Ethereum (ETH), crypto’s overachieving stepchild, still can’t quite break the $4K psychological barrier-like a millennial panic-shopping their crypto retirement fund. 💃 After that brutal October 9 meltdown (scrambling to test support at $3,435 like a positivity-challenged parrot), it’s been stuck in a “meh” zone, hovering just below where networking events go wrong.

ETH’s Dance Above the “Ghost Price” – Bulls Posing in the Philistine?

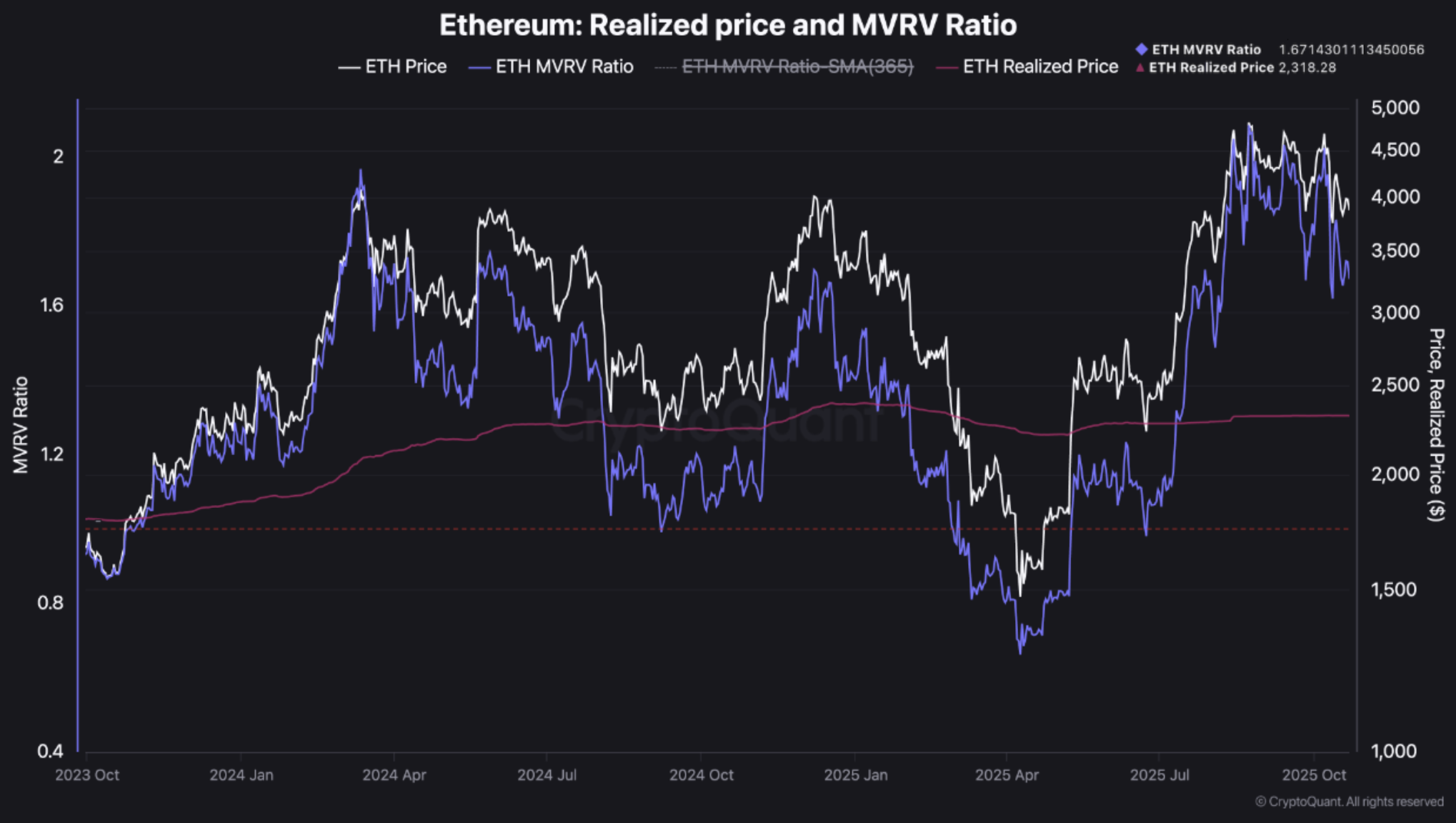

According to CryptoQuant’s TeddyVision (clearly a PhD in cryptospeak), Ethereum’s currently trading above its “Realized Price” of $2,300. Dubbed a “fundamental support zone” by our brave analyst, this is where ETH’s last gasp turns into a revival meeting. After all, dips below it usually mean the market’s throwing a mandatory crying session, a la breakup with a Roomba.

Still with me? Me neither. Okay, Realized Price is basically the crypto-version of a therapist’s ledger: it’s the average cost of every ETH move on-chain, divided by how many coins exist now. So if ETH’s above that… congratulations, you’re in profit, dear. And not the kind that disappears when you check your crypto wallet. 🎉💰

This ratio also helps us figure out if the market’s in denial mode or finally embracing its crypto destiny. Let’s just say ETH’s not getting hystero-what? It’s trading above realized value, so structurally, the bulls feel like they’ve cracked the password to Wall Street’s Wi-Fi. 🔐

TeddyVision also highlighted the market’s MVRV ratio (just pretend it’s a brand of sparkling water, not a metric). Right now, holders are sitting at 67% profit. Not bad, not amazing, but sort of like a mediocre but well-intentioned birthday gift. This tells us two significant things:

1) You’re doing great, but don’t get too cozy yet.

2) Market players are, like, “Meh, we can do this,” not “OMG apocalyptic moon phases happen!”

MVRV is just crypto’s version of a blood pressure test. High MVRV = investors sweating over imaginary profits. Low MVRV = everyone’s panicking over pineapple memes. Simple, right? 😅

TeddyVision also noted ETH’s flirtation with the “Upper Realized Price Band” (we just call it $5,300, but let’s dress it up). The analyst proclaimed:

Price pulled back during its flirt with the “Overheating Zone.” Error message? Nope. It’s just taking a strategic coffee break. Not a reversal, darling-at least not yet. ☕

Meanwhile, fewer and fewer ETH hoppers are funneling their coins into exchanges-like ants avoiding a sticky spotlight. If this keeps up, ETH’s next big move will need new liquidity, not just leveraged cameo appearances in lever boys’ portfolios. Bottom line? Ethereum’s shifting from “dumping zone” to “make-out session with consolidation.” Romantic! 💘

We still can’t predict crypto better than a psychic hotline (spoiler: they don’t charge by the minute), but the latest on-chain trends say ETH’s back in bullish flirtation mode. Binance’s funding rates, for instance, recently whispered, “ETH could moon to $6,800!”-which is like your ex saying they love you but forgetting your birthday.

Plus, ETH’s exchange reserves are hitting multi-year lows faster than your Netflix password after a hack. Low supply = ripe for a supply crunch, which might tickle up ETH’s price with the subtlety of a crypto evangelist preaching to crickets. 🐸

And yet, Nik Patel (caveat emptor) insists the downturn might not be finished yet. At press time, ETH is plinking around $3,849. A 0.3% gain in the 24 hours is about as exciting as a tax inspector’s fashion sense. But maybe-it just hasn’t stirred today yet. 🚀

Read More

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Crypto Carnage: Fed’s “Hawkish Cut” Leaves Bitcoin in Tatters 🎢💸

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- NEXO PREDICTION. NEXO cryptocurrency

2025-10-24 04:01