On a chilly Sunday morning in October, Bitcoin decided to make an entrance, opening trading at a cool $111,200. But wait – what’s this? A little jump here, a little jump there – and before you know it, BTC’s sitting pretty at $113,800. Not too shabby. Investors, perhaps inspired by the brisk autumn air, have deposited a whopping $400 million into Bitcoin-Defi protocols since Gold’s historic price discovery phase paused at $4,380 on October 18. Could it be that the glittering yellow metal is losing its shine? 🧐

Bitcoin Recovers as Trump Meets Xi Jinping

Oh, but the plot thickens – Bitcoin climbed to 10-day peaks near $114,000 as President Trump, probably in the middle of deciding which tie to wear, prepares for his big meeting with China’s Xi Jinping. The two are set to discuss trade relations in Korea, capping off Trump’s whirlwind week-long Asia tour. Talk about high stakes! Meanwhile, global markets are buzzing with optimism after Trump oversaw a peace pact between Cambodia and Thailand, proving once again that diplomacy can move markets (who knew?).

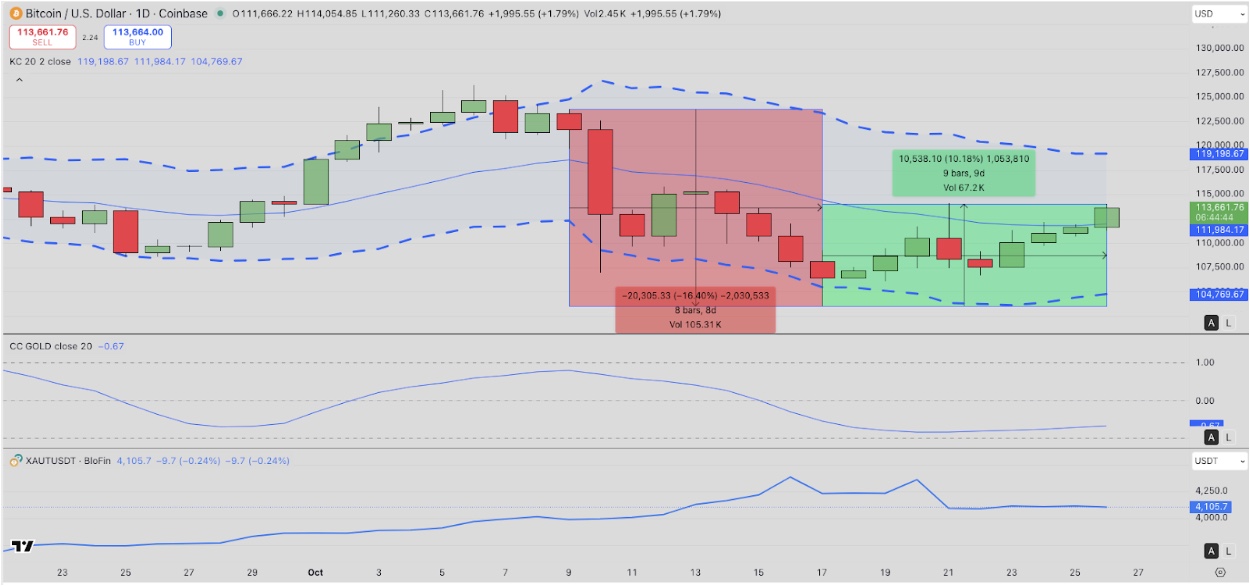

In the last ten days, Bitcoin managed to claw back almost 10% of its mid-October losses, rising from a somewhat sad $103,500 to the happy $113,800 we see today. Bravo, BTC. 👏

Meanwhile, Gold, which hit a record high of $4,381 per ounce on October 18, is currently having a little meltdown, dropping by 6% to $4,103. Oops. 😬

Bitcoin price action and correlation to Gold (XAU), October 26, 2025 | Source: TradingView

Bitcoin’s recovery comes after a rather volatile October – it’s been a rollercoaster ride! Mid-month, markets were rattled by Trump’s deferred tariff call on China and the U.S. government shutdown, which dragged on longer than a bad soap opera. The resulting chaos triggered a $19.4 billion liquidation wave in crypto derivatives markets. That’s some serious drama, folks. 🍿

From October 10 to October 17, Bitcoin plunged by a dramatic 16%, from $123,800 to a dismal $103,500, while Gold seemed to have a sudden burst of confidence, rising 12% from $3,900 to $4,381 per ounce. However, the two assets’ correlation took a nosedive to -0.84, its lowest point since February 2025. Ouch. Poor Gold. 😂

BTC TVL Rises $400M in 10 Days: Is Gold Ceding Ground to Bitcoin?

