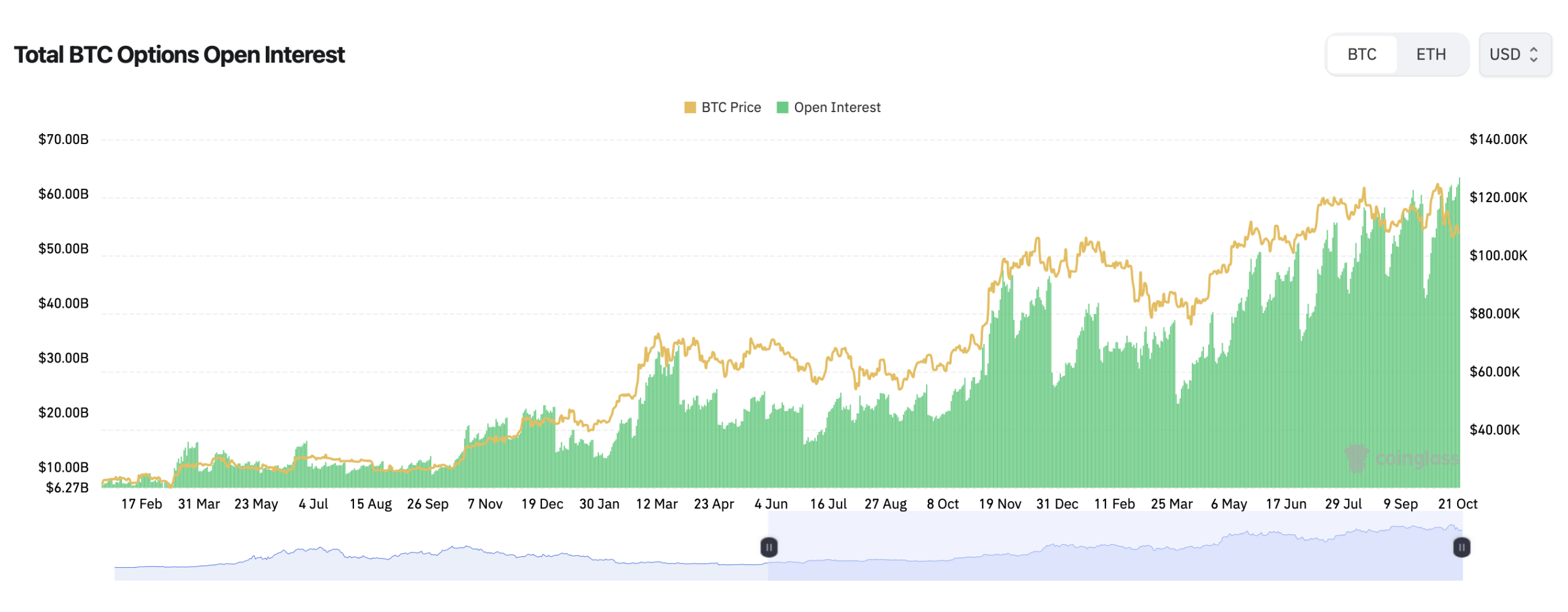

Bitcoin’s options market is on fire – open interest has blasted to a new record as traders wrestle between euphoric calls and cautionary puts, all while BTC lounges around $110,614 per coin, according to Coinglass data. 🧠💸

BTC Options Data Shows Record Leverage 📈

Total open interest (OI) in bitcoin options has climbed near $65 billion – the highest ever recorded. The market is humming with leverage, conviction, and just enough nerves to keep everyone awake. 🕵️♂️

Deribit, the current heavyweight of crypto options, is seeing a flood of activity. Volume has exploded in recent weeks, pushing into multi-billion-dollar territory daily. This week’s session has been among the year’s busiest, hinting that even short-term players are diving in before volatility decides which way to bite. 🐍

The split between calls and puts paints a fascinating picture. Open interest still favors the optimists – 57.96% calls (301,842.96 BTC) versus 42.04% puts (218,924.29 BTC) – showing that more traders are betting on upside continuation. 🎉

But zoom in on the last 24 hours, and the tone shifts: puts made up 55.66% (32,133.77 BTC) of volume, outpacing calls at 44.34% (25,597.3 BTC). Translation? Long-term bulls, short-term hedgers – the perfect cocktail for fireworks. 🔥

Strike positioning suggests traders are targeting the moon – or at least the stratosphere. Deribit’s biggest open-interest clusters sit at $140,000, $150,000, and $200,000 for December 2025 expiries. Those high-flying call stacks show traders dreaming big, while puts at $85,000 and $80,000 signal where the nervous money lives. 🌌

Then there’s “max pain,” the level where the most traders lose the most money. Coinglass data currently pegs that zone between $108,000 and $114,000, right where BTC is currently waltzing. If prices drift sideways, options writers will be smiling; if BTC breaks away, someone’s about to get burned. 🔥

Put together, the derivatives picture screams high-stakes poker. Record open interest, ballooning volume, lofty call strikes, and a battlefield around the $110K line make this one of the most tightly wound setups of the year. Traders are either about to get very rich – or very humbled. 💸

FAQ 💡

- What is BTC’s price now? About $110,614 per coin at press time. 🕒

- How high is open interest? Total BTC options open interest has hit a record, nearing $65 billion. 📈

- Who’s winning between calls and puts? Calls lead open interest, but puts dominated daily trading volume. 🤷♂️

- Where is max pain? Around $108,000 to $114,000, where most options expire worthless if BTC stays flat. 🧠

Read More

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Crypto Carnage: Fed’s “Hawkish Cut” Leaves Bitcoin in Tatters 🎢💸

2025-10-23 23:04