Now, here’s an interesting turn of events. Since Gold’s rally hit a wall on October 17, investors have started shifting their funds towards Bitcoin, clearly seeking something more… yielding. In just ten days, Bitcoin’s total value locked (TVL) in decentralized finance protocols jumped from $7.8 billion to $8.2 billion, adding a neat $400 million to the pot. Clearly, yield-bearing Bitcoin positions are the hot new trend. Who knew crypto could be so fashionable? 🤑

Bitcoin TVL rises $400 million from $7.8 billion to $8.2 billion between Oct 17 – Oct 26 | Source: Artemis

When investors move BTC into staking and lending protocols, it’s a clear sign they’re in it for the long haul. Bitcoin’s not just a trendy asset anymore – it’s starting to look like a reliable investment. Or at least, that’s what the data suggests. 📈

LYN ALDEN: “Bitcoin is gold combined with a tech stock.”

– Bitcoin Archive (@BTC_Archive) October 25, 2025

In an interview that definitely got the crypto world buzzing, macro analyst Lyn Alden brushed off Gold’s influence on Bitcoin’s short-term price prospects. According to Alden, Bitcoin is no longer competing with Gold – it’s gunning for tech stocks now. That’s right, folks, the future of finance is here, and it has a little bit of Silicon Valley in its DNA. 💻

Bitcoin Price Outlook: Markets Await Trump-Xi Meeting and Fed Policy Decision

Looking forward, global markets are holding their breath as the U.S. government shutdown drags on into its fourth week, with no resolution in sight. Yawn. The fate of the market, as always, depends on two key events this week: the Federal Reserve’s policy meeting on October 29 and the Trump-Xi Jinping summit on October 30. Oh, the suspense! 🎭

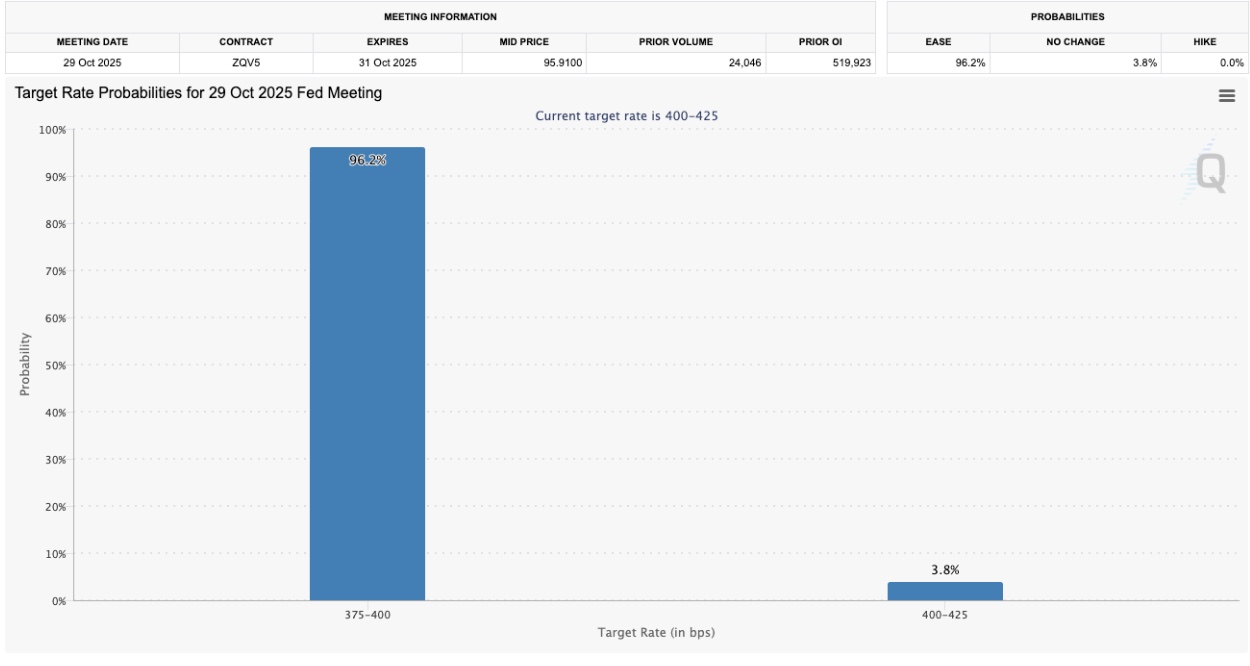

US Fed Rate probabilities for October 29, FOMC meeting | Source: CME Fedwatch

Right now, investors are placing bets on a 96.2% chance of another rate cut of 375 to 400 basis points, according to CME FedWatch. Let’s see how that pans out.

If the Trump-Xi talks spark some positive trade signals, or if the Fed goes all dovish (as we all expect), Bitcoin could continue its upward climb, reaching between $115,000 and $118,000. However, if tensions rise, or the Fed throws a wrench in the gears with a hawkish stance, expect a brief pullback toward $109,000 support. Drama, drama, drama. 🤑

Read More

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- USD MYR PREDICTION

- CNY JPY PREDICTION

- WLD PREDICTION. WLD cryptocurrency

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

2025-10-26 23:32